Silver: Outperforming Gold yet Still Massively Undervalued

For people who missed the boat when Silver was 25 dollars per ounce will they now pile in if Silver is 25 cents per ounce?... follow the flawless logic.

Over the past three years, central banks have set records by purchasing over 1,000 metric tons of gold annually, driven by geopolitical tensions and economic uncertainty.

The global landscape is further complicated by President Trump's tariffs, which are causing market volatility and investor unease.

Meanwhile, the U.S. faces a staggering $37 trillion debt, with debt servicing as its top budget item.

Many nations are divesting from U.S. Treasuries in favor of gold.

But Guess What? Silver has outperformed gold over the last five years, with predictions it will continue to do so in 2025

Silver does not get the headlines like Gold because It is being managed by industrial users and financialized interests.

But this won’t last because the West is quickly losing its ability to manipulate Silver to the downside, given the buying syndicate of BRICS, the Shanghai Gold exchange being physical compared to COMEX being paper, and the toxic orbit of the US Dollar. Moreover, supply/demand dynamics are leading to Silver’s price discovery.

Remember - yes, stack physically, but meanwhile, obtain the leverage play.

SILVER MINERS ARE POISED TO GO 10X if you follow best practices, do your own research or interact with this newsletter simultaneously

Mexico, the #1 producer of Silver, is going to nationalize or tax the crap out of Silver.

Either way, (Nationalizing or Taxing excessively) has the same net impact on the unfortunate silver mining investor hoping Mexico will be like it was years ago.

The facts are that the Morena party has removed all profit margins for silver miners operating out of Mexico.

Where else can you look?

Do you think China is going to export its Silver? NO

Do you think Russia is going to export its Silver? NO (they just recently passed a law stating it is prohibited to export recycled or scrap silver)

So, if Mexico, China, and Russia are closed, where else?

US ( in many ways worse jurisdiction than Peru when it comes to US environmentalists looming, bureaucratic backlogs, and US declining ore grades)

All eyes are on Morocco, Peru, Bolivia, and Canada, but at this point, Canada doesn’t have any significant silver mines in production.

Kuya Silver: Prosperity in Peru

Kuya Silver Corp. is listed under the ticker symbol KUYAF on the OTC market in the US and KUYA on the CSE in Canada

In the heart of Peru, a silver mine is poised to revolutionize the industry with its ambitious 100/100 Plan.

Kuya Silver's Bethania project, nestled in the prolific silver-zinc-lead belt of Central Peru, is on the cusp of a major breakthrough.

With permitting, mine preparation, and startup phases now complete, this mine is set to achieve break-even in the next few months and continue expanding from there.

100 Million Ounces of Silver Equivalent

The 100/100 Plan aims to unlock at least 100 million ounces of silver equivalent, a feat that, based on historical success rates, could be achieved at a remarkably low cost of approximately $20 million USD, or $0.20 per discovery ounce.

Then through production expansions, this ambitious target positions Bethania as a significant player in the global silver market, with potential annual free cash flow of $100 million.

Operational Excellence and Expansion

Currently leveraging a toll milling model, Kuya Silver has secured all necessary permits to establish its own processing plant. The company is targeting an initial throughput of 350 tonnes per day, with plans to expand to over 1000 tonnes per day in the future.

This strategic expansion will not only increase production capacity but also enhance profitability, particularly with silver prices remaining robust.

Potential or a Lock?

Consider a scenario where Kuya Silver in the future produces just 5 million ounces annually at a margin of $20 per ounce. This could translate into substantial revenue, bolstering the company's financial standing and paving the way for further growth.

Price Per Ounce Calculation in USD

Given Kuya Silver's market cap of $25 million and if they can find 100 million ounces of silver in the Bethania district they control, the implied price per ounce today is approximately $0.25.

This modified valuation underscores the potential for significant upside as the mine ramps up production and realizes its full potential.

As Kuya Silver embarks on this journey, investors and industry watchers alike are eagerly anticipating the realization of the 100/100 Plan.

With its robust infrastructure, strategic partnerships, and commitment to sustainable mining practices, Bethania is poised to become a flagship operation in Peru's vibrant mining sector.

And the news gets better

Investing in Kuya Silver, a mine where 80% of revenue comes from silver is attractive because it offers direct exposure to silver's potential upside.

Silver is currently undervalued, making such a mine a strategic choice for those betting on its price increase. In contrast, investing in mines where silver is a byproduct exposes investors to risks associated with other metals like lead, zinc, and copper, which could suffer during economic downturns. By focusing on a predominantly silver-producing mine, investors can mitigate these risks and capitalize on silver's potential growth without being tied to the performance of other metals.

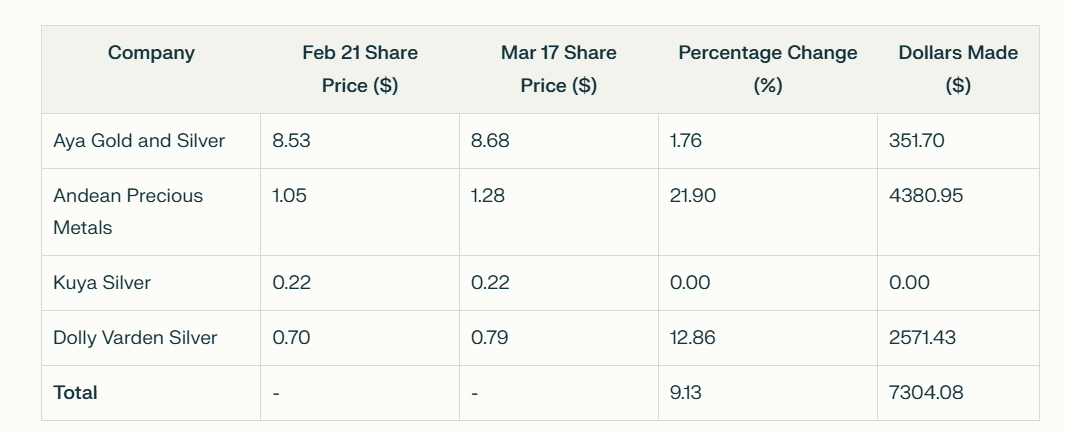

Also, please note the article I wrote just yesterday. My picks prevailed way beyond other analysts by a mile.

If you read this article below closely, you will see why KUYA Silver is the sleeping giant.

Recall that Silver is on the Brink of Extinction and that discovery is approaching.

Invest accordingly. Why would you allow your money to languish in the US banking system where any day now you will see bank runs (you can bookmark this prediction)

Silver's Blast Off Imminent: Prepare for a Price Explosion

On February 21, 2025 (less than a month ago) I urged our readers to BUY the Dip as indicated in this February 21, 2025 Silver Academy article I wrote myself

end of segment

not financial advice

my opinions are not the opinions of sponsors

editorial department is separate from promotions