Flying Taxis and China's Low-Altitude Economy: Robotics & More Silver Devoured in China

he flying car division of XPENG Motors, is advancing modular eVTOL (electric vertical takeoff and landing) designs, with certification from Chinese aviation authorities underway.

Flying Taxis and China's Low-Altitude Economy: Revolutionizing Urban Mobility

China’s low-altitude economy, a strategic initiative focused on airspace below 1,000 meters, is poised to transform urban transportation, slashing traditional three-hour commutes to under 20 minutes. This sector, projected to reach $207 billion by 2025, leverages cutting-edge technologies like autonomous aerial vehicles (AAVs) and drones. Companies such as Ehang have already secured regulatory approval to deploy flying taxis, with their EH216-S model achieving speeds of 130 km/h and a 30 km range. These vehicles will initially serve tourism routes in cities like Hefei and Shenzhen before expanding into broader urban networks, offering a scalable solution to traffic congestion.

Silver: The Invisible Backbone of Robotics

The rapid growth of China’s low-altitude economy relies heavily on advanced robotics, where silver plays a critical role. Key attributes driving its use include:

Anti-Corrosive Properties: Silver nanoparticles (AgNPs) form protective layers on metals, inhibiting bacterial biofilm formation and reducing corrosion rates by 77% in industrial applications. Silver plating also resists moisture, ammonia, and chlorine, though it remains vulnerable to sulfur.

Thermal and Electrical Conductivity: Silver-hydrogel composites enhance conductivity in soft robotics, enabling human-machine interfaces and bioelectronic applications. Its use in drone components ensures efficient energy transfer and heat dissipation.

Cost-Effectiveness: Despite its utility, silver remains relatively inexpensive compared to alternatives like gold, making it ideal for mass production.

China’s Strategic Silver Stockpiling

China has aggressively accumulated silver reserves, importing over 400 tons monthly in 2024—double the previous year’s average. This aligns with its declining domestic production and soaring industrial demand, particularly for solar panels and robotics9. Analysts suggest China’s stockpiling aims to secure supply ahead of potential price surges, with reserves reportedly reaching 71,000 tons in 2023. By purchasing unrefined silver concentrate from Latin America, China bypasses traditional markets, crowding out Western buyers and tightening global supply.

Financial expert and Silver Academy contributor Alasdair Macleod warns that China’s cessation of market manipulation could trigger a price explosion.

Implications and Future Outlook

The convergence of low-altitude mobility and silver-dependent technologies positions China to dominate emerging industries.

However, the nation’s covert stockpiling raises concerns about global silver availability, with potential supply chain disruptions and inflationary pressures on electronics, aerospace, military, electric vehicles, solar infrastructure, robotics, and now FLYING TAXIS.

As Ehang’s flying taxis take flight and silver reserves dwindle, the world watches a dual transformation: one in the skies above Chinese cities, and another in the delicate balance of a critical resource market.

China’s Low-Altitude Economy Takes Flight: Who’s Betting Big on the Sky Revolution?

China’s ambitious push into the low-altitude economy—a sector focused on airspace below 1,000 meters—has become a magnet for domestic giants and global players alike. With the market projected to hit $207 billion by 2025, the race to dominate this space is heating up, blending cutting-edge technology, strategic partnerships, and geopolitical maneuvering.

At the forefront is EHang, the Guangzhou-based pioneer of autonomous aerial vehicles (AAVs). After securing China’s first airworthiness certification for its pilotless EH216-S passenger drone, the company has partnered with automaker Changan Automobile to co-develop urban air mobility networks. Their demonstrations in Guangdong province showcase applications ranging from emergency medical deliveries to luxury tourism flights. But EHang isn’t alone. State-backed entities like the Shanghai Low-Altitude Economy Industry Development Co., a consortium involving Shanghai Airport Group, are building critical infrastructure—think vertiports and air traffic control systems—to support this aerial ecosystem.

Automakers are also diving in. GAC Group, known for its gasoline-powered cars, unveiled its GOVY AirJet prototype in 2024, targeting both cargo and passenger markets. Meanwhile, XPENG Aeroht, the flying car division of XPENG Motors, is advancing modular eVTOL (electric vertical takeoff and landing) designs, with certification from Chinese aviation authorities underway. Tech titan DJI, which commands 70% of the global consumer drone market, is leveraging its Shenzhen base to expand into urban air mobility, while Shanghai’s AutoFlight focuses on low-altitude logistics with cargo-specific eVTOL models.

Internationally, the stakes are equally high. Airbus Helicopters planted its flag in late 2024 by establishing its China headquarters in Hengqin, Guangdong, aiming to capitalize on emergency medical and tourism routes in the Greater Bay Area. The U.S. is responding through regulatory shifts—the FAA’s streamlined eVTOL rules have opened doors for firms like Joby Aviation to explore manufacturing partnerships in China. Germany’s Volocopter plans test flights in Shenzhen by 2026, and Japan’s Toyota-backed SkyDrive is eyeing freight drone ventures in Guangdong and Zhejiang provinces.

Regionally, cities are competing for dominance. Hefei, a pilot zone for sub-600-meter airspace operations, is testing drone-based traffic monitoring and scenic tourism routes. The Guangdong-Shenzhen-Zhuhai triangle, home to 30% of China’s low-altitude industry chains, has become a hotspot for R&D. Meanwhile, the Xiong’an New Area lures startups with subsidies up to $6.87 million and promises tax breaks for top talent in eVTOL engineering.

The implications are profound. China’s state-driven infrastructure investments and rapid regulatory approvals have positioned it as a global leader in urban air mobility. Yet challenges remain: airspace management conflicts, battery efficiency limits, and the looming question of whether international players can carve out niches without being eclipsed by homegrown champions like EHang. As one industry insider noted, “Who controls the sky could redefine not just commutes, but economic power itself.” With prototypes already buzzing over Chinese cities, the low-altitude revolution is no longer speculative—it’s airborne.

Where we going to get this Silver?

Andean Precious Metals: Unrivaled Processing Power & Risk-Free Operations Ensure Profitability Regardless of Silver Prices

special report by Carmine Lombardi.

Also reminding everyone who wrote me last week concerned about Silver prices.

Even after the beating past 2 or 3 days let’s zoom out and provide context and comparisons with Dow Jones (for example)

First lets look at Dow Jones over past 30 days. DOWN 9.26%

Second we look at Silver over the same time period (30 days) Down 2.62%

Third we look at Gold over the same time period (30 days) UP 6.26%

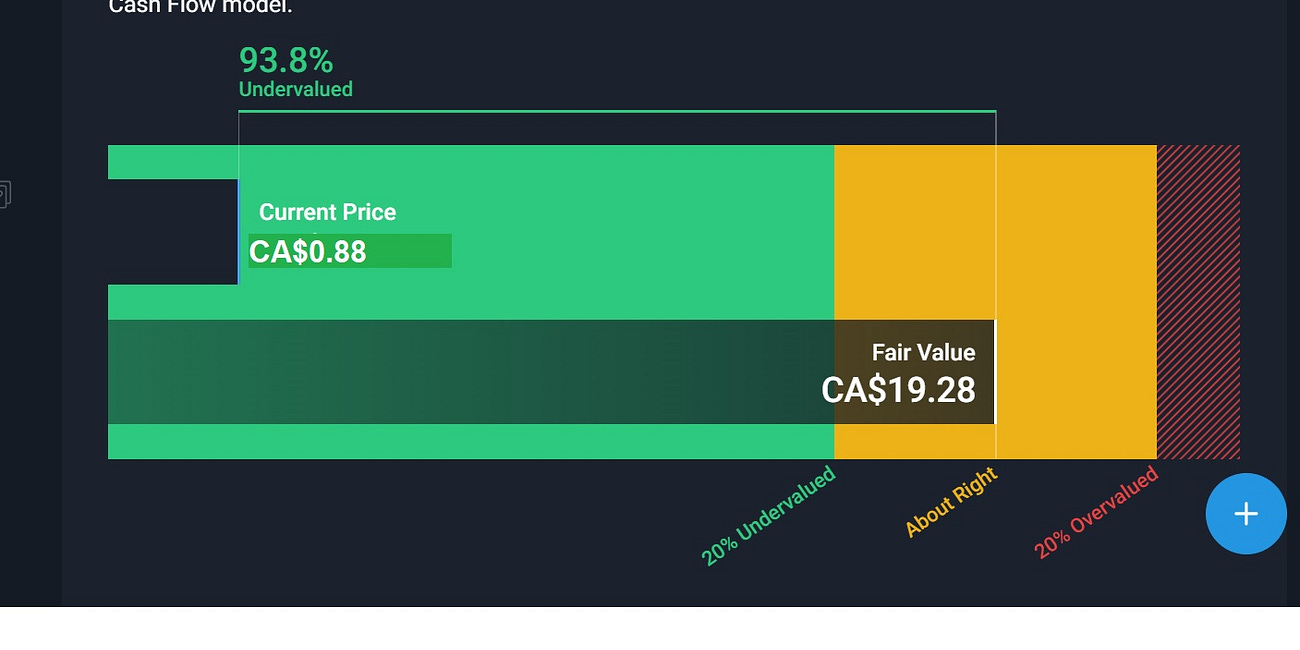

Buy the Andean Precious Metals Dip and HOLD

Andean Precious Metals: TSXV: APM, OTCQX: ANPMF

our opinions are not necessarily our sponsors

editorial department separate from promotions

not financial advice

buy the dip