Unlocking Hidden Value: Summa Silver’s Rise in a World of Overpriced Stocks

Summa Silver Offers Investors Unmatched Value in High-Grade Silver Exploration and Development

The Silver Spark: Lighting Up the Mining World

An over valued so called “Market on Fire—But Not the Kind That Lasts”

The rotation into tangibles is upon us.

Global equity markets are burning brighter than ever—at least, in terms of price. They’re in their second most expensive year in history, as measured by the market cap-to-GDP ratio. The only time valuations were higher was in 2021, at the peak of the market. Today, this ratio is a full 7 percentage points above the tech bubble highs of 2000. With US stocks making up nearly 60% of the global market cap, they’re the fuel behind this blaze. But savvy investors know: not all that glitters is gold—sometimes, it’s silver.

The Forgotten Foundation: Where Innovation Begins

Mining: The Unsung Hero of Modern Life

Without metals, our world would grind to a halt. No infrastructure, no technology, no medicine, no finance, no AI, no electric trains, no aerospace.

Silver, in particular, is the star of the show—the best conductor of electricity, flexible, durable, and even antimicrobial. It’s the hidden ingredient in everything from your smartphone to the latest battery breakthroughs. Yet, mining stocks have been left in the dust. Today, they make up just 1% of the global stock market—down from an average of 7% between the 1940s and 1980s, and sometimes as high as 11%. The sector has been slipping for decades, but now, it’s at rock bottom. For those of us looking to time a bottom, this is the perfect entry point. The perfect time to get positioned in Silver mining equities.

Silver’s Breakout: The Market’s Next Big Move

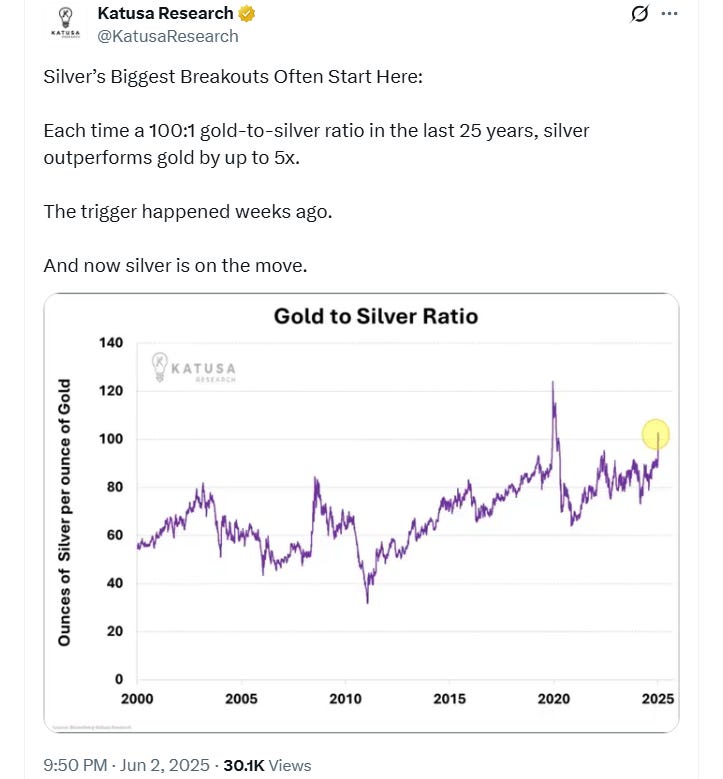

Gold’s Dominance Fades as Silver Accelerates

The gold-to-silver ratio is another compelling signal. This ratio is now breaking down as silver prices accelerate and begin to catch up with gold. Just a month ago, many investors were convinced that this time was different—that the ratio would not revert and that we were witnessing a structural shift. But the trend is now clear: silver is gaining momentum. Capital is flowing from gold to royalty companies, then to senior producers, and now, the focus is shifting to early-stage mining companies. This is where Summa Silver comes into the picture.

Summa Silver Corp. is a premier U.S. high-grade silver explorer and developer. The company is advancing a portfolio of exceptional silver assets, with the goal of bringing high-grade silver projects into production. With additional funding, Summa Silver is poised to move closer to becoming an operating mine, offering investors direct exposure to the next wave of silver market growth.

Recently, Summa Silver and Silver47 announced a transformative merger, set to finalize in the third quarter of 2025. This consolidation creates a new powerhouse in the silver exploration sector. The combined company—Silver47 Exploration Corp.—will control over 246 million silver-equivalent ounces across three high-grade projects in Alaska, Nevada, and New Mexico.

The Red Mountain Project in Alaska alone contains 168.6 million silver-equivalent ounces, including critical metals like antimony and gallium.

The Hughes Project in Nevada boasts 45.9 million silver-equivalent ounces, with high-grade intercepts such as 3,971 grams per tonne over 2.8 meters.

The Mogollon Project in New Mexico features 32.1 million silver-equivalent ounces, with drilling results showing intercepts of 448 grams per tonne over 31 meters.

This merger is about more than just scale—it’s about strategic positioning. By combining forces, Summa Silver and Silver47 are creating a company with the critical mass and technical expertise to advance projects from exploration to production. The market has taken notice, with strong investor demand leading to an upsized brokered private placement offering of C$6 million. This financing will fund the advancement of U.S. silver projects and provide working capital for the combined company. Each subscription receipt converts into a unit consisting of one share of Summa and half of a warrant, with warrants exercisable at $0.36 within 24 months.

Why invest in Summa Silver now? The answer is clear: mining stocks are undervalued relative to the broader market, offering a rare value opportunity. Silver is essential for clean energy, electronics, and as a hedge against inflation and currency devaluation. The strategic merger with Silver47 creates a leading U.S. silver explorer with a clear path to production. Strong investor interest, as shown by the upsized financing, demonstrates confidence in the company’s vision and assets. With over 246 million silver-equivalent ounces across top-tier projects, Summa Silver is well-positioned to capitalize on the next phase of the silver bull market.

In a world of overvalued equities and financialized assets, Summa Silver represents a golden opportunity—or, more accurately, a silver one. The company is perfectly positioned to benefit from the resurgence of mining stocks, the breakout in silver prices, and the growing demand for critical metals. With a transformative merger, strong investor support, and a clear roadmap to production, Summa Silver is not just a silver explorer—it’s a future silver producer, ready to shine in the years ahead.

Summa Silver Could Poised for a Major Rally

Silver Academy’s Carmine Lombardi and Jon Forrest Little believe Summa Silver is most definitely on the cusp of a significant share price increase, driven by a combination of market and industry trends.

Valuation Disconnect

Despite recent gains in gold and silver prices, Summa Silver’s (and this entire industry’s) share price has not fully reflected the surge in underlying metal values. This creates a lucrative opportunity for investors, as the company’s valuation will catch up to broader precious metals market trends.

Growing Market Recognition

Silver Junior miners are just now attracting renewed attention from investors after a period of limited market interest. As capital flows back into the sector and merger and acquisition activity heats up, Summa Silver stands to benefit from increased visibility and investment.

Increased M&A Activity

With larger mining companies and institutional investors seeking out promising silver assets, Summa Silver’s high-quality projects in Nevada and New Mexico make it an attractive target. Enter Alaska (a historically mineral rich region) Now that they merged with Silver47, the two companies merged into one will control over 246 million silver-equivalent ounces across three high-grade projects in Alaska, Nevada, and New Mexico.

This will drive further share price. With this massive silver structural deficit serious eyeballs will be looking at the number 246 million.

Silver’s Outperformance Potential

The gold-to-silver ratio remains historically high, signaling that silver is monstrously undervalued compared to gold. As this gap narrows, silver-focused companies like Summa Silver will experience outsized gains.

Favorable Policy Environment

Recent policy changes in the United States are making it easier for silver mining companies to obtain permits and operate. These developments provide a supportive backdrop for Summa Silver’s growth and exploration efforts.

Summary

With an attractive valuation, growing investor interest, and a supportive policy environment, Summa Silver is well-positioned for a potential rally. As Silver Academy’s Jon Forrest Little notes, the company could see significant upside in the months ahead.

Read more : on the merger between Summa Silver and Silver47

Further disclaimers:

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader.

The Silver Academy is not and does not necessarily profess to be a professional investment advisor, and strongly encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before making any investment decision. The Silver Academy and/or independent consultants or members of their families may have a position in the securities mentioned.

Mr. Little does consult on a paid basis both with private investors and various companies. Investing and speculation are inherently risky and should not be undertaken without professional advice. By your act of reading this independent market research letter, you fully and explicitly agree that The Silver Academy will not be held liable or responsible for any decisions you make regarding any information discussed herein.

Further Disclaimers:

Silver Academy, The Pickaxe, Mineral Wealth often posted by contributing writers

Section 230 of the Communication Decency Act protects Free Speech for platforms like Substack

Section 230 of the Communications Decency Act (CDA) protects online platforms such as Substack for content posted by their users.

Our Advertising Department and Editorial Department are Separate Divisions.

Sponsors do not necessarily hold the opinions of Silver Academy's editorial staff.

The opinions of this broadcast are not the opinions of the sponsors.

Editorial staff do not consult with sponsors before broadcasting or publishing.

sponsors do not pay for specific posts they generate (meaning Jon Little writes up articles that feature sponsors and or mining companies he endorses from scratch)

Not financial advice