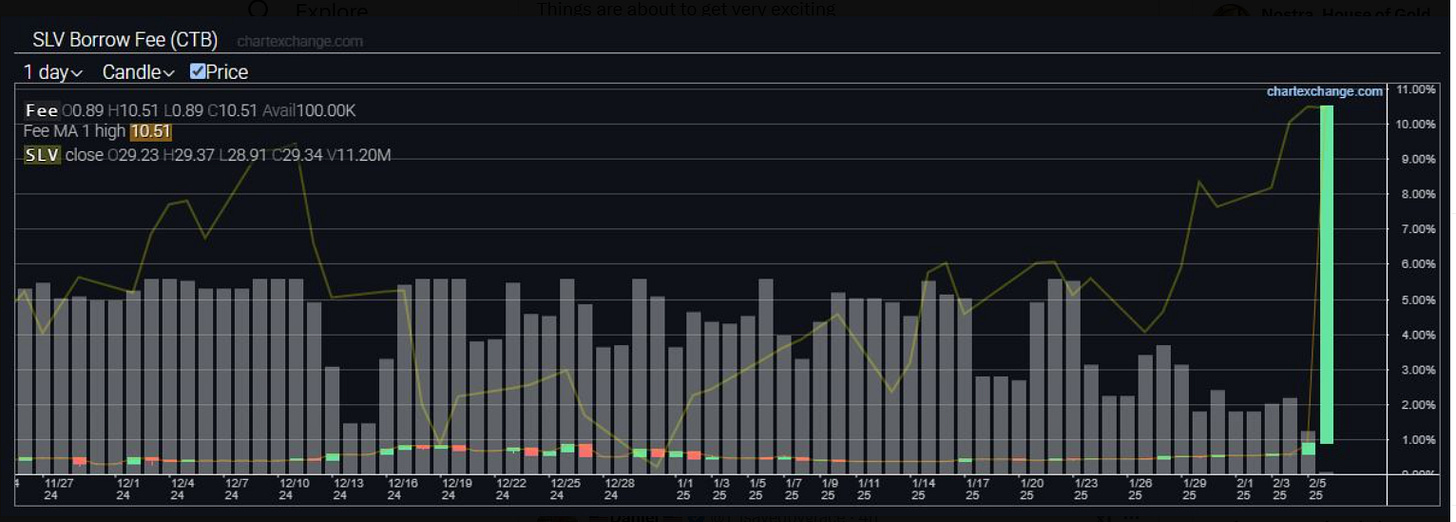

The number of SLV shares available for borrowing has plummeted from 10 million to a mere 10,000 in just two weeks

From 10 million to a mere 10,000 in just 2 weeks, representing a 99.9% reduction. This dramatic decrease in borrowable shares, coupled with the soaring borrowing fees, suggests severe supply shortage.

The silver market is experiencing unprecedented turmoil, with recent developments in the iShares Silver Trust (SLV) ETF painting a picture of extreme market stress.

They are trying to redeem shares for physical

The silver market's turmoil has intensified, with a new development adding fuel to an already volatile situation. A staggering 47,000 in-the-money (ITM) calls on the iShares Silver Trust (SLV) ETF are set to expire, representing a potential demand for 4.7 million shares. This expiration event is occurring against a backdrop of extreme market stress, where only 10,000 shares are available to borrow.

The magnitude of this options expiration relative to the available shares paints a stark picture of the potential squeeze facing silver shorts. With 4.7 million shares potentially needing to be delivered and a mere 10,000 available to borrow, the imbalance is profound. This situation could force short sellers into a corner, potentially triggering a significant short squeeze and driving silver prices higher.

This options expiration adds another layer of complexity to the already precarious state of the silver market. The borrowing fee for SLV has recently skyrocketed, increasing tenfold in a single day to reach 11.51%. This vertical ascent in borrowing costs, coupled with the severe shortage of borrowable shares, indicates extraordinary demand and market dislocation.

The convergence of these factors - the large number of ITM calls expiring, the minimal shares available to borrow, and the soaring borrowing fees - suggests that silver shorts are indeed in a precarious position. The potential for a short squeeze has increased significantly, which could lead to rapid upward price movements in silver.

Adding to the broader context, the recent news of the Bank of England's de facto default on gold has heightened concerns in the precious metals market. This development, combined with the unfolding situation in silver, points to a period of significant turbulence in the precious metals sector as a whole.

As these events unfold, market participants should be prepared for increased volatility and potential rapid price movements in silver and related assets. The situation underscores the intricate dynamics of options markets and their potential to exacerbate underlying market stresses.

Regulatory bodies are likely to be watching these developments closely, and the possibility of market interventions or rule changes cannot be ruled out. Nevertheless, the writing on the wall spells out what we have been saying all along, There is a massive shortage of Silver.

In this high-stakes environment, both long and short positions in silver face substantial risks. The coming days may prove crucial in determining the direction of silver prices and the fate of those caught on the wrong side of this unfolding market drama.

Look at similar dynamics playing out in Gold Market

But there is way more leverage in the system than when this occurred last.

Speaking of Leverage

We have identified a miner in Morocco that is PURE LEVERAGE PLAY in a Tier 1 Jurisdiction.

We should expect Silver and Gold to jump significantly soon…

But a miner like the one we recommend below is poised for a 10 X move in the next 3 to 12 months

see below

North African Silver Awakening: Global Markets Take Notice

Aya Gold & Silver: TSE: AYA | NYSE: AYASF