Winners Think This Way.

The question is not if, but when, silver will reclaim its rightful place in the pantheon of valuable assets.

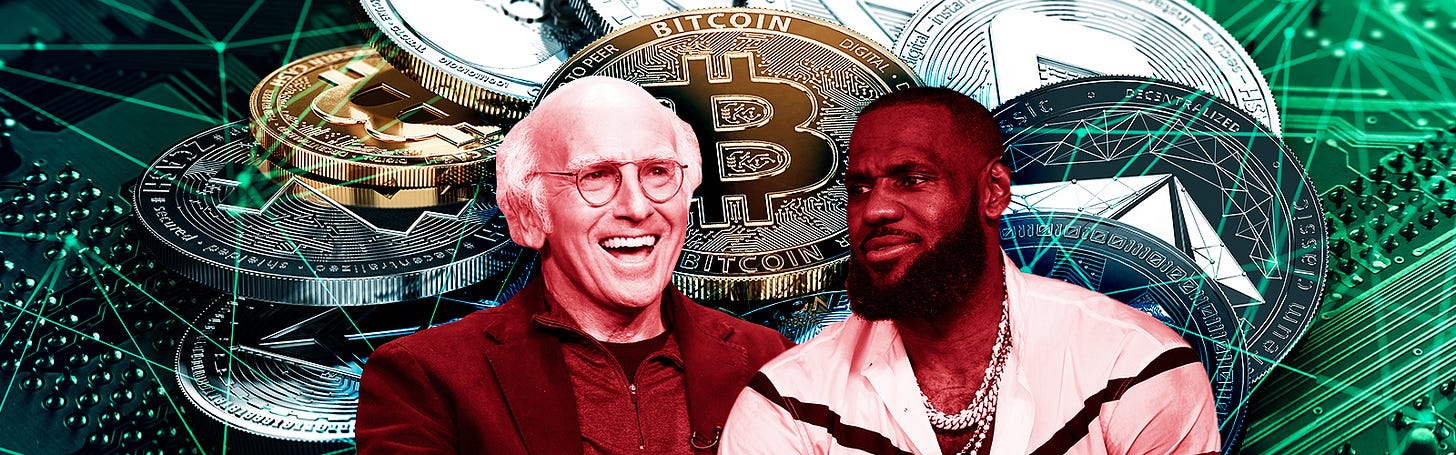

The 2022 "Crypto Bowl" stands as a monument to digital-age folly. Cryptocurrency companies, drunk on hype and hubris, burned through $54 million on Super Bowl ads. Coinbase's $14 million QR code, FTX's Larry David spot, Crypto.com's LeBron James feature - all grand gestures signifying nothing but impending doom. These titans of make-believe money paraded their wares before millions, using celebrity glitz to mask the hollowness of their offerings. Fast forward a year: FTX bankrupt, others reeling, and not a crypto ad in sight at the next Super Bowl. It's a cautionary tale of an industry built on sand, using smoke and mirrors to sell digital dreams that vanished faster than you can say "blockchain."

A massive opportunity for the smart money that goes against bearish sentiment

In the tumultuous world of financial markets, silver is a neglected asset. Its true value is obscured by the dazzling allure of cryptocurrencies ( plus AI, the not-so-magnificent seven comprised of all-tech and not one manufacturing or Energy Company) and the relentless pursuit of quick profits. This widespread bearish sentiment towards silver is not just misguided; it's dangerous. (But it also creates a massive opportunity for the smart money that goes against bearish sentiment)

The current disinterest in silver stems largely from the crypto distraction, a phenomenon that has captivated retail investors with promises of astronomical returns. As "Fartcoin" skyrockets 18,500% in mere months, prudent investments in precious metals seem quaint by comparison.

This crypto mania has created a perilous bubble, drawing attention away from silver's solid fundamentals and historical significance.

What many fail to realize is that while crypto speculators chase digital dreams, industrialists depend on silver as a critical factory input. Silver's unparalleled electrical conductivity makes it indispensable in electronics, solar panels, and emerging technologies/

As we hurtle towards a future dominated by renewable energy and advanced electronics, the industrial demand for silver is set to soar. The short-sightedness of current market sentiment ignores this looming supply-demand imbalance.

The danger of low silver sentiment lies in its potential to create a sudden and dramatic market correction. As contrarian logic dictates, when the crowd leans heavily in one direction, the smart money often moves the opposite way.

The extreme bearish sentiment in silver, evidenced by record-high short interest in silver ETFs, is setting the stage for a potential short squeeze of epic proportions.

Moreover, the industrial reliance on silver creates a ticking time bomb. As inventories deplete and new supply struggles to meet growing demand, we're approaching a critical juncture. The moment silver reclaims its status as a monetary metal, even in a single community, it could trigger a cascading effect across markets.

Imagine a scenario where a forward-thinking municipality adopts silver as a form of local currency. This seemingly small step could reignite global interest in silver's monetary properties, leading to a rapid reassessment of its value. As awareness spreads, the industrial sector might scramble to secure supplies, further driving up prices.

The current silver price, hovering around $30 per ounce, belies its true potential

UBS projects Silver will reach between $35 to $38 per ounce shortly or even $50 driven by a combination of industrial demand, investment interest, and potential monetary use

This upside potential is magnified by the current gold-to-silver ratio, which screams that silver is significantly undervalued relative to gold.

In conclusion, the danger of low silver sentiment is multifaceted. It blinds investors to a unique opportunity, leaves industries vulnerable to supply shocks, and sets the stage for potentially volatile market corrections. As the world inevitably shifts focus back to tangible assets with intrinsic value, those who recognized silver's potential early stand to reap substantial rewards.

The wise investor should view the current bearish sentiment not as a deterrent, but as a contrarian signal of immense opportunity. In a world distracted by digital speculation, silver quietly awaits its moment to shine. When that moment comes – and history suggests it will – the transformation could be swift and dramatic. The question is not if, but when, silver will reclaim its rightful place in the pantheon of valuable assets.