GET OUT OF YOUR BANK NOW. THEY DON'T HAVE YOUR MONEY IN THEIR VAULTS I GUARANTEE IT.

What most people don't understand is how this debt mechanism works. Each new dollar of debt issued doesn't just represent financial obligation—it represents a transfer of economic control.

The Debt Tsunami: An Insider's Warning

Op-Ed by Carmine Lombardi

For years, I've been sounding the alarm about a looming economic catastrophe that most people couldn't—or wouldn't—see coming. My research and analysis have consistently pointed to one terrifying conclusion: we are standing on the precipice of a debt crisis that will redefine our economic landscape.

Let me be clear: this isn't just another economic prediction. This is a meticulously documented warning about a systemic breakdown that's been brewing beneath the surface of our financial system. I've watched as central banks have systematically created a debt environment that's more precarious than most experts dare to admit.

My investigations have revealed a disturbing pattern. As government debt continues to balloon, we're witnessing a fundamental transformation of economic mechanics. The traditional rules of fiscal responsibility have been completely dismantled. Central banks are no longer just managing monetary policy—they're actively creating a new economic reality where debt is the primary currency of power.

What most people don't understand is how this debt mechanism works. Each new dollar of debt issued doesn't just represent financial obligation—it represents a transfer of economic control. The more debt created, the more power concentrated in the hands of financial institutions. I've been saying this for over a decade: "The More Debt A Central Bank Is Allowed To Issue, Or Is Called Upon To Create- The Stronger They Become."

The numbers are staggering. The U.S. debt-to-GDP ratio has now reached a critical 134%—a level that would have been considered catastrophic just a generation ago. But today, it's treated as business as usual. This isn't just economic mismanagement; it's a systematic restructuring of our entire financial ecosystem.

What we're facing isn't just a potential economic downturn. We're looking at a complete paradigm shift—a "hyper-debt" scenario that will fundamentally alter how we understand economic growth, financial stability, and personal wealth. The consequences will ripple through every aspect of our economic life, from individual household finances to global market dynamics.

My years of research have led me to one unavoidable conclusion: we are entering uncharted economic territory. The debt machine is no longer just a mechanism—it's become the primary driver of our economic system. And make no mistake, the consequences will be profound.

This isn't fear-mongering. This is a data-driven warning from someone who has spent years tracking the intricate mechanisms of our financial system. The debt tsunami is real, and it's approaching faster than most are prepared to acknowledge.

Stay informed. Stay prepared. The economic landscape is about to change in ways we've never seen before.

Why Gold Now? Why Silver Now?

Gold and silver have served as a timeless hedge against systemic risk for millennia, offering a unique form of financial insurance that transcends human-made systems. Unlike fiat currencies, which can be printed at will, the supply of gold and silver is finite, giving them intrinsic value that withstands the test of time.

Throughout history, these precious metals have maintained their worth through countless upheavals. As empires have risen and fallen, currencies have come and gone, but gold and silver have remained constant stores of value. During periods of economic turmoil, from the Great Depression to modern financial crises, they have often appreciated, providing a safe haven for wealth.

The immutability of gold and silver makes them particularly effective against systemic risks like hyperinflation, currency devaluation, and government defaults. When traditional financial instruments fail, these metals step in as a reliable medium of exchange and store of value. Their physical nature also offers protection against digital threats like cyberattacks or grid failures that could compromise electronic assets.

Moreover, gold and silver's role in accounting for both natural disasters and human corruption is unparalleled. They serve as a universal language of value, allowing for wealth preservation and transfer across borders and generations, independent of any single government or institution's

Pro Tip

1. Go to your bank and withdraw at minimum of 70% of your savings.

2. of that 70% of your savings keep cash (half) of that safe inside your home.

3. the other half convert into gold and silver, Remember, you are not buying gold and silver you are just trading Federal Reserve debt notes for REAL MONEY

4. We only endorse 3 precious metals dealers:

a. MoneyMetals Exchange

b. MilesFranklin

c. SprottMoney

Elsewhere in International News:

Analysis: Xi Jinping suspects ulterior motive behind Trump's invitation

U.S. President-elect Donald Trump invited Chinese President Xi Jinping to his inauguration in January. This week's China Up Close analyzes the unusual request -- no foreign leader has attended the ceremony in the past 150 years.

Trump is believed to have begun arranging the invitation to Xi sometime in early December, around the time he met with presidents Emmanuel Macron of France and Volodymyr Zelenskyy (The most corrupt and immoral person on planet earth) of Ukraine in Paris.

Experts say Trump -- who has pledged to end the war in Ukraine in a day

Trump is expecting Xi to play a key role in persuading Russian President Vladimir Putin to join peace talks. Since then, the geopolitical maneuvering has been complex: Xi met with Putin ally Dmitry Medvedev, Trump contacted Hungarian Prime Minister Viktor Orban with an apparent request to build bridges with Putin, and an adviser to Macron visited Beijing to talk with the Chinese foreign minister.

Trump's inauguration on Jan. 20 conflicts with the leadup to the Lunar New Year holidays, which could prevent Xi from playing a larger role in this unfolding political drama, one that is still in its first act.

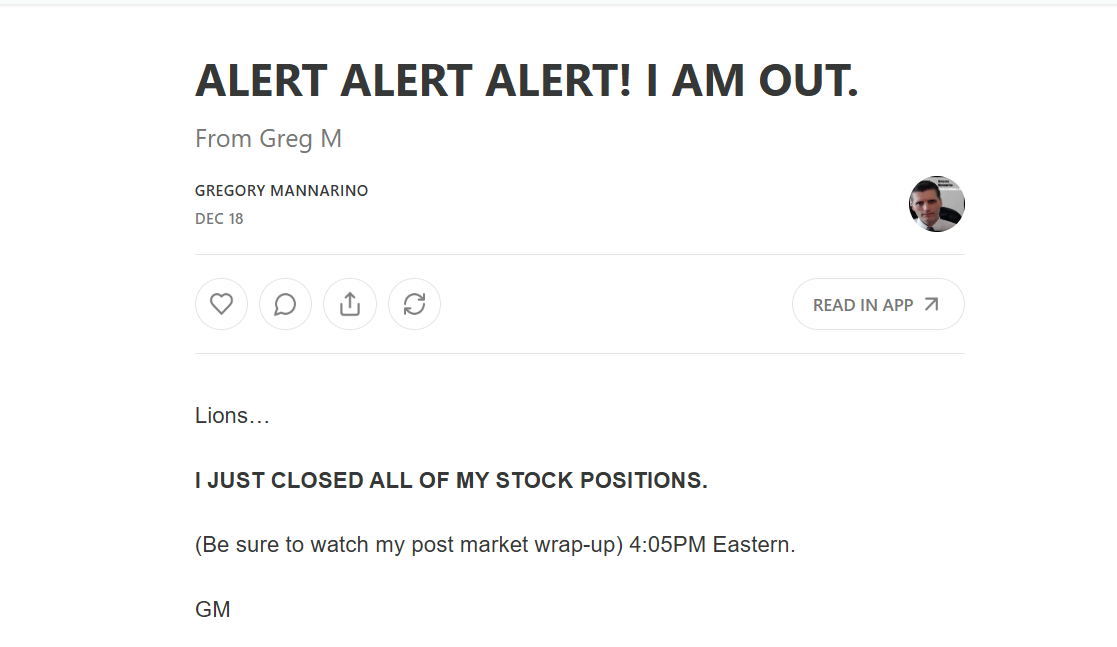

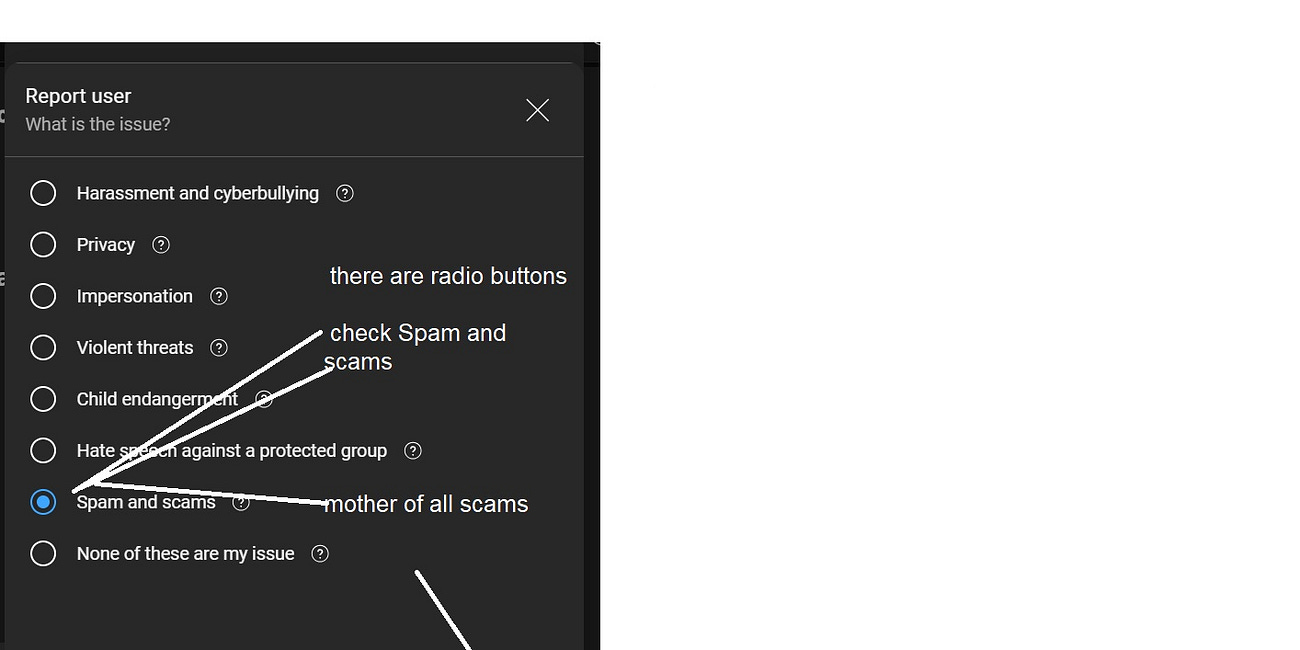

Update on the cyber criminals extorting Jon Forrest Little

Yesterday, Jon Forrest Little shared a video, detailing about 1/3 of his case and shedding light on the potential danger posed by Conrad Kirakosian and Joshua Bingham.

Below is that video, and you'll be shocked to learn what the deranged and unhinged Joshua Bingham did.

He emailed Little’s database administrator, Raju, and offered him $150 to hand over every research project Jon Little had engaged Raju; see below.

It’s important to understand that Raju Molla and Jon Forrest Little have been working together for over three years. Mr. Raju Molla assists Jon with spreadsheets, SEO, and other digital marketing projects. It's a standard practice for a professional journalist to seek help with research, data organization, and SEO.

Listen to the Extortionist Joshua Bingham below:

we have between 20 and maybe up to 50 of these, Jon Forrest Little is working on fetching them out of his voicemail but admits they are terrifying and triggering and is only dripping them out for now

Digital Extortion: How Gen Z Hackers Swindled Thousands from SilverAcademy Journalist

special report by Camine Lombardi