Which Bank Just Said There are increasing risks of a Silver short-squeeze?

Chasing this, will post later today

Report Topics include:

LBMA shortage

supply deficit

above ground compensatory limitations

demand inelasticity

tariff implications

Silver’s price is up 17% this year, aided by gold’s unrelenting rally.

The ratio of LBMA silver stocks to silver-back ETF holdings has fallen to a historical low of 1.

Furthermore, there are increasing risks of a short-squeeze, as swap-dealer positions are net short at the highest since 2020.

A tight physical market is expected to persist for the fifth consecutive year.

Industrial demand is likely to be resilient despite tariff-related headwinds. Improving manufacturing activity in China is another supportive factor for silver demand.

Recall the military and aerospace of silver as #1 and #2, far exceeding solar. So even in recessions (when poor silver analysts claim silver demand lowers), they are dead wrong because nations, especially the US, China, Russia, N. Korea, Israel, Germany, France, UK, and Iran, will always devour silver-zinc batteries for torpedoes, satellites, missiles, etc

Nevertheless, US investment demand will be crucial now…. without it, time will likely bail out the short-squeeze candidates.

I spoke with a silver mining CEO yesterday over the phone, and he has been invited to meet with some of the largest wealth management funds in the US and Europe.

This signals that even traditional financial powerhouse names like Raymond James, Morgan Stanley, and Goldman Sachs are interested in gaining more exposure to gold and silver.

It’s important to remember that institutional investing crushes retail investing. Right now, these significant funds (including sovereign wealth funds, insurance funds, pension funds, university investments, and state retirement funds) hold less than one-half of one percent in precious metals.

They are predicted to return to their historic mean of 3% allocation being precious metals. This represents a staggering 6x metric (increase)

Folks, there isn’t enough Silver for this type of sales increase (Not enough Silver). Once again, there is 3 to 4 times more gold above ground than Silver. Why? Because most all the gold ever mined is still either

- in someone’s safe place

- in some bank’s vault

- in some nation's vault

- or passed from family (generation to generation) as a store of wealth

Whereas silver has been consumed in thousands of industrial applications (landfills full of electronics, solar panels, mobile phones, computers) and on way too many bombs, missiles, torpedo batteries, or floating around in space (You can’t use inferior batteries when something is submerged or in orbit, it’s not like a flashlight where you screw off the top and pop in the energizer bunny)

Buy the Right Silver Miner

Aya Gold & Silver

AYA Gold & Silver SHORT SQUEEZE in motion

OTCQX: AYASF

TSX:AYA

Surprisingly, short interest went up from the email below to 13 m shares from 11.7 m shares.

13 m shares short on float of 115 m. The stock has only traded 650k shares so far today.

The stock may waffle here at $13 but this is the key level.

We would not be surprised to see the stock outperform peers from here for awhile.

Good luck to all longs

and apologies to the shorts.

a text book set up on AYA:

AYA looks like a bear trap breakdown and positive reversal

watch for aggressive positive price action from here.

As a reminder almost (7.8 m AYASF 3.9 m AYA or 11.7 m shares in total on float of 114.8 m shares or over 10%)

A positive March production update would be the final nail in the shorts coffin.

Disclosure, this writer is throwing $50,000 at this play

You should too!

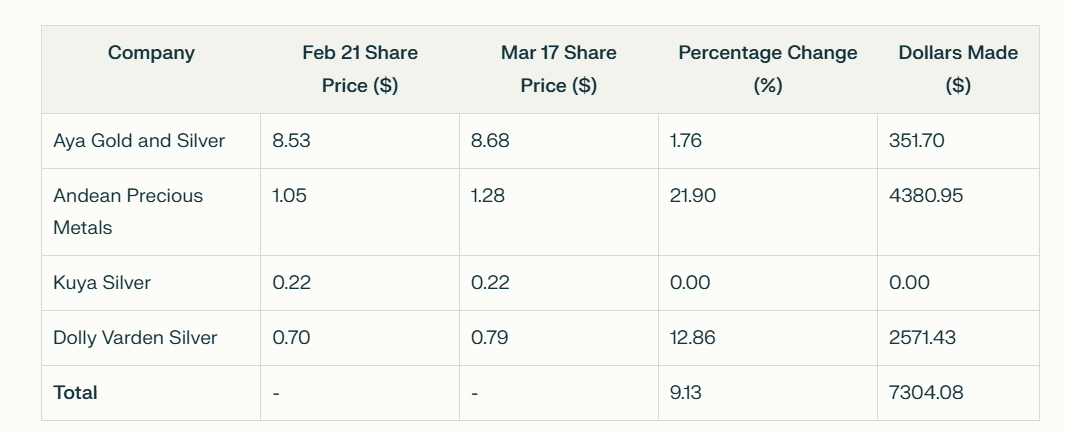

Read yesterday’s report to see how my elite group of 4 silver mining companies (endorsements) are killing it even within an overall lackluster equity bear market.

Unlike other analysts, when I make the call, I keep track to demonstrate my win/loss ratio, the highest in the industry. As Jim Rome says, “Scoreboard”

Read how well we were doing last month when the overall market was down

Over the last 30 days, the U.S. stock market has experienced significant declines. Here are the changes in major indices:

S&P 500: The S&P 500 has dropped from approximately 6,129.58 to 5,614.66, representing a decline of about 8.4% over the past 30 days2.

Dow Jones Industrial Average: The Dow Jones has fallen from about 44,556.34 to 41,581.31, marking a decrease of roughly 6.68% over the same period2.

Nasdaq Composite: While specific 30-day data for the Nasdaq isn't provided in the search results, it has shown a monthly decrease of about 12.62%

Jon Little’s elite group of miners up over 9% during this same time period

and the Great Silver Bull Run hasn’t even left the cattle gates yet (so you can still pile in)

See the scoreboard clicking on article below

Silver's Blast Off Imminent: Prepare for a Price Explosion

On February 21, 2025 (less than a month ago) I urged our readers to BUY the Dip as indicated in this February 21, 2025 Silver Academy article I wrote myself

end of segment

editorial department is separate from promotions department

my opinions are opinions of sponsors

not financial advice