America Distracted: Chasing Crypto Fads That Will Implode Spectacularly

Let's Stay Focused and Get Back To Work, Enough with this nonsense.

The stark contrast between the $19 billion valuation of all silver miners combined and the over $2 trillion cryptocurrency market capitalization highlights a significant disparity in investor focus and resource allocation.

This 107-fold difference becomes particularly confounding when considering silver's critical role in various industries and its ongoing 5-year severe supply deficit.

With skyrocketing demand for silver in sectors like solar, aerospace, EV batteries, military, electronics, and medical applications, coupled with limited mining capacity, investors in silver stand to potentially benefit from a substantial market correction.

As the physical constraints of silver production collide with its essential real-world applications, the opportunity for silver investors becomes increasingly apparent, suggesting a possible revaluation of this underappreciated precious metal in comparison to the speculative nature of many cryptocurrencies

Crypto is speculative

Why Gold is Better (stock to flow ratio explained)

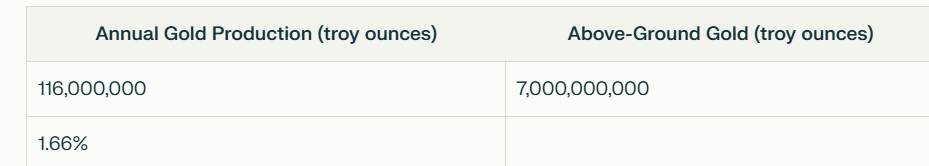

This means the annual gold production (116 million troy ounces) is approximately 1.66% of the total above-ground gold stock (7 billion troy ounces).

Gold's unique properties as a form of hard money are exemplified by its remarkable stock-to-flow ratio. Nearly all the gold ever mined throughout history, estimated at around 212,582 tonnes or roughly 7 billion ounces, remains above ground today

This vast existing supply dwarfs the annual production of approximately 3,000 tonnes or 116 million ounces.

The resulting stock-to-flow ratio, which compares the existing supply to new production, is exceptionally high for gold. This characteristic makes gold incredibly resistant to inflation and artificial devaluation. Unlike fiat currencies that can be printed at will, (or crypto introducing new meme coins by the dozens everyday ) gold's supply increases at a predictable and slow rate, typically less than 2% annually.

This scarcity and difficulty in production ensure that new gold entering the market has minimal impact on the overall supply, preserving its value over time and cementing its status as the quintessential hard money

The Great Crypto Gamble: A Risky Bet in Uncertain Times

As we navigate increasingly turbulent economic waters, the inauguration of Donald Trump (his launch of "Trump Coin" and his wife Melania's new meme coin) and the allure of cryptocurrency continue to captivate many.

Yet, this frenzy is built on shaky ground, with fundamental flaws that should give any sensible investor pause.

First and foremost, crypto has yet to weather an actual economic storm. What do I mean when I say this?

We're talking about a financial instrument that hasn't faced a single recession.

It's akin to entrusting a fair-weather captain to navigate your ship through a hurricane – a risky proposition, to say the least.

And what tangible value does cryptocurrency offer?

Unlike precious metals, which have a mix of practical applications, crypto exists in a digital void, solving no real-world problems beyond speculation.

It's a solution in search of a problem, and that's a dangerous foundation for any investment.

In our increasingly volatile world, crypto's vulnerabilities become even more glaring. Threats to digital assets are numerous and severe, from cyberattacks to electromagnetic pulses.

A single well-placed attack could wipe out fortunes in an instant. And let's not forget the looming specter of quantum computing, which could render current blockchain technology obsolete. The crypto ecosystem is a breeding ground for scams and market manipulation.

We recently saw meme coins associated with political figures skyrocket overnight – a clear sign of the speculative frenzy gripping this market.

This Wild West of finance leaves many, especially the elderly and the less tech-savvy, at a severe disadvantage.

In stark contrast, Silver and Gold are beacons of stability and intrinsic value.

With its myriad of industrial applications, silver plays a pivotal role in technologies from solar energy to electronics. These precious metals have endured millennia of human history, surviving wars, famines, regime changes, power blackouts, or natural disasters that would render crypto worthless.

Unlike the untested nature of digital assets, silver, and gold are tangible, portable, and divisible.

They can't be printed at will or manipulated by a few lines of code. Their value isn't dependent on internet connectivity or the integrity of a digital ledger.

The choice between unproven digital tokens and time-tested precious metals becomes clear as we face an uncertain future.

Crypto may promise quick riches, but silver and gold offer tried and true security and value.

These metals have been the bedrock of economies for thousands of years, preserving wealth through the rise and fall of empires.

Digital assets can vanish with a power outage or a quantum breakthrough; the enduring value of silver and gold shines brighter than ever.

As investors, we must look beyond the hype and recognize the fundamental strengths of Traditional Money. They're not just relics of the past but essential components of our present and future, offering a stable haven in an increasingly unstable world.

end of segment

Crypto is being favored and promoted by a self-dealing President and his wife is predatory This is a form of misusing the office of President for personal gain, and places an entire swath of the American public in unfair situation.