How Argentina's Reforms Could Reshape US Economy. How Silver Activists Are Stepping Forward.

Fuel Your Portfolio with The 2025 Great Silver Bull Run.

Op-Ed by Jon Forrest Little

Prior to Javier Milei's presidency, Argentina was in dire economic straits. Inflation had soared to a staggering 211% year-on-year, making it the third highest in the world.

The economy was in crisis, with poverty rates exceeding 40%

The peso had lost most of its value, and the country was on the verge of hyperinflation. Government inefficiency was rampant, with excessive protectionism and fiscal mismanagement disrupting economic progress. Simple administrative processes, like obtaining a birth certificate, required extended waiting periods.

The government's reliance on printing money to finance deficits exacerbated inflation, while price controls and subsidies on energy and transport further distorted the economy

Javier Milei's libertarian approach in Argentina has garnered attention from prominent figures in the United States, including Elon Musk and Donald Trump. Milei's policies of drastically cutting government agencies, reducing regulations, increasing drilling, and lowering taxes align with the libertarian ideology that some U.S. politicians are now advocating for implementation in America.

Since taking office, Milei has implemented significant changes in Argentina. He has halved the number of ministries, dismissed over 30,000 government employees, and made substantial cuts to healthcare, welfare, and education spending. These measures, while controversial, aim to address Argentina's economic crisis and rampant inflation.

Milei's approach to energy policy is particularly noteworthy. Argentina currently has three operational nuclear power plants, contributing about 10% of the country's electricity.

Milei has announced plans to expand nuclear energy production, including the development of Small Modular Reactors (SMRs).

This focus on nuclear energy aligns with his goal of making Argentina a pioneer in powering the growing demands of artificial intelligence and data centers.

The friendship between Milei, Musk, and Trump has led to increased interest in applying similar policies in the United States. Musk and politicians like J.D. Vance has expressed support for adopting elements of Milei's approach. Their proposed strategy for the U.S. includes:

1. Drastic cuts to government spending

2. Elimination or significant reduction of certain federal agencies

3. Deregulation to ease compliance burdens on businesses

4. Tax cuts

5. Potential currency devaluation to boost exports

Proponents argue that this approach could stimulate economic growth by reducing government intervention and creating a more business-friendly environment. They suggest that cutting regulations and taxes would allow businesses to operate more efficiently and competitively.

The idea of weakening the dollar, as proposed by J.D. Vance, is aimed at making U.S. exports more attractive in the global market. This could potentially help revitalize industries in regions like the Rust Belt, including steel production in Pittsburgh, automobile manufacturing in Detroit, and coal mining in Appalachia.

Supporters of this approach believe it could address several economic challenges facing the United States:

1. Reverse the effects of recent monetary policies that have led to increased money supply

2. Combat unemployment by creating a more favorable environment for businesses

3. Boost productivity by reducing regulatory burdens

4. Stem the tide of layoffs and store closures by improving overall economic conditions

However, it's important to note that such radical changes would likely face significant political and social challenges. Let’s be encouraged by the word radical. Radical is derived from latin as “getting to the root”

The success of such an approach in the U.S. context remains speculative but there is always hope.. Milei's policies have shown some staggering and early signs of success in Argentina, particularly in reducing inflation.

As the U.S. approaches its next election cycle, the debate over these economic strategies is likely to intensify. The potential implementation of such policies would represent a significant shift in U.S. economic policy, with far-reaching implications for businesses, workers, and the overall structure of the American economy.

Argentina's economic crisis serves as a stark warning of the perils of unchecked government spending and stifling regulation. The nation found itself shackled by a labyrinth of conflicting, overlapping bureaucracies that choked growth and innovation. This mirrors the dangerous path the United States risks treading if drastic changes are not made.

The insidious nature of fiat currency cannot be overstated. These paper promises, masquerading as substitutes for real money like gold and silver, are the first steps on a treacherous road to economic ruin. They silently rob hardworking citizens through the hidden tax of inflation, eroding the value of their labor and savings. In contrast, silver stands as a beacon of sound money - divisible, fungible, and a true store of wealth that resists the corrosive effects of inflation.

The United States can learn from Argentina's hard-won lessons. By embracing a "buy local" mentality and empowering individual states to champion sound money principles, we can forge a path out of the economic darkness. This is our chance to reject the path of ruin and restore the foundational values of integrity, vitality, and prosperity that once defined our nation.

By unleashing the spirit of entrepreneurship and fostering a sense of community and unity, we can break free from the chains of fiat currency overlords. It's time to boost the US economy not through reckless money printing, but through the time-tested principles of sound money and free enterprise. This is our moment to reclaim our economic sovereignty and build a future of sustainable prosperity for all Americans.

end of segment

opinions expressed here are not opinions of sponsors

editorial department is sole and separate from promotions department

not financial advice

In case you missed it

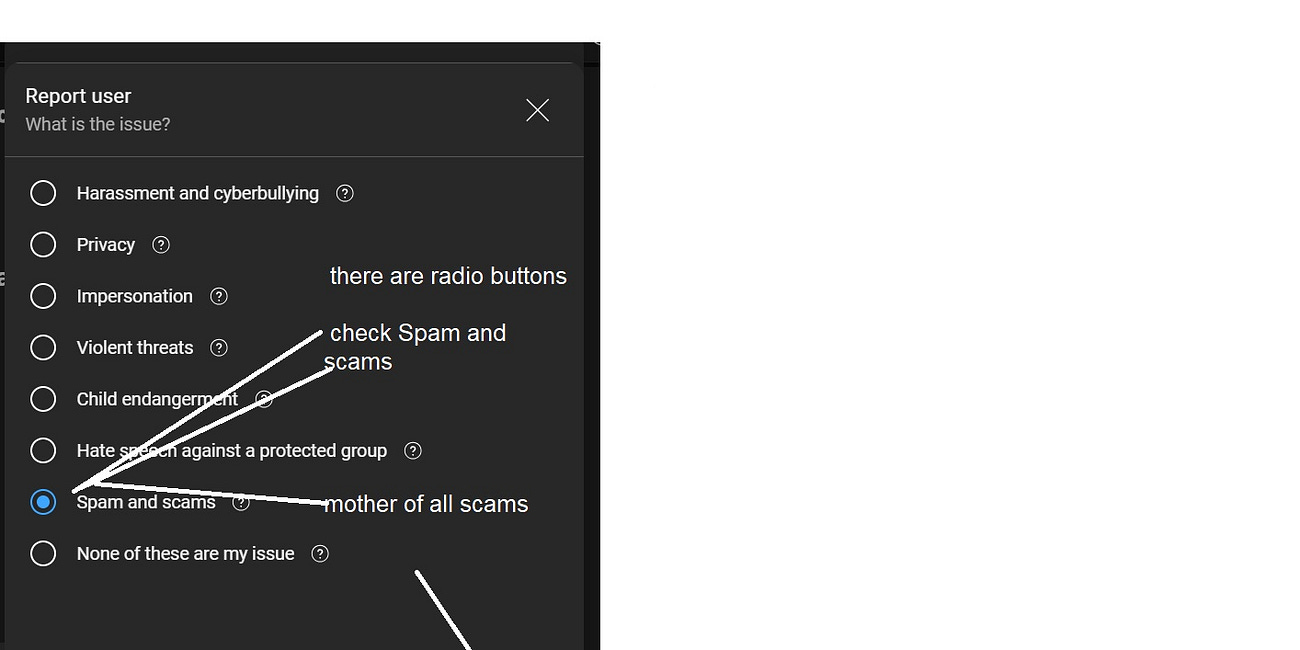

Joshua Bingham (aka Illuminated Ape) & Conrad Kirakosian (King of Money) investigation by SEC: FRAUD

2 of 10 videos exposing the fraud

Public Figure Jon Little Vindicated: SEC Investigating Joshua Bingham & Conrad Kirakosian in Landmark AI Voice Cloning Cybercrime Case

Investigative News Feature by Carmine Lombardi

Digital Extortion: How Gen Z Hackers Swindled Thousands from SilverAcademy Journalist

special report by Camine Lombardi

Reddit Users Recorded Attempting to Extort Jon Little; Public Opinion Shifts Dramatically in Favor of Silver Academy

special news report by Carmine Lombardi

SilverWars: The BrainChild of Joshua Bingham and Conrad Kirakosian Now Under SEC investigation?

This channel purchased on “Black hat world” once had hundreds of videos loaded including: