The American Commercial Real Estate Crisis. Likely the Cause of the 2025 Great Financial Collapse

Why Silver May Be the Only Safe Haven Left.

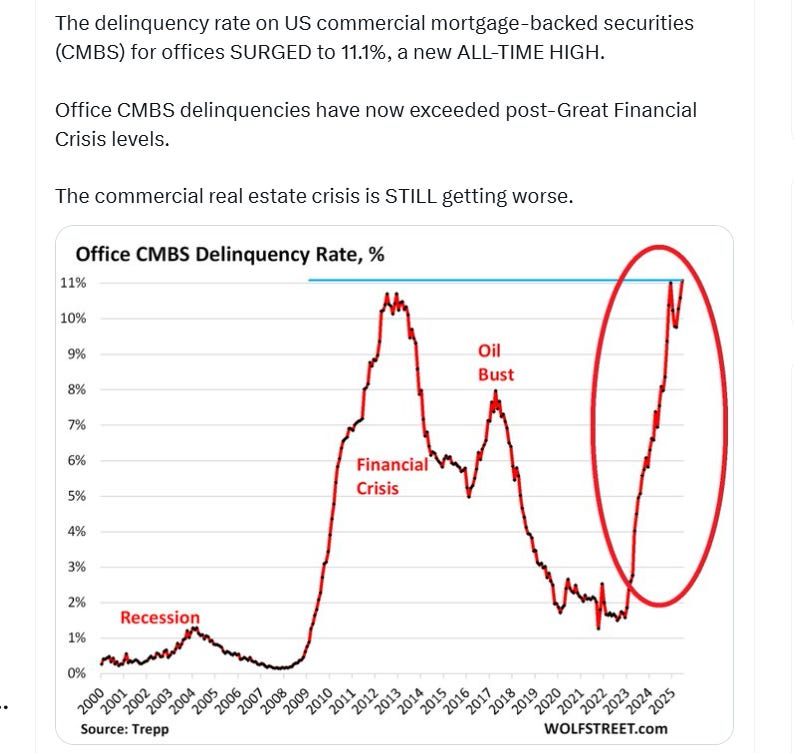

The U.S. commercial real estate market is in freefall, and the numbers are not just bad—they’re historic. In June 2025, the delinquency rate on office commercial mortgage-backed securities (CMBS) surged to 11.1%, smashing through the previous all-time high set during the depths of the Great Financial Crisis. This is not a blip. It’s a catastrophic unraveling of an entire asset class that once underpinned the American urban economy.

Why Offices Are Dying: The End of the Gathering Age

The collapse of the office market is not a mystery. The COVID-19 pandemic didn’t just push workers out of cubicles; it proved that most white-collar jobs can be done anywhere with Wi-Fi. The only exception? Medical facilities, where physical presence is still required for examinations and procedures. For everyone else, the “need” to gather in an office has been exposed as a relic of a bygone era.

Workers have tasted autonomy. Companies have slashed costs by shrinking their footprints. The result: a glut of empty towers in every major city, and a tidal wave of defaults as landlords can’t cover their debts.

Commerce Has Changed Forever

This isn’t just about offices. The entire landscape of American commerce has shifted. Amazon and the e-commerce revolution have gutted brick-and-mortar retail4. Consumers want convenience, selection, and price transparency—none of which require a trip to the mall. The pandemic only accelerated this shift, driving foot traffic and sales at physical stores into the ground. Many retailers have failed to adapt, leaving behind shuttered storefronts and unpaid leases.

The Maturity Wall: A Ticking Time Bomb

It’s about to get much worse. In 2025 alone, $957 billion—a staggering 20% of all outstanding commercial and multifamily mortgages—will mature. Many of these loans were written in an era of low rates and high demand. Now, owners face refinancing at much higher rates, with properties that are worth far less and generating little or no income. The “extend and pretend” era is over. Defaults will accelerate as reality sets in.

Systemic Risk: Banks, Debt, and a Nation at War

The U.S. banking system is already straining under the weight of these losses. Even if banks are less exposed to CMBS than in 2008, the ripple effects are massive—hitting institutional investors, pension funds, and insurance companies. Layer on top of this the $37 trillion national debt, with $11 trillion maturing soon and needing to be refinanced at higher rates. Congress is poised to raise the debt ceiling by another $4–5 trillion, the largest increase in history.

Meanwhile, the U.S. is embroiled in proxy wars with China, Russia, and Iran, while subsidizing Israel and Ukraine, and maintaining a global military presence with 850 bases. Defense spending is ballooning, with a $1 trillion Pentagon budget on the horizon. The government is feeding the beast of war while the home front crumbles.

The Human Cost: Layoffs, Unaffordable Living, and Despair

The economic pain is everywhere. Layoffs in 2025 have hit 744,308 workers—the highest since the pandemic’s darkest days. Retail, tech, media, and even federal agencies are slashing jobs. The cost of living is skyrocketing, with housing and health insurance out of reach for millions. Middle-income Americans are locked out of homeownership, and even those with “good” jobs can’t keep up with inflation and rising costs.

What Can the Fed Do?

The Federal Reserve is cornered. Cut rates, and risk a dollar crisis and runaway inflation. Hike rates, and trigger a wave of defaults that could threaten the entire financial system. The Fed’s traditional toolkit is useless against a crisis of this magnitude, where real estate, debt, global conflict, and political dysfunction collide.

The Silver Lining—Literally

In this environment, traditional money—silver and gold—is staging a quiet comeback. Silver, in particular, is in a structural deficit, with demand outstripping supply for the fourth year in a row. Mines can’t keep up, and recycling offers only partial relief. Meanwhile, states like Texas, Florida, Idaho, Utah, and Louisiana are re-legitimizing silver as legal tender, and central banks are starting to accumulate it.

Silver is the “wild animal” of the monetary world: ignored for years, then suddenly exploding higher when confidence in fiat evaporates. Its historical pattern is clear—quiet accumulation, skepticism, then a breakout that catches everyone off guard. In past crises, silver has outperformed gold, and the setup today is eerily similar.

Conclusion: The System Is Failing—Silver Is the Escape Hatch

The American banking system cannot endure this convergence of commercial real estate collapse, unsustainable debt, global conflict, and social unraveling. As the pillars of the old economy crumble, silver stands ready—not just as a hedge, but as a lifeline. In a world awash in paper promises and digital illusions, real money is making its move. Ignore it at your peril.

Technical Analyst Jesse Columbo writes,

While silver has spent the past few weeks in a healthy consolidation, it has managed to hold onto its gains — a very constructive sign. I’m now watching for a breakout from this consolidation, which I believe will set the stage for a rapid move to $40 an ounce and beyond.

Columbo continues,

It’s also worth noting that silver often rallies in this step-like fashion, moving from one technical pattern to the next. For example, last month’s $4.50 per ounce surge was preceded by a well-defined triangle pattern that formed in April and May. The current bull flag appears to be continuing this pattern of behavior, making it an exciting setup to watch for us silver bulls.

end of segment

Meanwhile in Mexico.

As we have been saying over 45 times via this newsletter

Why Mexico is a Flashing Red Risk

Aggressive Nationalization of Strategic Sectors: The Morena party has enacted sweeping nationalizations, including:

Lithium (2022): All lithium reserves were nationalized, closing the sector to private and foreign investment and creating a state monopoly.

Electricity (2023): State-owned companies (Pemex and CFE) were reclassified as public entities with legal preference over private competitors, reversing previous reforms that encouraged private participation.

Mining: No new mining concessions will be granted, and existing permits are under review for environmental compliance, creating a de facto moratorium on sector expansion.

Expropriation and State Seizures: The Morena government has demonstrated willingness to seize private and foreign-owned assets, as seen in the 2024 seizure of a US-owned rock quarry, raising fears of further expropriations without due process or compensation.

Policy Instability and Regulatory Uncertainty:

Frequent legal and regulatory changes, often passed rapidly and without broad consultation, undermine investor confidence and complicate long-term planning.

Existing concessions and contracts are subject to review, and there is ambiguity about the protection of previously granted rights, especially in the mining and energy sectors.

Shift Toward State-Led Economic Model: The "Fourth Transformation" agenda prioritizes state control over natural resources and key industries, explicitly rejecting neoliberal policies and favoring a more interventionist, left-leaning economic model.

Alignment with Non-Western Powers:

Russia: Mexico is deepening energy cooperation with Russia, including joint ventures with Pemex, Russian LNG imports, and technology transfers, aiming to reduce reliance on US energy and diminish US leverage.

Ideological Shift: The current administration’s rhetoric and policies increasingly align with the resource nationalism and state-centric models seen in Russia and China, rather than the US and Western Europe.

Strained US-Mexico Relations: Bilateral tensions are exacerbated by hostile rhetoric from the US (notably the Trump administration), US immigration crackdowns, and Mexico’s overt moves to diversify away from US economic influence.

Populist Social Spending and Fiscal Risks: Massive increases in social programs, minimum wage hikes, union empowerment, universal pensions, and large-scale infrastructure projects risk fiscal sustainability and signal a policy environment where political priorities can override market logic.

Resource Nationalism and Political Rhetoric: The government’s rallying cry—"resources of Mexico belong to the people" and "must secure Mexico’s energy future"—signals a willingness to prioritize sovereignty and state control over honoring foreign investment commitments, increasing the risk of arbitrary or politically motivated actions.

Tax and Regulatory Risks: The administration has promised to address perceived under-taxation in sectors like mining, raising the prospect of retroactive tax hikes or new levies on foreign and private investors.

Judicial and Contractual Unpredictability: Politicization of the judiciary and frequent contract reviews undermine the reliability of legal protections for investors, increasing the risk of disputes and losses.

In summary: Mexico under Morena is a high jurisdictional risk for foreign investors due to aggressive nationalizations, legal unpredictability, resource nationalism, state-favored economic policies, alignment with non-Western powers, and deteriorating relations with the US. This environment creates heightened risks of expropriation, contract frustration, regulatory changes, and fiscal instability.

Mexico: One Sandal Away from Nationalizing Silver

Please, after reading this article Google the translation from Spanish to English, “Pistola Humeante”

end of segment