As of February 21, 2025, the silver mining sector is poised for a remarkable surge, with companies like Aya Gold & Silver, Andean Precious Metals, Kuya Silver, and Dolly Varden Silver at the forefront of this exciting trend. The gold-to-silver ratio, which has been stubbornly high for years, is finally showing signs of correcting from its extreme 91:1 level, creating a catalyst for silver miners.

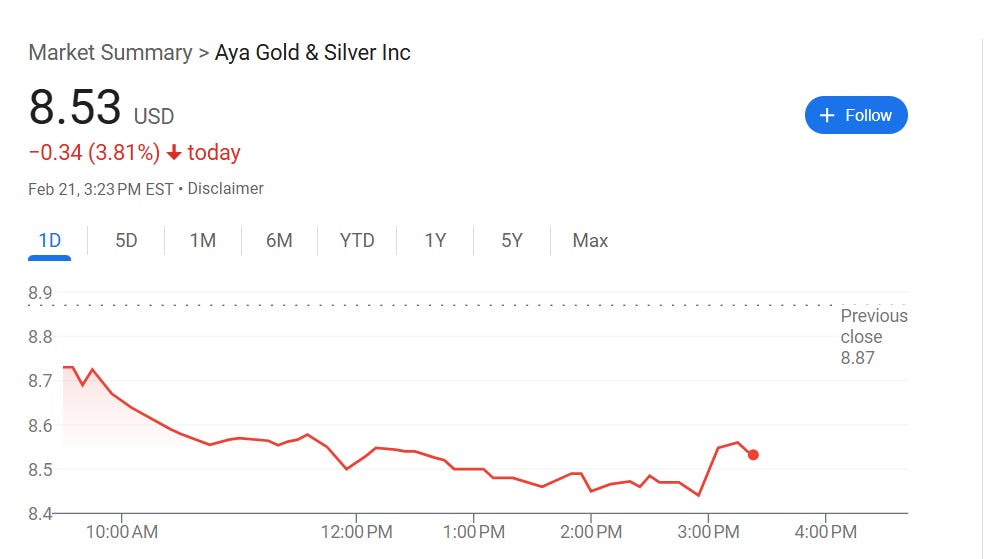

Aya Gold & Silver has been a standout performer, with its Zgounder mine now consistently operating above nameplate capacity. The company's ambitious expansion plans have come to fruition, and they're on track to produce a staggering 8 million ounces of silver annually by the end of this year. This remarkable growth has caught the attention of analysts, with several firms raising their price targets in recent weeks.

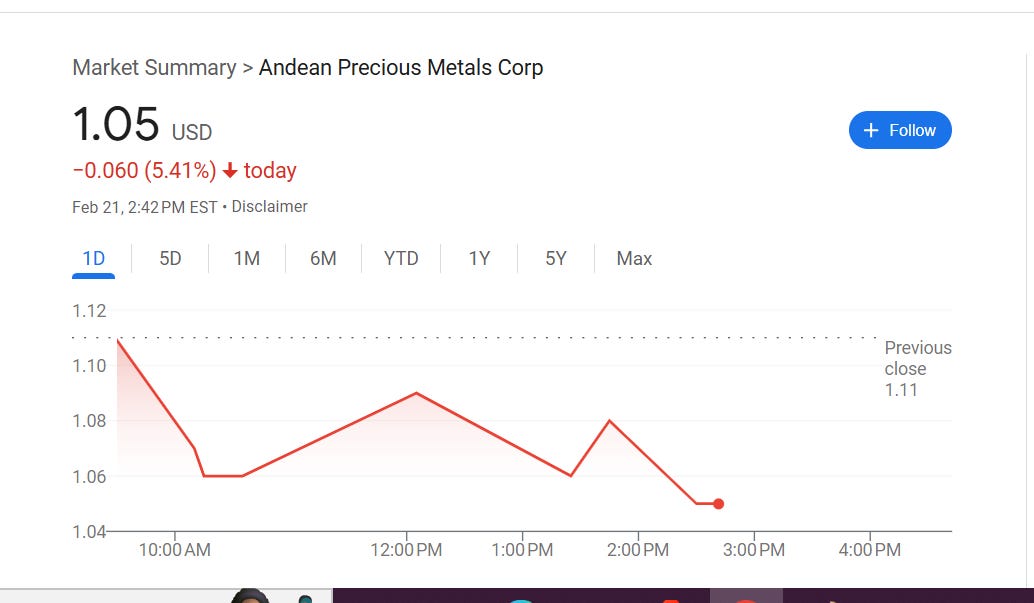

Andean Precious Metals has also made significant strides. Their Golden Queen project, acquired in 2023, is exceeding expectations. Recent drill results have confirmed high-grade extensions, and the company's focus on operational efficiency is paying off with improved margins. The newly discovered Hilltop target has added an exciting dimension to their exploration potential.

Kuya Silver's (Bethania mine in Peru) is now in full swing. This cutting-edge approach has allowed them to access high-grade veins with minimal dilution, dramatically improving their production profile. The ramp-up to 350 tonnes per day is progressing smoothly, positioning Kuya as one of the fastest-growing junior silver producers.

Dolly Varden Silver continues to impress with its exploration success. The Wolf and Moose zones have expanded significantly, now stretching over 1,400 meters. With Hecla Mining's strategic investment providing a strong financial foundation, Dolly Varden is aggressively pursuing its district-scale potential in the Golden Triangle.

The broader silver market is finally catching up to the fundamentals that these companies have long anticipated. Industrial demand, particularly from aerospace, military, the solar and electric vehicle sectors, has created a persistent supply deficit.

This, combined with renewed investor interest in precious metals as a hedge against economic uncertainty, has pushed silver prices to multi-year highs.

As the gold-to-silver ratio continues to normalize, these companies are perfectly positioned to deliver outsized returns.

Conservative estimates suggest upside of 4 to 25 times current valuations over the next 18 months, depending on the specific company and the extent of silver's price appreciation.

BUY THE DIP NOW

Invest $20,000 today and this will snap back by mid week Feb 24

Invest $20,000 today and this will snap back by mid week Feb 24

Invest $20,000 today and this will snap back by mid week Feb 24

Invest $20,000 today and this will snap back by mid week Feb 24