Warren Buffet and Jamie Dimon Know a Monster is Looming Around The Corner

Plus 10 other reasons to get your hands on Gold and Silver

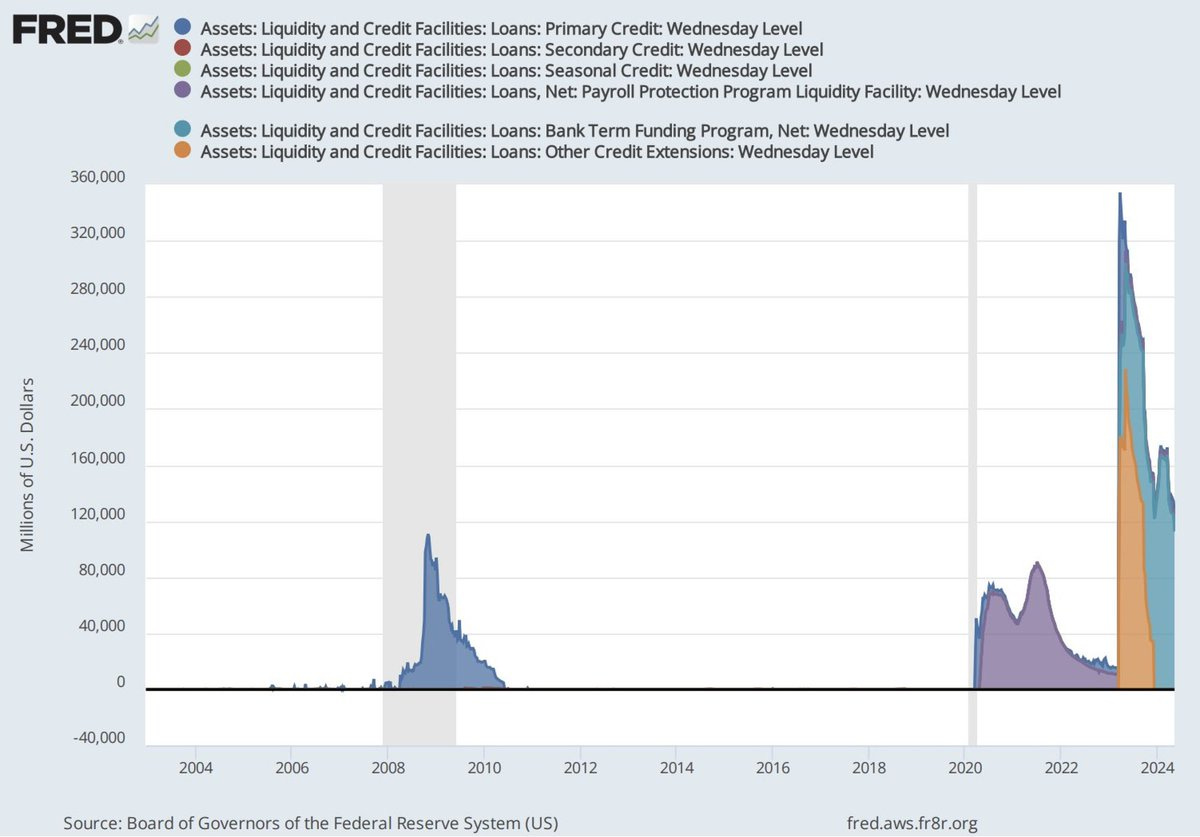

More emergency loans than 2008

The Fed made more emergency loans in 2023 than during the financial crisis of 2008?

Look at this graph from the Fed.

The blue bump below on the left is the lending from the global financial crisis of 2008 —

The purple bump is COVID.

And the giant orange/aquamarine monster on the right is the 2023 banking crisis.

See how much higher it is than even 2008

More borrowing than COVID

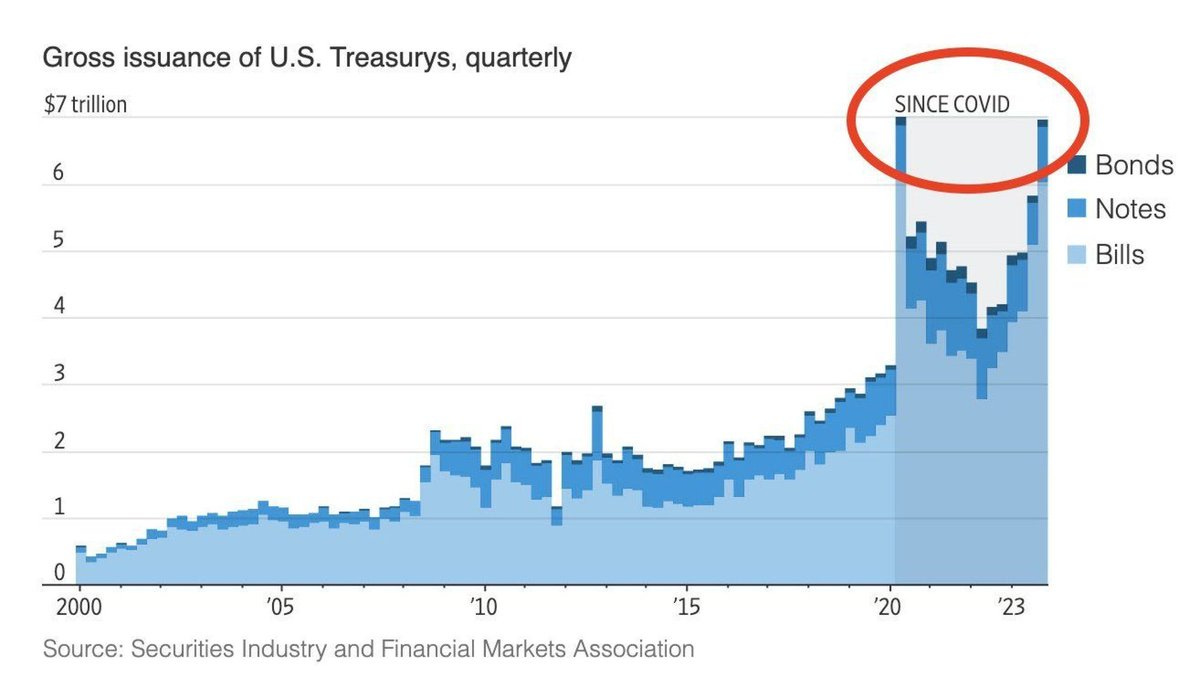

The US is borrowed more under Biden than it did during COVID? Set aside whether a coronavirus should have been treated as a financial crisis. At least the COVID borrowing was at ~0% rates. But today the US government is borrowing historical sums of money in peacetime…and at various rates from 4.33% to 5% rates!

Interest servicing National Debt More than Defense Spending

Truflation 18%

US dollar has lost 25% of its value in 4 years.

Economist Larry Summers estimates that purchasing power has been eroded even more radically than this, with annual numbers hitting 18% if you include the enormous spike in loan payments due to rate hikes. Compounded over four years, that’d be easily more than 25% of the dollar's value.

25% in four years is quite a lot:

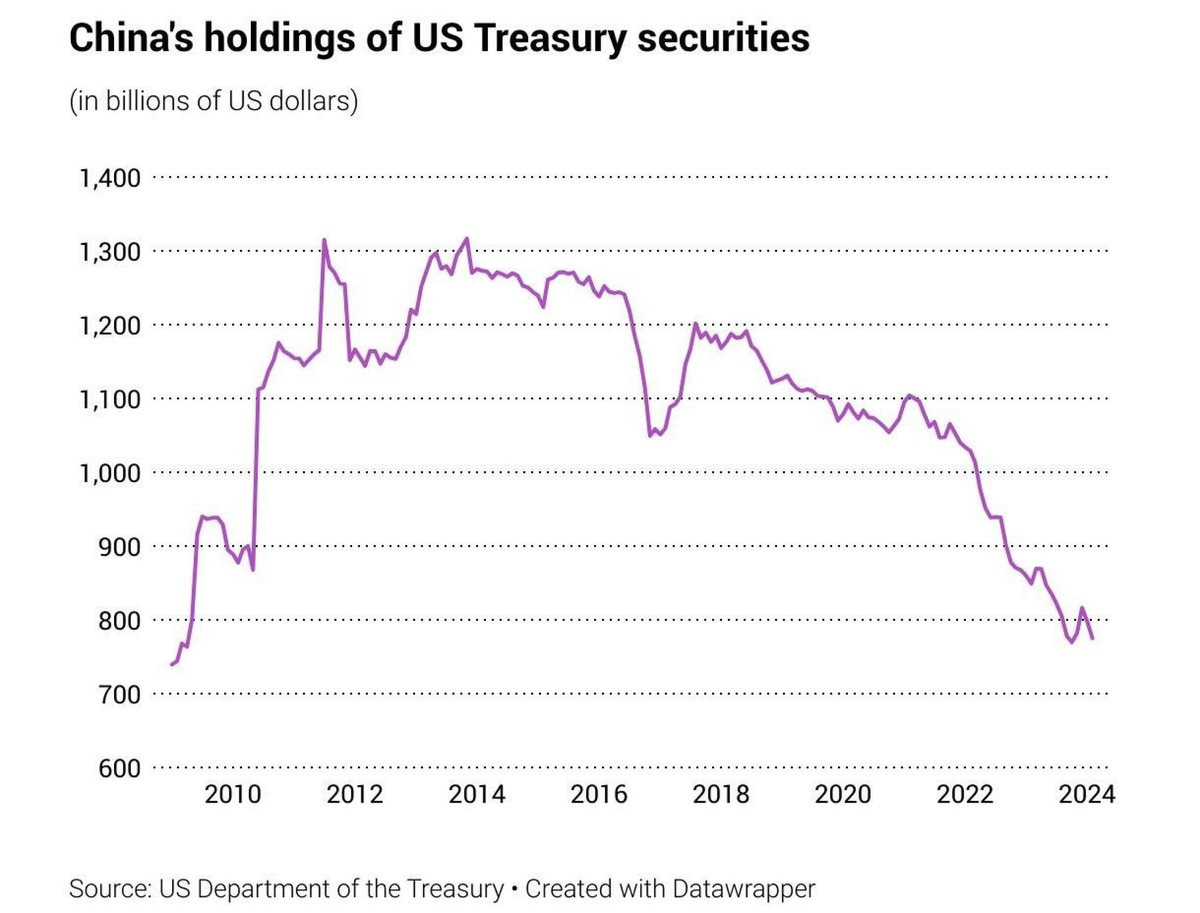

Treasury dumping by China , Japan and Others

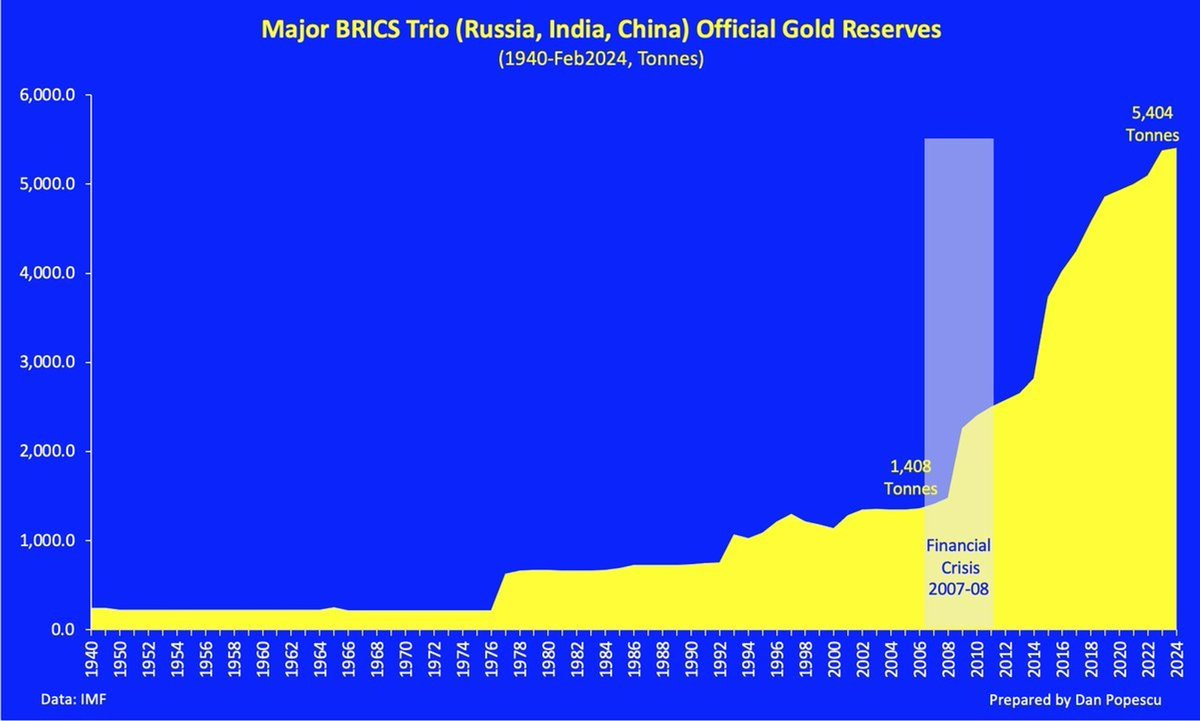

More gold buying by BRICS

Almost 4 Times More than the 2008 Great Financial Collapse

Guessing the US dollar really isn’t a store of value and that is why other countries are dumping US Treasuries and buying Gold

Warren Buffet and Jamie Dimon know a Monster is Looming around the Corner

Why is Warren Buffet running for the hills?

Why is Jamie Dimon joining him?

The Real debt is over $175 Trillion not $36.6 Trillion

hat tip to Balajis.com and The Kobeissi Letter for some of these charts

What is safest asset right now?

Shawn Khunkhun starts this brief podcast with a powerful statement. Many people believe real estate is safe during market crashes. But is real estate liquid or do you have to list the property, show the property, go through inspections, go through another round of counter-offers (NOT LIQUID AT ALL. MORE LIKE AN ANCHOR)

I spoke with Shawn yesterday where we discuss many of the problems above and why Silver and her big brother gold are the safest plays (and always have been)

While Trump and his fan-boy Elon are pumping up crypto, remember crypto has never gone through even one recession. The graphic below shows what Gold and Silver have endured, and I must emphasize that many power outages are in our future (cyber-attacks, grid failures, terrorist attacks, even your own Government will turn off the lights, trust me on this)

All future wars are attacks on the power-grid.

The idea is to take your “enemy” off line so the Hospitals, Banks, Supply Chains and Businesses are crippled.

Gold and Silver have endured thousands of wars, regime changes, revolutions, natural disasters, plagues, famines and hundreds of recessions

Crypto has not been through one recession

When the Lights go out your Gold and Silver still shine in the candlelight whereas crypto is vaporized to ZERO