Fiscal Train Wreck: From Afghan Waste to Inflation Acceleration - How Trillions in Spending Derailed America's Economy

first segment by James Hickman

January 10, 2025

In the calendar year of 2024, the government racked up a $1.74 trillion deficit.

But the national debt actually increased by an even higher $2.23 trillion from January 1, 2024 through December 31, 2024.

That’s a lot of money spent for a Congress that never even passed a budget!

The entire year, Congress relied on continuing resolutions to fund government operations. And most of these hinged around political battles that almost caused government shutdowns each time.

And both of these factors—the actual numbers and the dysfunction— threaten the status of the dollar as the global reserve currency.

The actual spending included things like $12 million for a Las Vegas Pickleball Complex, and $15 million the nearly bankrupt Pension Benefit Guaranty Corporation spent on furniture for largely empty offices that federal employees refuse to report to.

But these, though ridiculous, are sadly miniscule expenditures to the US government.

It spent a total of $10 BILLION maintaining, leasing, and furnishing those almost entirely empty federal office buildings.

$6 billion disappeared in Ukraine, adding to the $65 billion total since 2022.

$88 BILLION went to brand new Navy vessels that quickly developed broken hulls, grinding transmissions, leaks, broken mission modules, and failed communications encryption.

The federal government also spent $236 BILLION making improper payments to the wrong people through Medicaid, unemployment insurance, and tax credits.

A billion here, 200 billion there, and pretty soon you’re talking about real money.

And again, the actual debt and deficit numbers themselves are bad enough to risk the status of the dollar. But the embarrassing failures and absurd priorities erode another important aspect of the dollar’s status: trust and confidence.

For example, a 2024 Inspector General report found that at LEAST $293 million worth of foreign aid was given to the Taliban, because there were no efforts to ensure Afghanistan-based NGOs (non-governmental organizations) received the money as intended.

This is sadly a drop in the bucket. But the fact that the US is literally handing its sworn enemy cash— in addition to the guns and equipment it left behind in Afghanistan— is a shameful embarrassment.

As if the government wasn’t $36 trillion in debt.

A serious government would cut everywhere it could. Instead:

A $2 million grant from Health and Human Services (HHS) funded a study on kids looking at Facebook ads about food.

HHS also spent $419,470 to find out that lonely rats are more likely than happy rats to do cocaine.

The US government took on more debt to spend $3 Million for ‘Girl-Centered Climate Action’ in Brazil.

Taxpayers paid $873,584 to fund movies in Jordan.

$2.1 million was spent on border security. Unfortunately for US taxpayers, it was to secure Paraguay’s border.

I mean sure, every deficit dollar brings America closer to losing the global reserve currency, but at least the Bearded Ladies Cabaret got a $10,000 grant for their climate change focused ice skating show.

The incoming administration has made it a priority to turn this around, eliminate waste, and strengthen the dollar’s position.

They certainly seem to be serious, and have a great team on their side.

And with so many idiotic expenditures, it’s pretty obvious where to start. Just stop spending on stupid things, and America will be heading in the right direction.

end of segment

More commentary by Jon Forrest Little

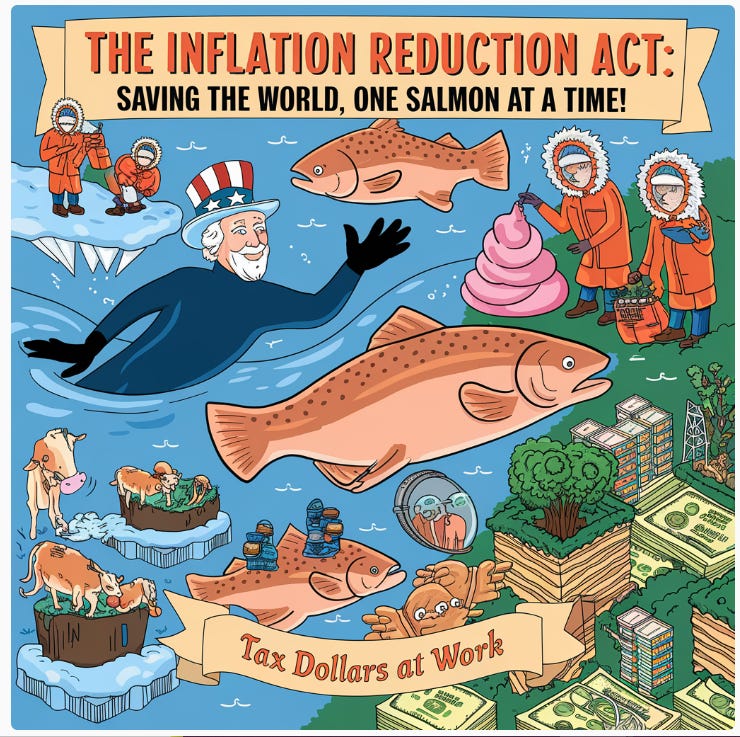

Here at this newsletter we refer to the Inflation Reduction act as the inflation amplification act and here is why?

The Inflation Reduction Act (IRA) of 2022 provided massive deficit spending across various sectors. Here's a detailed breakdown of the key funding allocations:

Milton Friedman defined inflation as a monetary phenomenon caused solely by excessive growth in the money supply, which is controlled by government policies. He argued that inflation is always the result of political decisions to increase the quantity of money faster than economic output

Energy and Climate:

- $369 billion for Energy Security and Climate Change programs.

- $5 billion through September 30, 2026, for the Energy Infrastructure Reinvestment (EIR) Program, with a total cap on loans of up to $250 billion.

- $40 billion of additional loan authority for projects eligible under section 1703 of the Energy Policy Act of 2005.

- $3.6 billion in credit subsidy to support the cost of section 1703 loans.

- $3 billion through September 30, 2028, for the costs of direct loans under the Advanced Technology Vehicles Manufacturing (ATVM) program.

- Expansion of the Tribal Energy Loan Guarantee Program (TELGP) from $2 billion to $20 billion.

- $75 million through September 30, 2028, to carry out TELGP.

- $11.7 billion for Loan Programs Office (LPO) programs to support issuing new loans.

So Called Clean Energy Tax Credits:

- Production Tax Credit of up to 2.75 cents per kilowatt-hour for qualified renewable energy sources.

- 10% bonus credit for qualifying clean energy production in energy communities.

- Investment Tax Credit of up to 30% for various clean energy technologies.

- Additional 10% credit for projects meeting domestic content conditions.

- Additional 10% credit for projects in energy communities.

- Up to 20% additional credit for low-income community solar projects.

Agriculture and Forestry:

- $24.9 billion for farmers, ranchers, and forest landowners to adopt climate-smart conservation practices.

- $8.45 billion for the Environmental Quality Incentives Program (EQIP).

Manufacturing and Industry: (Yet still no initiatives to bring Steel back to Indiana, Pennsylvania, Alabama, or tires back to Akron or Coal back to Kentucky)

- $2 billion through 2031 for grants to retool existing auto manufacturing facilities for clean vehicle production.

- $500 million for critical mineral processing and heat pumps under the Defense Production Act.

- At least $4 billion for the Advanced Energy Project Credit for projects in areas affected by coal mine closures or coal-fired power plant retirements.

Biofuels:

- $10 million to EPA for grants supporting advanced biofuel industries.

- $500 million until 2031 for competitive grants to support biofuel infrastructure improvements.

Rural Electrification:

- Nearly $11 billion for rural electric co-ops.

- $1.3 billion for agricultural producers and small rural businesses to invest in clean energy and efficiency improvements.

Home Energy Efficiency:

- Up to $1,200 annually for the Energy Efficient Home Improvement Credit.

- Up to $2,000 for electric heat pump installation.

- $150 credit for home energy audits.

- 30% Residential Clean Energy Credit for rooftop solar and battery storage installations.

Healthcare:

- $64 billion for Affordable Care Act extension. Don’t you love the name Affordable Care Act (George Orwell would)

Tax Enforcement:

- $124 billion for IRS tax enforcement.

The IRA also allows state, local, and Tribal governments, non-profit organizations, and other tax-exempt entities to receive certain tax credits as direct payments.

1. Republicans advanced a bill to prohibit funding for the new National Museum of the American Latino and the operation of the existing Molina Family Latino Gallery. This move was seen as preventing the Smithsonian from highlighting the contributions of American Latinos in United States history and culture.

2. The IRA provided $150 million for State-Based Home Energy Efficiency Contractor Training Grants, which include education and certification for residential energy efficiency workers.

3. Inflation Reduction Act funding is being used to update Museum Collections Emergency Operations Plans in national parks, including developing prioritized lists of items to be evacuated in emergencies. Critics might argue this is not a critical use of funds.

4. The Biden-Harris Administration announced $40 million for training the clean energy workforce, including certifications for conducting energy audits and surveys. Skeptics might view this as an overreach of government into job training.

5. The Environmental and Climate Justice Community Change Grants program allocated approximately $2 billion for environmental and climate justice activities in disadvantaged communities. While this spending is intended to reduce pollution and increase climate resilience, some might question its scale.

The Inflation Reduction Act (IRA) and related initiatives have included several measures to support LGBTQI+ individuals and women in Pakistan:

LGBTQI+ Initiatives:

- The IRA extends Affordable Care Act health insurance exchange subsidies, which benefits LGBTQI+ individuals who may face discrimination in healthcare.

- The Biden-Harris Administration is working to increase healthcare access and reduce discrimination and financial barriers for LGBTQI+ people on Medicare.

- The administration has championed racial equity and advanced equal opportunity for underserved communities, including LGBTQI+ individuals, through landmark legislation and executive actions.

Pakistan Women's Initiatives:

- The Benazir Income Support Programme (BISP) provides unconditional cash transfers of Rs. 1000 monthly to women, accounting for a 20% increase for families living on Rs. 5000 monthly.

- BISP has increased women's empowerment, political participation, and autonomous economic decision-making.

- The program has established 55,000 Beneficiary Committees in 32 districts, providing a platform for women to discuss important issues like nutrition, education, and family planning.

- Pakistan's National Financial Inclusion Strategy (NFIS) and Banking on Equality (BOE) policy aim to reduce the gender gap in financial inclusion.

- The State Bank of Pakistan has set a target of ensuring at least 20 million women have active digital transaction accounts by 2023.

Don’t forget spending programs for birds, worms, fish, mammals, rats, etc

- $2.9 million for Arctic research, including studies on changing climate conditions' effects on Arctic marine resources, fisheries, marine ecosystems, and subsistence-harvested marine mammals.

- $82 million for North Atlantic Right Whale conservation efforts, including new technologies and improved distribution models to reduce vessel strikes and entanglements.

- $42 million for Pacific salmon conservation, including funding for science and research supporting transformative modeling to identify and prioritize high-impact restoration.

- $50 million per year from the Environmental Quality Incentives Program (EQIP) funds for Conservation Innovation Grants (CIG) On-Farm Trials, with a priority for applications that "utilize diet and feed management to reduce enteric methane emissions from ruminants."

$1.5 billion for the Urban & Community Forestry Assistance Program funds tree-planting projects that prioritize underserved populations and areas.

The absurd list above is for domestic spending projects.

At least we can expect that our Foreign Adventures indicate more responsible spending right?

Let’s see…???

Afghanistan equipment we left in the hands of The Taliban (who was the intended enemy in this war that cost 2.3 trillion , or 5 times the price of Vietnam)

Aircraft and Helicopters:

73 aircraft at Kabul International Airport (rendered inoperable)

12 A-29B light attack aircraft

12 C-208/AC-208 utility/attack aircraft

3 C-130 transport aircraft

1 PC-12NG special mission aircraft

12 UH-60A 'Blackhawk' transport helicopters

6 CH-46 transport helicopters

14 MD 530F attack helicopters

14 Mi-8/Mi-17 transport helicopters

2 Mi-24V attack helicopters

Vehicles:

Up to 22,174 Humvee vehicles

Nearly 1,000 armored vehicles

42,000 pick-up trucks and SUVs

70 Mine-Resistant Ambush Protected vehicles (MRAPs)

Weapons:

64,363 machine guns

Up to 358,530 assault rifles

126,295 pistols

Nearly 200 artillery units

Other Equipment:

Nearly 42,000 pieces of night vision, surveillance, biometric, and positioning equipment

17,500 pieces of explosive detection, electronic countermeasure, disposal, and personal protective equipment

"Nearly all" communications equipment, including base-station, mobile, man-portable, and hand-held commercial and military radio systems

Ammunition:

9,524 air-to-ground munitions

Less than 1,537,000 "specialty munitions" and "common small arms ammunition"