US credit card defaults hit the highest level since 2010

Credit card lenders wrote off $46 billion in seriously delinquent loan balances during the first nine months of 2024. A 50% increase compared to the same period in the previous year.

You’re Right Jennifer Garner, Capital One is in a “league of their own” … a league also called Usury

Have you ever walked into Dillards or Kohl’s to buy Levis and then been enticed by a store clerk to apply for a credit card. Recently I was flying to visit my mother and the flight attendant went up and down the aisle promoting a credit card.

I politely decline these enticing offers and here is why?

The face of Americana

Mrs. Jennifer Garner is prominently featured in several commercials for Capital One, including "There's No Crying in Baseball" ad for the Capital One Venture Card. This commercial showcases her engaging with themes of sports and humor, drawing inspiration from the classic film A League of Their Own

Jennifer (as I call her) also stars in the "Once Upon a Farm" campaign for the Capital One Venture X Business Card, emphasizing the card's benefits for business travelers

How about that Jennifer, The All American girl promoting a credit card with promises of instant discounts or rewards.

Beware: behind those alluring offers lurks a potential debt trap. Some retail credit cards now charge a staggering 33% interest, exploiting a little-known loophole in consumer protection laws. This usurious practice is leaving countless Americans drowning in debt, unable to escape the cycle of predatory lending.

Some store credit cards now charge more than 33% interest, after blowing past a symbolic 30% threshold that retailers and banks dared not cross.

Can they even do that?

The answer: yes.

“Yep. They can charge that much,” said Chi Chi Wu, a senior attorney at the nonprofit National Consumer Law Center. “Credit cards can actually charge whatever they want. It’s a little-known fact.”

The soaring credit card interest rates, now averaging 20.35%, have reached levels that many consider usurious and predatory. This alarming trend in consumer lending practices raises serious concerns about the financial well-being of American households, particularly those in lower-income brackets.

Usury, once a term used to describe unfair interest-bearing loans, now refers to excessively high interest rates that are often illegal.

The current average credit card interest rate of 20.35% far exceeds what many would consider reasonable, and in some cases, rates have climbed even higher. For instance, many retail credit cards now charge a staggering 33.24% annual interest.

- Jon Forrest Little

These rates bear the hallmarks of predatory lending, which the FDIC defines as "imposing unfair and abusive loan terms on borrowers"

Predatory lenders typically target vulnerable populations, exploiting their lack of financial knowledge or limited access to traditional banking services.

The current credit card interest rates seem to fit this description, potentially trapping consumers in cycles of debt that are increasingly difficult to escape.

While usury laws exist in many states to protect consumers from excessive interest rates, their effectiveness has been significantly eroded by federal legislation and Supreme Court decisions.

As a result, credit card companies can often charge interest rates that would be considered usurious in many borrowers' home states by incorporating in states with more lenient or non-existent usury laws, such as Delaware or South Dakota.

The combination of high interest rates and aggressive marketing tactics employed by some credit card issuers raises ethical questions about the nature of these lending practices. As consumers struggle with rising costs of living and stagnant wages, the burden of high-interest credit card debt becomes increasingly oppressive, potentially leading to long-term financial hardship for many American families.

December 29th, 2024

US credit card defaults jump to highest level since 2010

Source:

https://www.ft.com/content/c755a34d-eb97-40d1-b780-ae2e2f0e7ad9

The recent surge in US credit card defaults has reached alarming levels, hitting the highest point since the aftermath of the 2008 financial crisis. According to data compiled by BankRegData, credit card lenders wrote off $46 billion (this seems like a lot) in seriously delinquent loan balances during the first nine months of 2024, marking a 50% increase from the same period in the previous year.

This significant rise in defaults serves as a stark indicator of the financial strain experienced by many American consumers, particularly those in lower-income brackets.

The escalation in credit card debt and defaults is occurring against a backdrop of persistent inflation and rising interest rates. The average American household credit card debt stood at $10,757 in the third quarter of 2024, with total credit card debt in the US surpassing $1.66 trillion.

This debt burden, coupled with an average credit card interest rate of 20.35%, has made it increasingly difficult for many borrowers to keep up with payments.

Mark Zandi, head of Moody's Analytics, highlighted the disparity in financial health across income levels, stating, "the bottom third of US consumers are tapped out. Their savings rate right now is zero"

This economic divide underscores the uneven impact of inflation and the challenges faced by lower-income Americans in managing their finances.

The rising trend in credit card defaults is not just a concern for individual consumers but also signals potential broader economic implications. As defaults increase, there's growing pressure on financial institutions and policymakers to address the underlying issues contributing to this financial stress.

The situation raises questions about the sustainability of consumer spending, which has been a key driver of economic growth, and the potential ripple effects on the banking sector and overall economic stability

Let’s review what we just read

Credit card lenders wrote off $46 billion in seriously delinquent loan balances during the first nine months of 2024

This represents a 50% increase compared to the same period in the previous year

The current level of write-offs is the highest in 14 years, dating back to the aftermath of the 2008 financial crisis

This system of financial exploitation bears a striking resemblance to historical usury practices, where lenders charged exorbitant interest rates to desperate borrowers. While modern credit card interest rates may be legal, their effect on low-income families is no less devastating.

These families are not just living paycheck to paycheck; they're falling further behind with each passing month, trapped in a cycle of debt that seems impossible to escape.

What else could possibly go wrong?

The next financial collapse could be triggered by a combination of factors, with the current economic landscape presenting a more precarious situation than the 2008 crisis. Here's an analysis of how these factors could contribute to a potential collapse:

The current $36 trillion debt, significantly larger than in 2008, creates a more volatile economic environment. This massive debt burden means there's more to unwind and higher leverage, potentially leading to a more explosive situation than the 2008 crisis. The sheer scale of debt amplifies the risk of a domino effect if defaults begin to occur.

Major urban centers like New York, San Francisco, Washington D.C., Austin, Portland, Seattle, and Los Angeles are facing unprecedented challenges in their commercial real estate markets. Once considered safe havens for investment, these cities are now grappling with high vacancy rates as remote work becomes more prevalent. This shift not only affects property values but also impacts the entire ecosystem of businesses that relied on office workers, including cafes, restaurants, and retail stores

Banks are currently holding higher unrealized losses than ever before. This situation, coupled with the potential defaults in the CRE sector, could lead to a banking crisis similar to or worse than the 2008 financial crisis. The interconnectedness of the financial system means that problems in one sector can quickly spread to others.

While official government figures show unemployment at around 4%, some argue that the real unemployment rate could be as high as 24%. This discrepancy, if accurate, points to a much weaker economy than officially recognized. High unemployment rates can lead to decreased consumer spending, further exacerbating economic problems.

To address these issues, the Federal Reserve might resort to quantitative easing (QE) on a scale far larger than previous interventions like TARP. Given the current debt levels, such QE would need to be significantly larger, potentially doubling previous efforts. This massive injection of liquidity could have far-reaching consequences for inflation and economic stability.

The ongoing trend of mergers and acquisitions is leading to the decline of family-owned and small businesses. Large corporations are increasingly dominating various sectors, as seen in the retail industry with the rise of Amazon and the decline of traditional retailers like Bed Bath & Beyond and Big Lots. This consolidation can lead to reduced competition and economic diversity

The U.S. government's extensive military commitments, including maintaining over 750 bases worldwide and funding long-term conflicts, place a significant burden on the economy. The recent aid to Ukraine, totaling over $195 billion, adds to this financial strain. These expenditures limit the government's ability to address domestic economic issues effectively.

Despite spending more on healthcare and education per capita than most countries, the U.S. sees poor returns on these investments. The healthcare system's focus on treating sickness rather than promoting wellness, coupled with the underperformance of the education system, contributes to long-term economic challenges.

Some argue that economic elites may be positioning themselves to benefit from a potential collapse. Warren Buffett's significant cash position, for instance, could be interpreted as preparation for acquiring assets at discounted prices during a downturn.

In the event of a collapse, the injection of new QE funds could disproportionately benefit those closest to the sources of credit. This scenario could lead to further concentration of wealth, as those with access to cheap credit would be able to acquire distressed assets, including real estate, at significantly reduced prices. This dynamic could exacerbate wealth inequality and potentially set the stage for future economic instability.

The combination of these factors creates a complex and potentially volatile economic landscape. The interconnectedness of these issues means that a crisis in one area could quickly spread, potentially leading to a systemic collapse that could surpass the 2008 financial crisis in both scale and impact

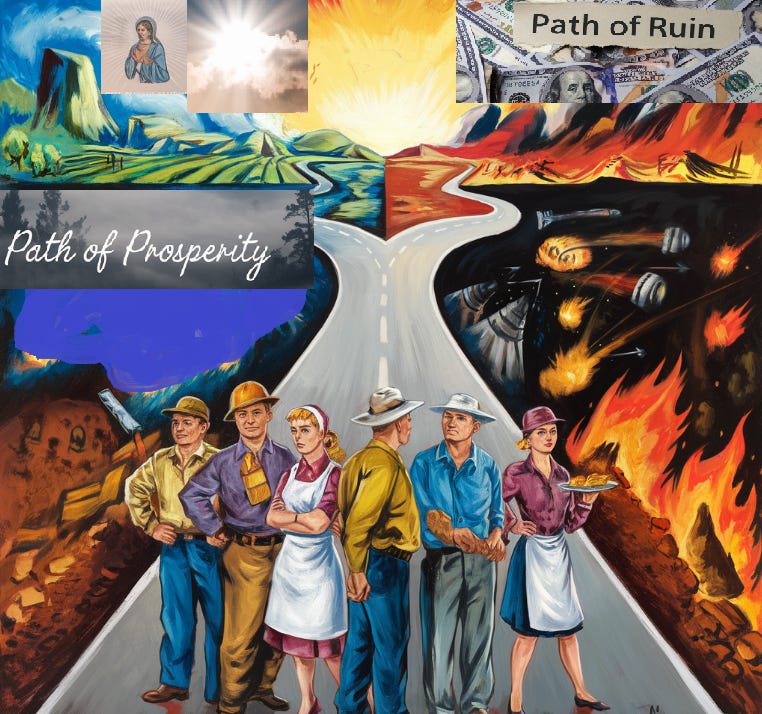

Path of Ruin

or

Path of Prosperity?

We must choose

The path of ruin, paved with fiat currency and usurious lending practices, leads to economic instability and widespread financial hardship. As central banks continue to print money at unprecedented rates and credit card companies charge exorbitant interest rates, the purchasing power of the average citizen erodes, trapping many in cycles of debt and poverty.

In stark contrast, the path of prosperity is highlighted by the timeless value of gold and silver. These precious metals, free from counterparty risk and immune to the whims of central bankers, offer a stable store of value in an increasingly uncertain economic landscape. Unlike fiat currencies that can be created at will, the limited supply of gold and silver provides a natural hedge against inflation and currency devaluation.

By embracing sound money principles and rejecting the siren song of easy credit, individuals can protect their wealth and secure their financial future. As the current system teeters on the brink of collapse, those who have chosen the path of gold and silver may find themselves better positioned to weather the storm and emerge prosperous on the other side.