Two Sides of the Gold and Silver Coin. NATO (the hater of Gold yet Loves it Enough to Steal) against the Rest of the World.

The 'Golden rule' states that “whoever holds the gold makes the rules. These are FACTS. And those who don't have it use their Guns to Steal it.

Central Bank of Serbia

Gold reserves at the Central Bank of Serbia increased by 5 tonnes last week

lifting total gold holdings to over 46 tonnes.

This has not been published in the official World Gold Council statistics yet

WGC will update their records when it is.

Czech National BankData from the Czech National Bank shows its Gold reserves rose by nearly 2 tonnes in May.

Now 16 consecutive months of buying.

Czech National Bank YTD net purchases of gold now total 11 tonnes lifting their total gold holdings to over 41 tonnes.

Central bank of UzbekistanData published by the Central bank of Uzbekistan shows its Gold reserves rose by 9 tonnes in June.

Central Bank of Uzbekistan YTD net sales now total 6 tonnes, leaving their total gold holdings at 365 tonnes.

People's Bank of ChinaAs reported over the weekend, the People's Bank of China kept its Gold reserves at 2,264 tonnes in June.

The second consecutive month it remained unchanged.

Gold still accounts for over 5% of total reserves.

The Reserve Bank of IndiaIndia's gold purchases in June were the highest in 2 years.

The Reserve Bank of India added more than 9 tons in June

The most since July 2022.

India’s gold reserves have expanded by 37 tons this year to 841 tons.

National Bank of PolandData published by the National Bank of Poland indicates a 4 tonne increase in its Gold reserves in June.

The third consecutive month of buying.

Total gold holdings now stand at 377 tonnes, nearly 19 tonnes higher than at the end of 2023.

Central Bank of JordanThe Central Bank of Jordan added a net 3 tonnes of Gold to its reserves in May, following three consecutive months of net sales.

Gold holdings now stand at 68 tonnes.

NATO Hates Gold

EVERYONE ELSE LOVES IT.

Countries accumulating gold out of fear of US sanctions:

Most sensible countries have indeed increased their gold reserves as a hedge against potential economic sanctions. For instance, Russia significantly boosted its gold reserves in recent years, partly as a response to Western sanctions.

This trend suggests that countries view gold as a safeguard against geopolitical risks and potential economic isolation.

NATO countries relying on military power to back the US dollar:

The concept of military power supporting currency strength is known as the "petrodollar" system. This system, established after the Nixon Shock, effectively replaced the gold standard with US military dominance as a backing for the dollar.

The US military's global presence and its role in protecting key oil-producing regions have helped maintain the dollar's status as the world's reserve currency.

It's worth noting that while NATO countries may not be accumulating gold at the same rate as others, they benefit from the current dollar-centric global financial system. Their military alliance with the US indirectly supports the dollar's strength, reducing their need to hold large gold reserves as a hedge against economic instability.

USA defaulted on their contract while some people write Nixon closed the gold window

The Nixon Shock of 1971, which ended the dollar's convertibility to gold, marked a significant shift in global monetary policy. This was simply the US defaulting on their financial and contractual obligation.

This move allowed the US to print more dollars without the constraint of gold backing, effectively leveraging its military and economic power to maintain the dollar's global dominance. The US embarked on its shrewd journey (because it defaulted) to pursue over 251 wars since nothing was backing the dollar.

This also explains why US uses its military to steal other countries gold (Libya, Ukraine, Iraq, Somalia

Gold and Oil:

Petrodollars and the United States Attacks in Libya, Somalia, Sudan, Mali, Iraq, Syria, Lebanon and Iran;

The nations which ratified Bretton Woods did so on two conditions. The first was that the Federal Reserve would refrain from over-printing the dollar as a means to loot real products and produce from other nations in exchange for ink and paper: basically an imperial tax. That assurance was backed up by the second, which was that the US dollar would always be convertible to gold at $35 per ounce.

Of course , the Federal Reserve, being a private bank and not answerable to the US Government, did start overprinting paper dollars, and much of the perceived prosperity of the 1950s and 1960s was the result of foreign nations’ obligations to accept the paper notes as being worth gold at the rate of $35 an ounce. . . . .

In the years leading up to 1970, expenditures in the Vietnam War made it clear to many countries that the US was printing far more money than it had in gold, and in response, they began to ask for their gold back. This, of course, set off a rapid decline in the value of the dollar . . . .

Then in 1970, France looked at the huge pile of paper notes sitting in their vaults, for which real French products like wine and cheese had been traded, and notified the United States government that they would exercise their option under Bretton Woods to return the paper notes for gold at the $35 per ounce exchange rate.

Of course, the United States had nowhere near the gold to redeem the paper notes, so on August 15th, 1971, Richard Nixon ‘temporarily’ suspended the gold convertibility of the US Federal Reserve Notes:

‘I have directed the Secretary of the Treasury to take the action necessary to defend the dollar against the speculators. I directed Secretary Connolly to suspend temporarily, the convertibility of the dollar into gold or other reserve assets except in amounts and in conditions determined to be in the interest of monetary stability and in the best interests of the United States.’

This ‘Nixon Shock’ effectively ended Bretton Woods and many global currencies started to disengage from the US dollar. Worse still, since the United States had collateralized their loans with the nation’s gold reserves, it quickly became apparent that the US Government did not in fact have enough gold to cover its outstanding debts.

Foreign nations began to get nervous about their loans to the US and understandably were reluctant to lend any additional money to the United States without some form of collateral.

So Richard Nixon started the environmental movement, with the EPA and its various programs such as ‘wilderness zones’, ‘Road-less areas’, ‘Heritage rivers’, ‘Wetlands’, all of which took vast areas of public lands and made them off limits to the American people who were technically the owners of those lands. But Nixon had little concern for the environment, for the real purpose of this land grab under the guise of the environment was to pledge those pristine lands and their vast mineral resources as collateral on the national debt.

The plethora of different programs was simply to conceal the true scale of how much American land was being pledged to foreign lenders as collateral on the government’s debts eventually almost 25% of the nation itself.

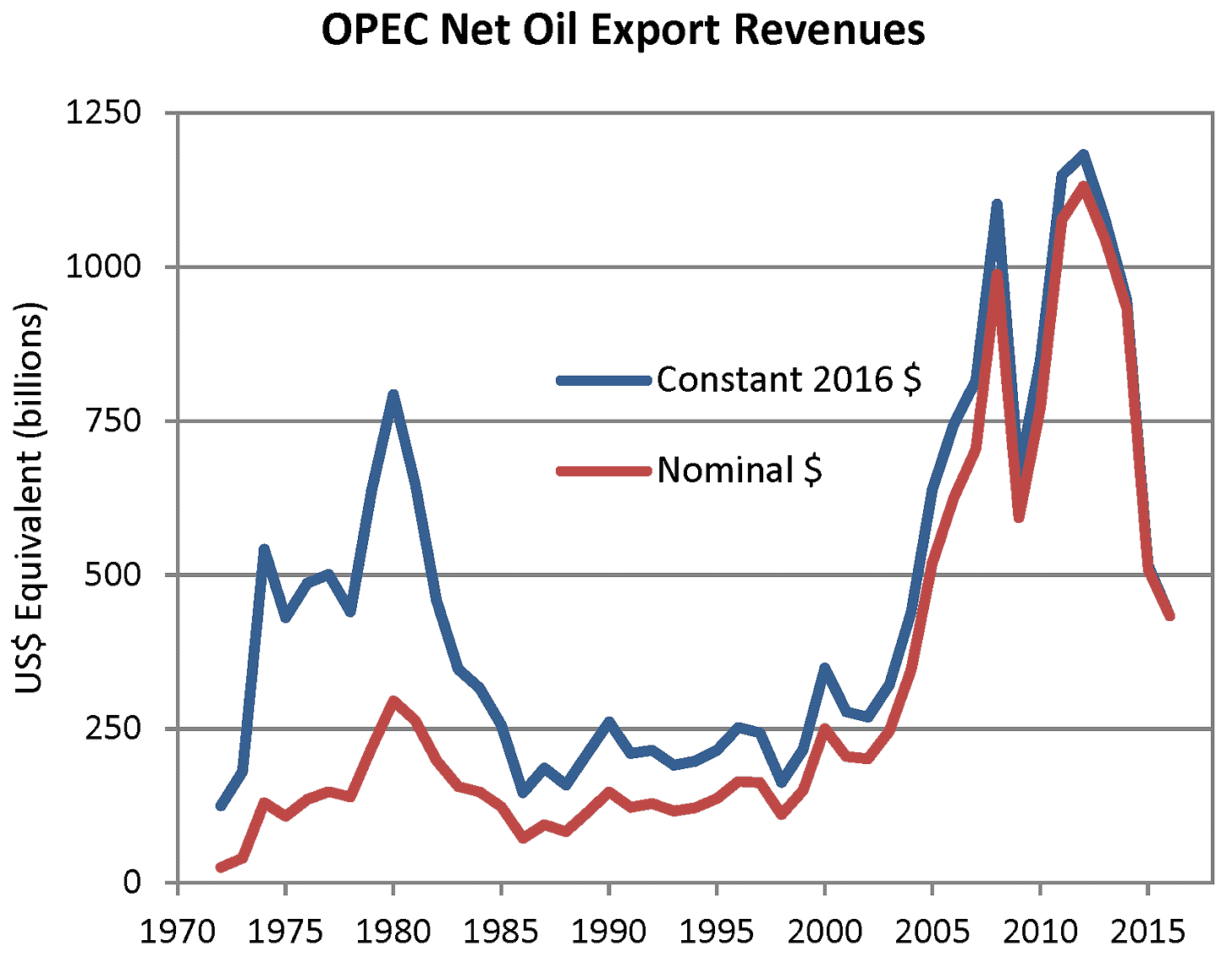

With open lands for collateral already in short supply, the US Government embarked on a new program to shore up sagging international demand for the dollar. The United States approached the world’s oil producing nations, mostly in the Middle East, and offered them a deal. In exchange for only selling their oil for dollars, the United States would guarantee the military safety of those oil-rich nations.

[Siphiwe note: this is called “extortion” and “gangsterism”]

The oil rich nations would agree to spend and invest their US paper dollars inside the United States, in particular in US Treasury Bonds, redeemable through future generations of US taxpayers. The concept was labelled the ‘petrodollar’. In effect, the US, no longer able to back the dollar with gold, was now backing it with oil. Other peoples’ oil, and the necessity to control those oil nations in order to prop up the dollar has shaped America’s foreign policy in the region ever since. . . .

This was not a temporary suspension as Nixon claimed, but rather a permanent default, and for the rest of the world who had entrusted the United States with their gold, it was outright theft. In 1973, President Nixon asked King Faisal of Saudi Arabia to accept only US dollars in payment for oil, and to invest any excess profits in US Treasury Bonds, Notes and Bills. In return, Nixon offered military protection for Saudi oil fields. The same offer was extended to each of the key oil-producing countries, and by 1975 every member of OPEC had agreed to only sell their oil in US dollars.

The act of moving the dollar off gold and tying it to foreign oil, instantly forced every oil-importing country in the world to maintain a constant supply of Federal Reserve paper, and in order to get that paper, whey would have to send real physical goods to America. . . . Paper went out, everything America needed came in, and the United States got very, very rich as a result. It was the largest financial con in recorded history.

The Arms Race of the Cold War was a game of poker. Military Expenditures were the chips, and the US had an endless supply of chips. With the Petro Dollar under its belt, it was able to raise the stakes higher and higher, outspending every other country on the planet, until eventually US military expenditure surpassed that of all of the other nations in the world combined - the Soviet Union never had a chance. . . .

The collapse of the communist bloc in 1991 removed the last counterbalance to American military might. The United States was now an undisputed Super-power with no rival. . . . Within that same year, the US invaded Iraq in the first Gulf War, and after crushing the Iraqi military, and destroying their infrastructure, including hospitals and water-purification plants, crippling sanctions were imposed which prevented Iraq’s infrastructure from being rebuilt.

These sanctions which were initiated by Bush Senior, and sustained throughout the entire Clinton administration, lasted for over a decade and were estimated to have killed more than five hundred thousand children . . . .

But as America’s manufacturing and agriculture has declined, the oil producing nations faced a dilemma. Those piles of US Federal Reserve notes were not able to purchase much from the United States because the United States had little (other than real estate) which anyone wanted to buy.

Europe’s cars and aircraft were superior and less costly, while experiments with GMO food crops led to nations refusing to buy US food exports. Israel’s constant belligerence against its neighbors caused them to wonder if the US could actually keep up their end of the petrodollar arrangement. Oil-producing nations started to talk of selling their oil for whatever currency the purchasers chose to use. Iraq, already hostile to the United States, following Desert Storm, demanded the right to sell their oil for Euros, in 2000, and the United Nations agreed to allow it in 2002 under the Oil for Food program instituted following Desert Storm. . . . In response, the US Government with the assistance of mainstream media, began to build up a mass propaganda campaign claiming that Iraq had weapons of mass destruction and was planning to use them. . . . One year later the United States re-invaded Iraq, lynched Saddam Hussein, and placed Iraq’s oil back on the world market only for US dollars.

Following 9-11, the US policy shift away from being an impartial broker of peace in the Middle East to one of unquestioned support for Israel’s aggressions, only further eroded confidence in the Petrodollar deal and even more oil-producing nations started openly talking of oil trade for other global currencies.

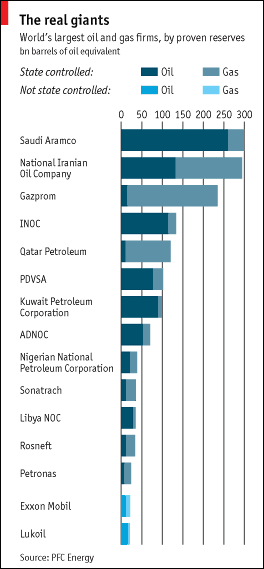

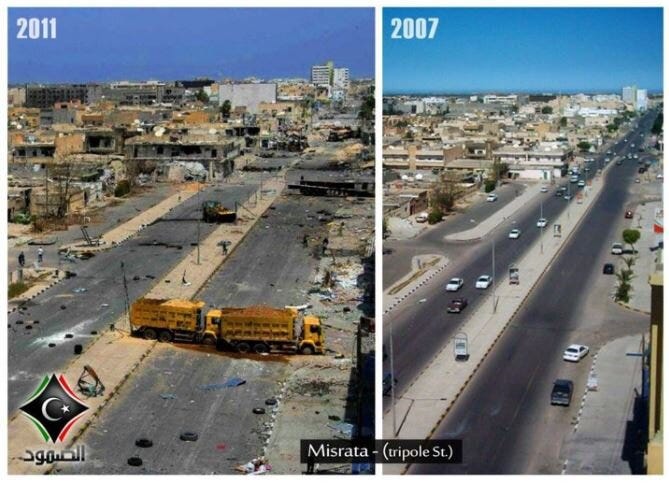

Over in Libya, Muammar Gaddafi had instituted a state-owned central bank and a value-based trade currency, the Gold Dinar. Gaddafi announced that Libya’s oil was for sale, but only for the gold Dinar. Other African nations, seeing the rise of the Gold Dinar and the Euro, even as the US dollar continued its inflation-driven decline, flocked to the new Libyan currency for trade. This move had the potential to seriously undermine the global hegemony of the dollar. French President Nicolas Sarkozy reportedly went so far as to call Libya a ‘threat’ to the financial security of the world.

According to General Wesley Clark, the master plan for the ‘dollarification’ of the world’s oil nations included seven targets, Irag; Syria; Lebanon; Libya; Somalia; Sudan; and Iran (Venezuela- which dared to sell their oil to China for the Yuan - is a late 8th addition). . . . On 2nd March 2007, US General Wesley Clark said,

‘So I came back to see him a few weeks later and by that time we were bombing Afghanistan. I said, ‘Are we still going to war with Iraq?’ And he said “oh it’s worse than that’. He said as he reached over on his desk and picked up a piece of paper and he said “I just got this down from upstairs today (meaning from the Secretary of Defense’s Office), this is a memo which describes how we are going to take out seven countries in five years, starting off with Iraq and Syria, Lebanon, Libya, Somalia, Sudan and finishing off Iran.’

What is notable about the original seven nations originally targeted by the US is that none of them are members of the Bank for International Settlements, the private central bankers private central bank, located in Switzerland. This meant that these nations were deciding for themselves how to run their nations’ economies, rather than submit to the private international banks. So, the United States invaded Libya, brutally murdered Gaddafi“

According to Gold Dinar: the Real Reason Behind Gaddafi’s Murder

"In 2009, Colonel Gaddafi, then President of the African Union, suggested to the States of the African continent to switch to a new currency, independent of the American dollar: the gold dinar.

The objective of this new currency was to divert oil revenues towards state-controlled funds rather than American banks. In other words, to stop using the dollar for oil transactions. Countries such as Nigeria, Tunisia, Egypt and Angola were ready to change their currencies. Unfortunately in March 2011, the NATO-led coalition began a military intervention in Libya in the name of freedom….

Free water, almost free gasoline, free health system and free education were commonplace for Libyans under Gaddafi’s dictatorship.

The leader, who has been in power for 41 years, has managed to gain the support of all the major tribes and buy social peace through radical measures and a policy of shared oil revenues.

Jihadism, the number one enemy of the West, Gaddafi eliminated it with Napalm in the 1990s. Although he financed many armed groups in the Sahel, Libya itself was a stable country where the risk of being kidnapped or even murdered by an armed militia was non-existent.

With an excellent management of oil revenues, the Libyan state had managed to store hundreds of tons of gold (143 tons according to WikiLeaks) and the same amount in silver.

ALL THESE RESOURCES WERE GOING TO MAKE LIBYA THE MOST INFLUENTIAL COUNTRY IN AFRICA, SUPPLANTING FRANCE FOR EXAMPLE.

Gaddafi wanted to avoid American influence in his oil transactions by using this gold. He launched the gold dinar project, and other major African governments were ready to support him in this project. It was both an African dream and a nightmare for the West’s financial system.

THE END OF THE AFRICAN DREAM

This information was discovered through Hillary Clinton’s electronic mailbox. One of the 3000 emails showed NATO’s willingness to overthrow Gaddafi’s government. NATO mainly wanted to to neutralize the African gold currency supported by Libyan oil reserves.

At the beginning of March, the Libyan army and the many militias loyal to the government had already crushed the rebellion, thanks to their numbers and equipment. However, with Western intervention, the dream of a unified monetary system based on gold and independent of the dollar perished…’

“(the object lesson of Saddam’s lynching not being enough of a message, apparently), [the US] imposed a private central bank, and returned Libya’s oil output to dollars only. The gold that was to have been made into the Gold Dinars is, as of last report, unaccounted for.

Now the banker’s gun sights are on Iran, which dares to have a government controlled central bak and sell their oil for whatever currency they choose. The war agenda is, as always, to force Iran’s oil to be sold only for dollars and to force them to accept a privately owned central bank.

The German government just recently asked for the return of some of their gold bullion from the Bank of France and the New York Federal Reserve. France has said it will take 5 years to return Germany’s gold. The United States has said the will need 8 years to return Germany’s gold. This suggests strongly that the Bank of France and the NY Federal Reserve have used the deposited gold for other purposes, and they are scrambling to find new gold to cover the shortfall and prevent a gold run.

Citations:

https://www.federalreservehistory.org/essays/gold-convertibility-ends https://history.state.gov/milestones/1969-1976/nixon-shock

https://www.investopedia.com/terms/n/nixon-shock.asp

https://insights.som.yale.edu/insights/how-the-nixon-shock-remade-the-world-economy

https://journals.sagepub.com/doi/pdf/10.1177/2378023119841812

https://www.balanta.org/news/imwa4buor0g0y5xu4nabs2cdqll8z6

https://unherd.com/newsroom/is-gold-repatriation-bad-news-for-the-dollar/

https://arabcenterdc.org/resource/the-fate-of-the-wagner-group-in-syria-libya-and-sudan/

https://af.usembassy.gov/u-s-citizen-services/scams/

https://www.crisisgroup.org/global/exploiting-disorder-al-qaeda-and-islamic-state