US Silver Stockpile Raided by Defense Department. Future Energy Needs Depend on US Silver Development.

The US is 79% import reliant on silver, creating an urgent need to source from US jurisdictions for Energy Future and National Security.

“Hey Siri, what’s going on with the silver deficit?”

”Alexa, can you check if Siri has all the facts?”

The confused investor must mine or dig around, so here’s some true due diligence.

Meet Pixy:

US investors will have to figure out three basic fundamentals.

Where are the top US silver deposits? High grade. Most ounces.

How are an elite few silver mining companies developing these deposits?

And of these companies, which one stands the best chance of bringing Silver to market?

How did we arrive at our thesis?

Backstory begins around the Manhattan Project in mid 1940s but then all of a sudden…

The Department of Energy, Department of Defense, United States Bureau of Mines, and Department of Interior stopped disclosing silver inventories 29 years ago (between 1995 and 1996). Moreover, the United States Bureau of Mines was abolished coincidentally during this same time horizon (specifically 1996)

The US once had a "strategic stockpile of silver," much like the strategic petroleum reserves. When we wrap up this 24-week research project, you can connect all the dots and see why the US must start developing more US-based silver production.

Our new reports will be plain sight and openly exhibited (whereas before, all this news and data was obscured, opaque, and obfuscated)

We can all draw powerful inferences guiding our investment choices.

There are no coincidences with the timing of these closures and the motive behind suppressing silver usage data.

This will also explain that not just the short selling of paper silver contracts creates manipulated silver commodity spot prices.

Once you see our spreadsheet of these massive silver uses, we will lay out our closing argument: defense contractors were motivated to leverage their political clout to incentivize their Government allies to keep their factory inputs as low as possible.

This is a collusive arrangement or cartel of price fixers between top-ranking government officials ( defense and aerospace contractors.) This also extends to companies that typically don't contract with the US Government, such as SpaceX, Blue Origin, Rocket Lab, and Virgin Galactic.

In all these cases, these gargantuan aerospace and defense enterprises (silver buyers) push for lower silver prices to maximize profits on rockets, bombs, shells, missiles, aircraft, tanks, night vision goggles, warships, satellites, nukes, submarines, torpedoes, etc.

Anyone who runs a business understands that factory inputs (raw materials, equipment, payroll, insurance, land, building structures, vehicle fleets, maintenance) all go into any accounting spreadsheet.

By minimizing costs, companies can improve their profit margin, which is the difference between revenue and expenses. A higher profit margin means that a company is more profitable.

Our research project was recently announced on October 12, 2023

On October 12, 2023, we reported how the US government

bureaus such as the Department of Defense, Department of Energy, Department of Interior, and United States Bureau of Mines (USBM) stopped reporting on silver inventories in 1995/1996.

For most of the 20th century, the United States Bureau of Mines (USBM) was the primary United States government agency conducting scientific research and disseminating information on the extraction, processing, use, and conservation of mineral resources. The Bureau was abolished in 1996. (coincidentally, at the same time, the Dept. of Defense started pretending silver was not the single most crucial component in manufacturing all these weapon systems.)

2023 Final Critical Materials List. Silver and Gold are Not on this LIST.

WTF?

https://www.federalregister.gov/documents/2022/02/24/2022-04027/2022-final-list-of-critical-minerals

Silver is arguably the Most Critical Mineral for Aerospace, Future Energy, Future Cars, Future Tech, and National Defense.

The US Department of Energy has determined the final Critical Materials List to include the following:

Critical materials for energy: aluminum, cobalt, copper, dysprosium, electrical steel, fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, silicon, silicon carbide and terbium.

Critical minerals: The Secretary of the Interior, acting through the Director of the US Geological Survey (USGS), published a 2022 final list of critical minerals that includes the following 50 minerals: "Aluminum, antimony, arsenic, barite, beryllium, bismuth, cerium, cesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium, palladium, platinum, praseodymium, rhodium, rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, vanadium, ytterbium, yttrium, zinc, and zirconium."

US Government's Denial of Silver and Gold's Importance is Putting the Country at Risk

The Silver Academy is a learning project but also a guide for investors (for the public to gain perspective and appreciation on how we are running out of silver.)

I am now calling this a SILVER CRISIS and will begin using that hashtag on social channels. #SilverCrisis

Moreover, we will indicate how much silver the US imports and how this poses a substantial risk to US energy independence and puts the US military in a precarious situation.

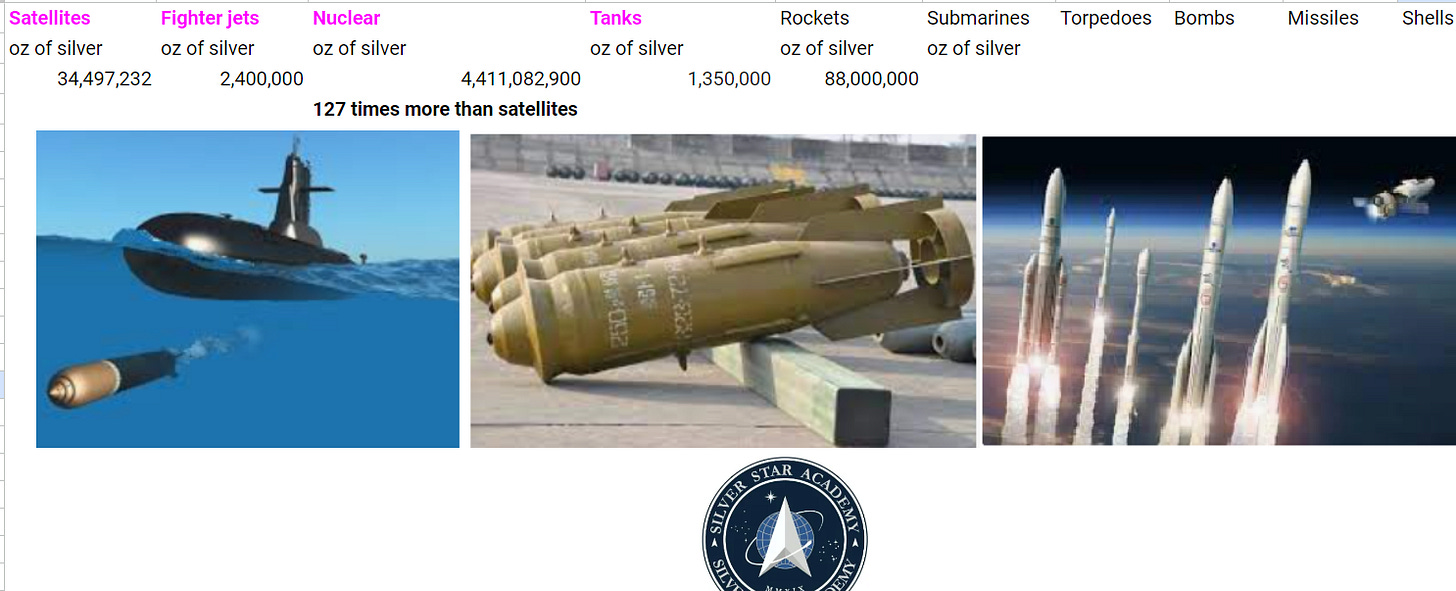

We are beginning to document these gargantuan numbers when calculating enormous uses of silver in the aerospace and defense industries.

We're talking about massive uses of silver in rockets, bombs, shells, missiles, torpedoes, nukes, fighter jets, tanks, submarines, and communication devices.

However, today, we will focus on satellites, which are just a tiny fraction of the entire silver use envelope yet still an important data point.

How many satellites from 1957 to 2027

Satellites in Orbit amount to 34.5 Million Ounces of Silver and 576,000 ounces of Gold beyond 2023. But this is peanuts compared to rockets, nukes, submarines, missiles, torpedoes, jets, tanks, etc.

Conclusion

This past year, the US lost its enormous privilege called the Petrodollar. This Petro dollar strengthened the dollar because Saudi/OPEC oil trade was denominated in US dollars. All the World's countries (except those sanctioned like Iran, Venezuela, Russia) previously have been forced to hold dollars.

As a result of US unwise and self-inflicted sanction wounds, BRICS deployed the gold for oil playbook by Russian economist Sergei Glazyev. Meanwhile:

The US is in a war with Russia.

The US is being dragged into the Palestine-Israeli War.

Just three days ago, The Biden regime delivered to Congress a $110 billion request for military aid, mostly for Israel and Ukraine, essentially daring lawmakers who oppose parts of the proposal to vote against an overall package that he said will ensure “American security for generations.”

The Central Banker Warfare Model indicates a very high probability Iran is next

Minerals are the new war; this is where our story heats up.

The US is over a barrel; when we think critically and look at what's happening with silver import dependency, it paints a picture of dire desperation for the USA (precisely because it can not control its own energy or military destiny.)

Now, look at the graphic below indicating a troubling statistic.

It shows the US is 79% import-reliant on silver (and jurisdictions like Mexico banned silver open pit mining). Moreover, there were only a few countries where the US could rely on silver imports from silver exporters as trade partners.

But we are in a different world since 2021. Silver exporters are not lining up to do business with the USA because of the US dollar's toxic orbit. (tied to over 33 Trillion Dollars in debt) and there's an intensifying shift in geopolitical World trade realignments.

Other nations don't want to be trapped in a Central Bankers Warfare Model and have begun a system of trading commodities for commodities (Pivoting away from exporting cars, appliances, textiles, electronics and raw materials in exchange for the US who is printing money out of thin air)

The dollar-centric system is rooted in a centuries-old model known as the Central Banking Warfare model, where central banks print currency, and the military ensures its acceptance.

The US is no longer the top dog; other nations are offloading US Treasuries at a record clip, and silver export nations (previously oppressed by North American neocolonialism) have long memories.

Plus, there are only a few silver-producing countries to begin with.

This is just like what happened with oil. The US once thought they could depend on Saudi. Still, it only takes a weekend or a new BRICS Summit meeting somewhere for new trade alliances to become institutionalized, leaving the US stranded without strategic trade partners.

This is why you are seeing a "run on US Treasuries." With silver and gold as part of the new BRICS architecture, no one is in a hurry to help out Uncle Sam, who has used "debt trap" Tony Soprano-style IMF loans for decades. These debt trap loans have created years of misery and poverty in the nations the US needs for silver imports, and it's doubtful they will feel too sorry for the USA's silver deficits.

Countries are wising up and increasingly unwilling to trade out their own self-interests. They are rejecting past patterns where a few elite industrialists and politicians could be bribed to continue as "modern-day" commodity colonies for the US.

They know how much the US needs silver, so the US could be cut off from silver imports from emerging markets.

There is a solution to the silver crisis. The answer is domestic development of silver deposits located in the USA.

Since silver is the most critical metal and foreign imports will be minimized to nonexistent, the only solution is identifying and developing silver projects on US soil.

US investors will have to figure out three basic fundamentals.

Where are the top US silver deposits? High grade. Most ounces.

How are an elite few silver mining companies developing these deposits?

And of these companies, which one stands the best chance of bringing Silver to market?

Summa Silver

(TSXV: SSVR) (OTCQX: SSVRF) (FSE: 48X)

High Grade Silver in USA

Summa Silver provides exposure to 2 of the highest grade underdeveloped silver projects in the United States. With a healthy financial position, Summa is well positioned to advance both projects and to continue building high grade ounces as well as make new discoveries.

The Mogollon Project In SW New Mexico was the largest historic silver producer in New Mexico up until 1942. Production only stopped due to the wartime cessation of all gold and silver mining in the United States. With little to no modern exploration on the project, Summa CEO, Galen McNamara stated "The Mogollon district presents a very rare discovery opportunity, and for good reason. It is my strong belief that the district has the potential to be one of the great remaining vein fields still left in the United States". With this being said, Summa has done a tremendous job in their modern exploration making numerous high grade silver discoveries.

The Hughes Project in Tonopah Nevada is one of the most prolific past producing districts in the United States. Formerly owned by Howard Hughes, this project follows a similar theme as a past-producing district that also has seen little to no modern work. The Hughes Project represents a unique opportunity to both revitalize a historic district and make new discoveries in the shadows of the headframes of some of America's great historic silver producers.

Management's Exploration Success - Summa is led by a group of geologists and experienced executives that have all contributed significantly to making world class discoveries. CEO, Galen McNamara, was instrumental in the Arrow Discovery while at NexGen Energy. Senior Geologist, Chris Leslie, co-discovered the Blackwater Gold deposit in BC which has over 8 million ounces in the proven and probable category. Mike Konnert, Director, is the CEO of Vizsla Silver which has taken a very similar approach to Summa but in Mexico and has had tremendous sources.

Summa Silver developing Eastern Half of Tonopah. Two Remarkable American Silver Discoveries

Last Tuesday 10/18/23 we reported: Blackrock Silver Updated Their Mineral Resource Estimate for the Tonopah West Project Totaling 100.04 million silver equivalent ounces at an average grade of 508.5 g/t. A 135% increase over the maiden resource estimate for Tonopah West

Disclaimer / Disclosure

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader.

The Pickaxe & MineralWEALTH is not and does not profess to be a professional investment advisor, and strongly encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before making any investment decision. The pickaxe & MineralWEALTH and/or independent consultants or members of their families may have a position in the securities mentioned. Mr. Little does consult on a paid basis both with private investors and various companies. Investing and speculation are inherently risky and should not be undertaken without professional advice. By your act of reading this independent market research letter, you fully and explicitly agree that The Pickaxe & MineralWEALTH will not be held liable or responsible for any decisions you make regarding any information discussed herein.