Gold & Silver Upside Explained via Schrödinger's Cat

Quantum Investing in 2025: Gold vs. Silver – Why Schrödinger's Cat Says You Can't Lose?

Foreword:

Schrödinger's cat paradox mirrors the silver-gold investment dilemma. Like the cat simultaneously alive and dead, both metals possess potential for gain. Until you "open the box" by investing, the outcome remains uncertain. Yet, given their inherent value and diverse applications, you're likely to see positive results regardless of which you choose

Setting the stage, who reigns supreme? Gold or Silver?

We’re all trying to figure that out right?

Gold out of the Gate: Swinging Fiercely at Politicians

The Bank of England faces mounting scrutiny as delays in fulfilling gold delivery orders expose systemic vulnerabilities in London’s bullion market. Wait times to withdraw gold from BoE vaults have surged from days to 4–8 weeks, a technical default on LBMA contracts guaranteeing prompt settlement.

This liquidity crisis coincides with a 75% spike in U.S. COMEX inventories since November 2024, as 12.2 million ounces were diverted from London to New York amid Trump tariff fears.

While BoE and LBMA officials cite logistical hurdles, critics argue the delays reveal a catastrophic mismatch: an estimated 380 million ounces of paper gold claims dwarf London’s 36-million-ounce “free float” of deliverable metal.

Bank of England Governor Andrew Bailey’s evasive testimony before Parliament’s Treasury Committee on January 29 further eroded confidence. When pressed about risks, Bailey dismissed concerns by stating “we’re not in the gold standard anymore”, despite London’s status as the global gold trading hub. Industry analysts now question whether the BoE’s vaults – long considered impregnable – contain sufficient unencumbered bullion to back paper claims, with some refiners privately declaring London warehouses “dry”

The debacle has triggered a $82/oz premium for COMEX futures over London spot prices, exposing cracks in the century-old system underpinning $50B daily gold trades.

The global financial landscape is undergoing a massive shift as investors abandon traditional assets for precious metals, with gold smashing records above $2,870/oz and silver emerging as the new frontier for retail investors.

This scramble reflects collapsing confidence in conventional systems - from bond markets to tech stocks - amid perfect storm conditions of geopolitical upheaval, currency erosion, and institutional fragility.

De-Dollarization Accelerates

Central banks have purchased 1,136 tonnes of gold in 2024 alone while BRICS nations liquidate $124B in US Treasuries - the fastest diversification from dollar reserves since 1971. The calculus is clear: one gram of gold now buys 36% more oil than five years ago, while the dollar's purchasing power against basic commodities has eroded 17% since 2020. With LBMA vaults reportedly nearing depletion and Shanghai gold premiums hitting $120/oz, the physical metal shortage reveals systemic stress.

Traditional Investments Collapse

The bond market crisis that toppled SVB persists, with Bank of America's held-to-maturity portfolio showing $109B in unrealized losses. Despite 6.8% inflation, savings accounts yield under 1% while the S&P 500's 2024 gains rely entirely on seven tech stocks. Nvidia's 22% plunge after China's DeepSeek unveiled AI superiority exemplifies sector fragility. Real estate transactions have stalled, with commercial property liquidity down 38% year-over-year.

Silver's Retail Spike when Gold Becomes too Expensive for Many.

As gold becomes prohibitively expensive at $2,870/oz, Asian retail investors are flooding into silver at $32.50/oz - 88x cheaper ounce-for-ounce. Vietnamese investor Hoang Tam's story typifies the trend: "When gold went parabolic, I switched to kilos of silver. It's the poor man's gold". Jewelers now market investment-grade silver bullion alongside decorative items, with Swiss and Japanese mints reporting 300% order increases.

Industrial Demand Meets Monetary Angst

Unlike gold, silver's dual role as monetary metal and industrial component creates unique pressure - solar panel manufacturers alone will consume over 280 million ounces in 2025 while mine production stagnates. Keep in mind there have been no new significant silver discoveries.

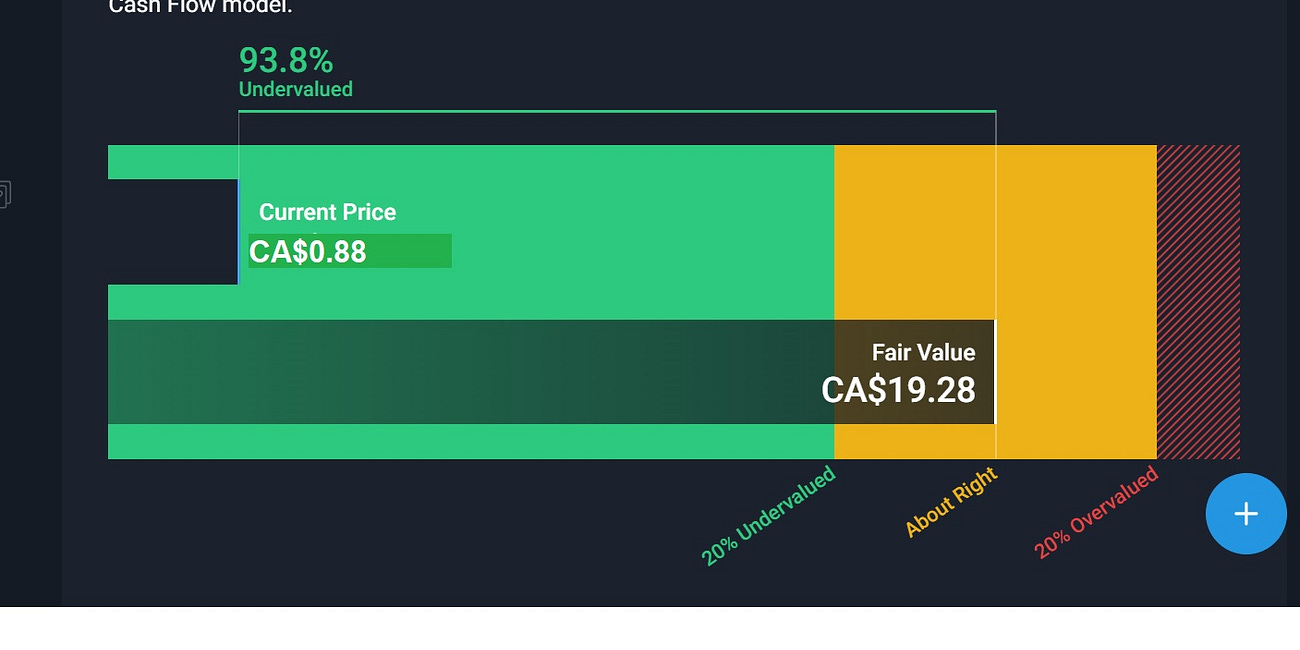

Jon Little of Silver Academy reports, “Aya Gold and Silver, Andean Precious Metals, and Kuya Silver are all screaming buys right now. As I have previously stated, I want to emphasize that when foreign governments, institutional funds, and central banks buy Gold or Silver, they do not buy shares in gold and silver mining companies. This sets up the ultimate play. Right now, gold is at an all-time high, and silver is following. The aforementioned mining companies (Aya Gold and Silver, Andean Precious Metals, and Kuya Silver) are profitable businesses that are also pure silver mining projects trading at extremely low discounts.

This convergence of financial hedging and green energy demand has created what analysts call "a coiled spring" - with inventories at 25-year lows, the metal could replicate 2011's 400% surge if ETF inflows resume.

The flight to precious metals signals deeper tremors in the global financial system. As central banks telegraph distrust in fiat systems through gold accumulation, retail investors are voting with their wallets - first embracing bullion, then pivoting to silver when gold became inaccessible. This metallic exodus, from Vietnamese shop owners to Chinese pension funds, represents a silent referendum on monetary policy failures and geopolitical instability.

Schrödinger's cat paradox , Can’t be wrong with Gold and Silver. If you think Gold is too high (buy silver). Most think Gold’s going much higher, (buy gold)

Gold and silver are staging a historic divergence in 2025, presenting investors with a Schrödinger's cat paradox where both metals simultaneously appear undervalued - depending on your perspective.

Let’s unpack this glittering conundrum through two key lenses:

The Gold-Silver Ratio: A 21st Century Anomaly

At 88:1 today’s gold-silver ratio resembles ancient Rome’s 12:1 ratio inverted through a modern funhouse mirror. This means it takes 88 ounces of silver to buy 1 ounce of gold - whereas the 50-year average of 55:1

Historically, ratios above 80 have preceded explosive silver rallies:

2020: Ratio peaked at 123:1 before silver surged 50%

2011: Ratio at 31:1 when silver hit $49/oz

1980: Ratio collapsed to 17:1 during silver’s moonshot

Source: MacroMicro data through Feb 5, 2025

Gold’s Ascent: The Ultimate Hedge Against Chaos

Gold’s record $2,870/oz price reflects a perfect storm:

Central Bank Demand: 15-year buying spree continues, with 2024 purchases hitting record 1,200 tonnes

Debt Doomsday Clock: U.S. interest payments now consume 14% of federal revenue

Geopolitical Powder Keg: Trump’s new tariffs spark 11% gold surge since January

Gold’s dominance persists because it answers three existential crises:

Currency devaluation (USD lost 98% gold value since 1913 )

Banking system fragility (regional bank stocks down 22% YTD )

Market concentration risk (S&P 500’s top 7 stocks = 32% index weight)

Thing’s looking great for gold Right?

Silver Closing argument even stronger

Dominant Sectors: Military & aerospace has now surpassed solar as the largest silver consumer, accounting for approximately 42.6% of the demand represented in this table.

Combined Impact: The top two sectors (military/aerospace and solar) account for a massive 575M oz of silver demand, which is about 69% of the total 2024 global silver production of 830M oz.

Total Industrial Demand: These four sectors alone now represent a staggering 692M oz of silver demand, or roughly 83.4% of annual global production. This doesn’t even take in the fact that Samsung claims to have developed a Silver Solid state battery (that goes twice as far, lasts twice as long, charges in under half the time and is 40% lighter) compared to antiquated Lithium-Ion batteries. Should that materialize this will wipe out all the Silver which is already on the brink of extinction.

Supply-Demand Imbalance: This level of industrial demand, coupled with investment demand and other industrial uses not listed here, suggests a significant supply deficit is likely.

Strategic Importance: The heavy use in both military/aerospace and green energy sectors underscores silver's critical role in advanced technologies and national security.

Price Pressure: Such intense demand from multiple critical sectors could lead to substantial upward pressure on silver prices, potentially accelerating the narrowing of the gold-silver ratio.

Geopolitical Considerations: The high demand from military and aerospace applications may lead to increased stockpiling efforts by nations, further tightening supply.

end of segment

Recall previously in this article where, I stated that when Central Banks, Sovereign Wealth Funds, Public Employee Retirement Funds, Insurance Companies (or other institutional investors) buy Gold and Silver, they are (generally speaking) not buying the miners. This is why you should take a serious look at these three companies which are absurdly undervalued. Remember, the market is not just about traditional factors anymore. It's also influenced by tweets from a “Strong man” and people chasing over-valued tech gadgets that China can reverse engineer at the blink of an eye. Being aware of these influences is crucial for making informed investment decisions.

North African Silver Awakening: Global Markets Take Notice

Aya Gold & Silver: TSE: AYA | NYSE: AYASF

Andean Precious Metals: Unrivaled Processing Power & Risk-Free Operations Ensure Profitability Regardless of Silver Prices

special report by Carmine Lombardi.

Against All Odds: The Remarkable Rise of a Peruvian Mine in Unforgiving Terrain

Kuya Silver | OTCMKTS: KUYAF | TSE: KUYA

editorial department is separate from promotions department

sponsors have no input on editorial

not financial advice

our opinions are not our sponsors opinions