America's Triple Threat: Motive, Means, and Opportunity to Sabotage Europe's Economy

US Profits as Europe Falters: Dollar Strengthens, EURO Manufacturing Crumbles, and US LNG Exports Soar Amid US planned European Energy Crisis

Op-Ed by Jon Forrest Little: I hate to say it, but once again it looks like I’m first to figure it all out? —such as connecting the dots: the crime map indicating how the US stoked the war with Russia to weaken Europe.

Europe's energy crisis, a dire consequence of the US-Russia conflict (commonly referred to as 'the conflict in Ukraine' by the mainstream media), has plunged the continent into a state of significant economic challenges and rapid deindustrialization. The continent's ill-fated energy policy, particularly its reliance on natural gas, has dealt a severe blow to its industrial output and standard of living.

Prior to the Ukraine conflict, Europe's energy landscape was heavily dominated by Russian gas, with some supply from Norway and limited domestic production. However, the war disrupted this delicate balance, resulting in a staggering 67% reduction in Russian imports and a significant shift in the continent's energy dynamics.

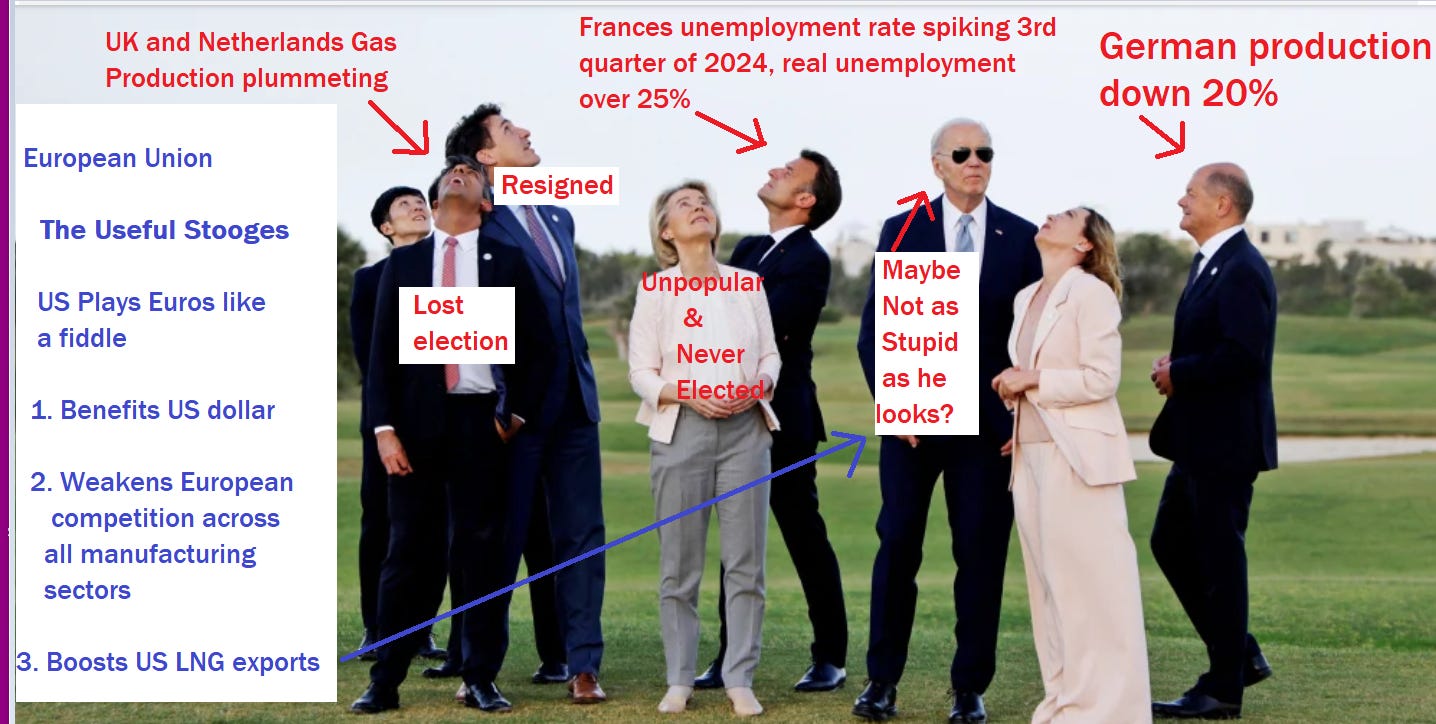

Simultaneously, UK and Dutch production declined, creating a substantial energy deficit.

While US LNG exports to Europe have seen a surge, they have primarily filled the gap left by reduced European production, rather than significantly expanding supply. This situation has led to a spike in natural gas prices and has played a significant role in Europe's deindustrialization, underscoring the weight of the US's influence in the crisis.

Germany, Europe's industrial powerhouse, has seen its industrial output plummet by 20% since the war began. This decline is a stark indicator of the broader economic impact of the energy crisis. As energy equals standard of living and manufacturing capability, this reduction effectively represents a severe recession, affecting production levels, economic development, and quality of life.

Contrary to popular belief, Europe's failure to adequately increase non-Russian gas supplies has exaggerated the situation. The continent's gas infrastructure has been systematically compromised:

1. Belarus pipeline ceased operations in 2021

2. The Yamal pipeline was sanctioned in 2022

3. Nord Stream was destroyed in 2022 (by the United States)

4. The Ukraine transit pipeline stopped in 2025.

Now, Europe has only the TurkStream pipeline and LNG imports from the US and Africa.

This precarious situation raises questions about the decision-making of European leaders like Macron, the UK leadership, and Olaf Scholz to confront Russia without a robust energy contingency plan.

The beneficiary of this crisis is the United States.

By encouraging its NATO allies to take an economic hit, the US stands to gain in several ways:

1. Strengthening the US dollar against European currencies weakened Europe's economy.

2. Eliminating competition from European manufacturers in key industries such as aerospace, defense, automotive, biotechnology, pharmaceuticals, electronics, fashion brands and robotics

3. Boosting LNG prices due to Europe's increased dependence on US gas.

Imagine two rival pizza shops in a small town. One day, the larger shop “mysteriously” burns down. Suddenly, the smaller shop sees a surge in customers and profits. While no one has caught them (yet) for causing the fire, they certainly benefit from filling the gap in the market left by their competitor's misfortune.

Then the Closing Argument.

US using US Navy Blows up Nord stream Pipeline

The U.S. has become the largest LNG supplier to Europe, accounting for nearly half of total LNG imports in 2023. This shift has allowed the US to capitalize on Europe's energy vulnerability, effectively turning the crisis into an economic opportunity.

Moreover, the EU's attempts to diversify its energy sources have benefited mainly US suppliers. The EU-US Task Force on Energy Security, formed in response to the Ukraine conflict, has significantly increased US LNG exports to Europe, far exceeding initial targets.

While European leaders struggle to maintain solidarity and manage the economic fallout, the US energy sector thrives. US LNG exports to Europe have nearly tripled since 2021, with the US now representing almost 50% of Europe's LNG imports.

This scenario raises concerns about the long-term implications for Europe's economic competitiveness and energy security. As the continent grapples with deindustrialization and rising energy costs, the US is the primary beneficiary of Europe's energy crisis. It was the US's plan to drag Europe into the war the US started with Russia (see how that works?).

The situation underscores the critical importance of energy policy in maintaining economic stability and industrial competitiveness. Europe's current predicament serves as a cautionary tale about the risks of over-reliance on a single energy source, trusting the US, and the potential consequences of geopolitical miscalculations.

Recall it was Henry Kissinger who said,

— 'It may be dangerous to be America's enemy, but to be America's friend is fatal.'

As Europe faces a winter of discontent and energy shortages, the question remains: was the decision to confront Russia without a robust energy backup plan a strategic miscalculation or part of a larger geopolitical strategy that disproportionately benefits the United States?

The answer is The Latter.

end of Op-Ed

sources

https://www.spglobal.com/commodity-insights/en/news-research/blog/natural-gas/022624-russia-ukraine-war-europe-russian-gas-lng

https://www.csis.org/analysis/geopolitical-significance-us-lng

https://www.chathamhouse.org/sites/default/files/2023-09/2023-09-13-consequences-war-ukraine-climate-food-energy-brown-et-al.pdf

https://www.consilium.europa.eu/en/infographics/eu-gas-supply/

https://energy.ec.europa.eu/system/files/2022-02/EU-US_LNG_2022_2.pdf

https://www.bakerinstitute.org/research/why-europe-not-replacing-russian-pipeline-gas-long-term-lng-contracts

https://www.france24.com/en/europe/20241231-russia-s-once-dominant-gas-supplies-to-europe-end-on-january-1

https://www.eia.gov/todayinenergy/detail.php?id=61483

https://www.bruegel.org/analysis/european-union-russia-energy-divorce-state-play

https://ec.europa.eu/eurostat/statistics-explained/index.php?title=EU_trade_with_Russia_-_latest_developments

https://www.brookings.edu/articles/europes-messy-russian-gas-divorce/