The Silver Drought: How Solar Power is Set to Deplete a Finite Resource

Solar Surge, Silver Squeeze: We Are Running Out of Time

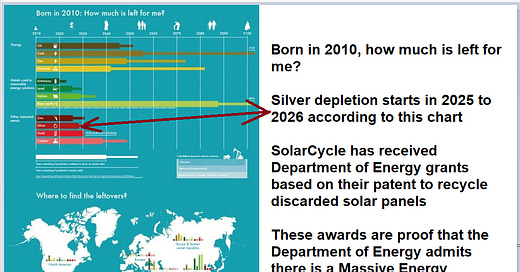

As the world races towards a greener future, an unexpected casualty may be emerging: silver. This precious metal, long valued for its luster and conductivity, is now facing unprecedented demand that threatens to deplete global inventories by the end of 2025. The culprit? The explosive growth of solar energy, coupled with increasing industrial applications most notably aerospace, military and silver zinc batteries.

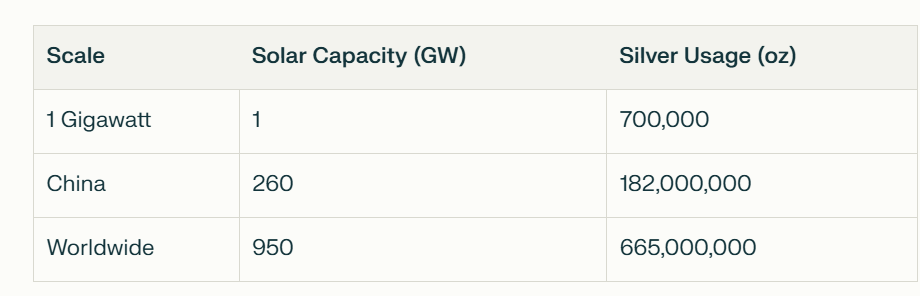

China, the world's largest solar market, is leading the charge. The China Photovoltaic Industry Association projects a staggering 260 gigawatts of new photovoltaic installations in the country alone. When we consider that each gigawatt requires approximately 700,000 ounces of silver, the scale of demand becomes clear. But China is just the tip of the iceberg.

Globally, new solar installations are projected to surpass 950 gigawatts. This translates to a mind-boggling 665 million ounces of silver demand from the solar sector alone. To put this in perspective, the entire global silver production in 2023 was just only 820 million ounces. The solar industry's appetite for silver is insatiable and growing.

However, solar is not the only industry driving this unprecedented demand. Aerospace, military applications, robotics, electric trains, artificial intelligence, electronics, computers, mobile phones, and electric vehicle batteries are all competing for this finite resource. The result? Silver is approaching its fifth consecutive year of structural deficit, with a shortfall exceeding 180 million ounces annually.

Adding fuel to the fire, India, another major player in the global economy, is projected to nearly double its silver imports this year. This surge in demand from multiple sectors and regions is creating a perfect storm that threatens to drain silver reserves entirely by mid to late 2025.

The implications of this looming silver shortage are far-reaching. For the renewable energy sector, it could mean skyrocketing costs and potential slowdowns in solar panel production. This comes at a critical time when many countries are racing to meet ambitious climate goals. The situation in Nevada serves as a microcosm of the challenges ahead, where the push for large-scale solar projects is meeting resistance due to concerns about land use and environmental impact.

For other industries reliant on silver, from aerospace to consumer electronics, the shortage could lead to production bottlenecks and increased costs. This, in turn, could slow technological advancements and economic growth across multiple sectors.

Investors and financial markets are also likely to feel the effects. As silver becomes scarcer, its value is expected to rise dramatically. This could lead to increased speculation and volatility in precious metal markets, potentially impacting global economic stability.

The situation calls for urgent action on multiple fronts. First, there's a need for increased investment in silver exploration and mining to boost supply. However, this must be balanced with environmental concerns and sustainable practices.

Secondly, improved recycling processes for silver recovery from electronic waste and other sources could help alleviate some of the supply pressure. This would not only address the silver shortage but also contribute to circular economy goals.

Lastly, policymakers and industry leaders need to collaborate on strategic planning to manage this impending crisis. This could involve prioritizing silver allocation to critical industries, incentivizing recycling, and limiting silver’s use in weapon systems.

The silver squeeze is a stark reminder of the complex challenges we face in transitioning to a sustainable future. As we push for renewable energy and technological advancement, we must also consider the resource implications of our choices. The coming years will be crucial in determining whether we can navigate this silver crisis without derailing our progress towards a greener, more technologically advanced world. The clock is ticking, and the world needs to act fast to prevent a silver shortage from tarnishing our bright, sustainable future.

end of section

Tomorrow, we release volumes of documents from Reddit Apes, WikiLeaks-style emails, and more. We found evidence of fraud and other nefarious acts.

This is beyond sad. We have added new staff to stay on top of this developing story. A volunteer army of researchers to stay on top of the day to day drama that Reddit SDC and Reddit WSS are known for.

1. First, it was Jim Lewis.

2. Then, it was The Silver Institute.

3. Then it was Bob Coleman.

4. Then it was Stephen St Angelo.

5. Then it was Jeff Christian.

6. Then it was Paul Bateman.

7. Then, “Illuminated Ape” and “King of Money " accused Miles Franklin of hedging their Silver and engaging in Short selling (another desperate and absurd claim). They had tried this stunt by accusing Bob Coleman of the same thing, creating a month's worth of content called “Bob has weak hands.”

8. Then, “illuminated ape” and “king of money” wanted to launch an investigation into Stefan Gleason, alleging he had some political ties they were not happy with. (I told them to knock it off)

9. Then, it was Phillips Baker, former CEO of Hecla.

10. Then, the "illuminated ape" went to great lengths to document the home address of Bix Weir, showing his land package and his gated community, demonstrating his assets, and suggesting that Bix Weir somehow amassed wealth by knowing the timing of the silver market over two years ago

11. Now, I am under attack. My name is Jon Little, and though this entire ordeal is annoying and unpleasant, I have it under control and will respond with an open and shut case tomorrow.

12. Tomorrow, I will release a drip-drip of screenshots, emails, three-way chats, and other data that will prove how these two anonymous people (who hide behind avatars) have created a new reign of terror. I will be forthcoming with some errors in judgment I made when engaging with people without vetting their legitimacy.

13. Then, the illuminated ape went to exhaustive lengths to try and paint a story about James Turk and Alasdair Macleod of GoldMoney and some commercial real estate they had purchased as if this was some kind of smoking gun. I was able to kill that story like I did on about 90% of their immoral, unwise, and insane stunts.

14. Moreover, "Illuminated Ape" and "King of Money" somehow acquired control of the First Majestic Reddit page, and they used it to message to First Majestic fans that Keith N is not a worthy CEO.

15. Tomorrow, I have dozens of more things to show folks. It's a waste of time, but these Reddit kids have started this, so I must get the TRUTH OUT.

- end of section

the advertising department and editorial department are separate

our opinions are not our sponsors

opinions of Silver Academy and SilverNATION are not those of thesilverindustry.substack.com

Not financial advice