Andean Precious Metals: Unrivaled Processing Power & Risk-Free Operations Ensure Profitability Regardless of Silver Prices

Record-Breaking Cash Flow, Diversified Growth, and Unwavering Commitment to Sustainability Propel Andean to the Forefront of Precious Metals Production

special report by Carmine Lombardi.

Andean Precious Metals stands as a shining example of innovation and success in the silver mining industry. Operating the San Bartolomé plant, the largest commercial oxide processing facility in Bolivia, this company has revolutionized silver production in one of the world's most historically significant mining regions.

The company's strategic location in Potosí, Bolivia, places it at the heart of a region renowned for its rich silver deposits since the 16th century.

San Bartolomé's proximity to the legendary Cerro Rico, once dubbed the "Treasury of the World," underscores the area's immense mineral wealth.

Andean Precious Metals has expertly tapped into this potential, extending the life of San Bartolomé far beyond its original expectations.

Innovative Business Model

Andean's business model is truly exceptional. By partnering with thousands of artisanal miners, the company has created a win-win situation that benefits both the local community and shareholders. This approach allows Andean to maintain consistent profitability, even in the face of fluctuating silver prices.

Operational Excellence

The company's transition from conventional mining to a processing-focused operation showcases its adaptability and foresight.

By securing long-term contracts for high-grade mill feed from various sources, Andean has ensured a steady supply of silver-rich material for years to come.

Sustainable Growth

Andean Precious Metals' commitment to sustainability is evident in its recent commissioning of the Fines Disposal Facility (FDF) at San Bartolomé.

This initiative not only improves operational efficiency but also demonstrates the company's dedication to responsible mining practices.With its robust financial position, strategic acquisitions, and focus on organic growth, Andean Precious Metals is well-positioned to become a leading mid-tier producer in the Americas.

The company's success story is a testament to the enduring allure of Potosí's silver and the power of innovative mining practices in the 21st century.

Look at this Growth Potential assuming you invest $20,000

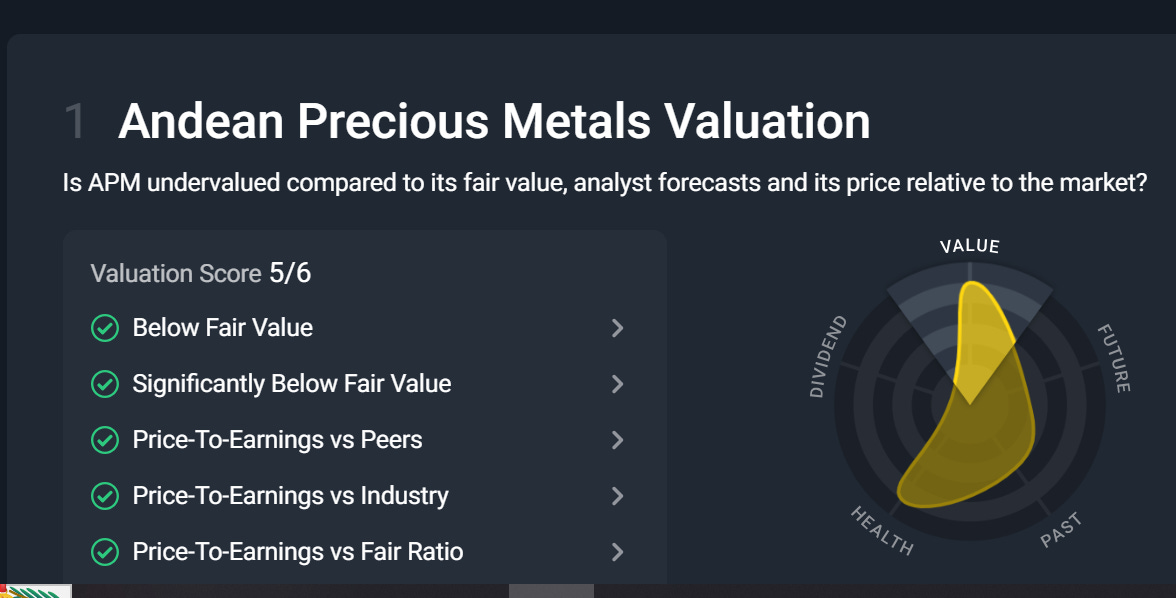

The increase from the current market share price of $0.88 to the fair market value of $19.28 represents an extraordinary growth of approximately 2,091%. This means that the current price would need to increase by nearly 22 times its present value to reach the fair market price target, indicating an extremely significant magnitude of change

Using the 22X formula as a potential return scenario for an investment of $20,000 would result in a significant increase in value. Let's break down the calculation and its implications:

The initial investment of $20,000 multiplied by 22 would result in a final value of $440,000. This represents an increase of $420,000 from the original investment amount.

22X to get to fair market value

end of segment

not financial advice

My opinions are not opinions of sponsors

editorial department is separate from advertising department