The State of Deception: A Nation Misled by Its Own Numbers

Plus two sensible calculations for Gold's revaluation. Option 1 unlikely, Option 2 very likely. $40,000 Gold per ounce in play. Invest accordingly

In an era where truth should reign supreme, we find ourselves drowning in a sea of statistical manipulation and government-sanctioned disinformation. The recent job reports paint a picture so distorted, it's barely recognizable as reality.

Consider the August job numbers, initially reported at a robust +159,000, only to be slashed by a staggering 51% to a mere +78,000. September's figures weren't spared either, with a 12% downward revision. These aren't minor adjustments; they're seismic shifts that reveal a troubling pattern of overestimation and subsequent quiet correction.

But the deception doesn't stop there. While the government touts a rosy 4% unemployment rate, the real figure lurks in the shadows at a shocking 24%. This isn't just a discrepancy; it's a chasm between truth and fiction.

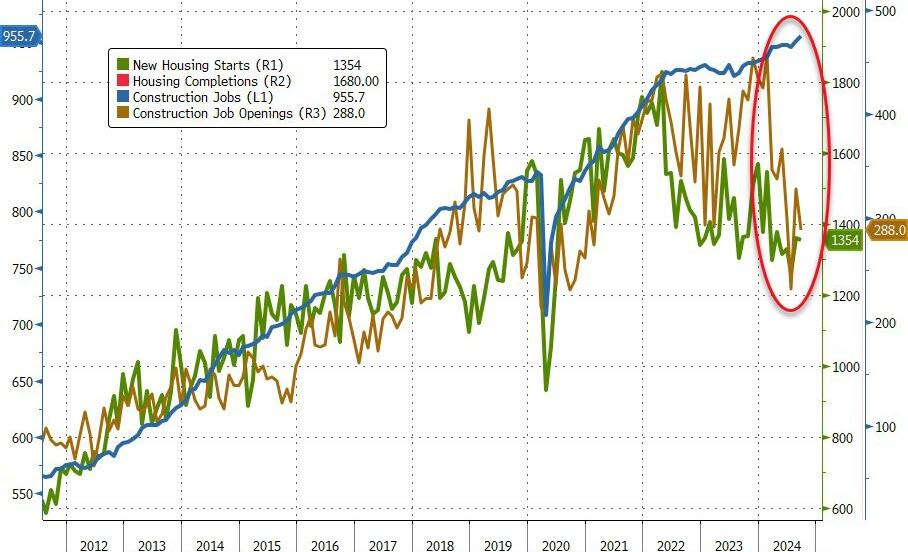

The construction sector supposedly hit an all-time high in jobs, even as housing starts, completions, and job openings plummet. It's as if we're being asked to believe in economic miracles while the foundations crumble beneath our feet.

Inflation figures are equally suspect, with the government's carefully curated basket of goods failing to reflect the crushing reality faced by most Americans. Utilities and health insurance costs have skyrocketed, yet official numbers remain stubbornly low.

Meanwhile, Warren Buffett's Berkshire Hathaway sits on a mountain of cash - $325.2 billion, to be precise. This isn't just a rainy day fund; it's a fortress built to weather an economic apocalypse. When one of the world's savviest investors hoards cash at unprecedented levels, it's time to question the rosy picture being painted by official sources.

We're not just witnessing statistical errors; we're facing a crisis of trust. When the numbers we rely on to make decisions are so wildly inaccurate, how can we navigate our economic future? It's time to demand transparency, accuracy, and honesty from those entrusted with our nation's economic data. Anything less is not just misleading - it's a betrayal of the public trust.

The Biden-Harris administration has reportedly spent nearly $1 billion on what they claim are efforts to combat misinformation and disinformation. This spending, which occurred between 2021 and 2023, was revealed in a report by the House Judiciary Committee and the Select Subcommittee on the Weaponization of the Federal Government

The funds were allocated across various federal agencies, including the State Department, Department of Defense, and National Science Foundation

Critics argue that this spending raises concerns about potential government overreach and infringement on free speech rights

The report suggests that these efforts may have been used to suppress certain viewpoints, particularly those critical of the administration or its policies

Additionally, the report highlights collaborations between federal agencies and private sector entities, including social media platforms, in these anti-misinformation initiatives

All this against this backdrop of Serious Lies

We must ask ourselves the following:

Why was the origin of COVID-19 and the vaccine the biggest lie since 9-11? (the truth is, COVID-19 was orchestrated like a biological weapon via gain-of-function research at US-funded Wuhan Virology Lab) Yet Government sources spun the cause as blaming the Chinese for their eating habits.

A Dutch court recently ruled that Bill Gates must stand trial in the Netherlands over allegations of COVID-19 vaccine injuries.

Seven plaintiffs initiated the lawsuit, claiming they suffered adverse effects from the vaccines. Alongside Gates, the defendants include former Dutch Prime Minister Mark Rutte, Pfizer CEO Albert Bourla, the Dutch government's COVID-19 Outbreak Management Team members, and the Dutch state itself. We will likely see hundreds of these on this side of the pond.

Mark Zuckerberg expressed regret over the pressure exerted by the Biden administration on Facebook to censor COVID-19 content. In a letter to the House Judiciary Committee, he stated that senior officials from the White House repeatedly urged his team to remove specific posts, including humor and satire.

Zuckerberg acknowledged that this governmental pressure was unrelenting and inappropriate, then issued regrets and statements, including an apology for not resisting Biden's pressure.

He emphasized that content standards should not be compromised due to political pressure and vowed to resist similar demands in the future.

Construction jobs somehow hit new all time high even as housing starts, completions and construction job openings nose dive.

The Gold Fix May Arrive

Better Late than Never!

Dr. Judy Shelton, a former economic adviser to President Trump, warns that the rapidly rising U.S. debt poses an "existential threat" to the stability of the dollar and the American economy. She advocates for a return to sound money, suggesting pegging the dollar to gold as a historically proven option.

The U.S. debt is approaching $36 trillion, with interest payments now exceeding defense spending. Shelton criticizes the Federal Reserve for enabling deficit spending and exercising unchecked power. She argues that the Fed has become too prominent, powerful, and political, potentially constraining future presidents' economic agendas.

In her book "Good as Gold," Shelton proposes linking currencies to gold to boost prosperity. She suggests issuing new Treasury Trust Bonds backed by gold reserves as a way to restore the dollar's value. This would involve using America's substantial gold reserves (over 8,100 tons) as collateral.

Shelton emphasizes the need for currency that maintains its purchasing power and is not devalued by Fed policies. She sees this gold-linked approach as a potential solution to the current debt crisis and a means to restore fiscal stability.

Dividing the Money Supply by US Gold reserves:

With 100% Gold backing, we arrive at a gold price of $80,270 per ounce, which would be a superb start to remedying the past sicknesses within our system.

With 50% gold backing, we arrive at a gold price of $40,135 per ounce, as this is just straightforward 3rd-grade math.

This is the same calculation that Jim Rickards arrived at a few months ago.

end of segment

Lately, I have received emails from two so-called precious metals analysts claiming that there is no evidence showing bankers manipulating the price of silver through derivative (paper) trading. We are chasing this story and will name names once the research is complete.

Our opinions are not our sponsors opinions.

The views expressed on TheSilverIndustry.substack.com are not necessarily those of the Silver Academy.

Not financial advice

FYI A good place to find information about manipulation in the gold market is GATA.org.

From my notes I will share with you: On Tuesday April 9/2013 Goldman Sachs told its clients to 'sell gold'. On Friday April 12/2013 at the Comex opening 3.4 million ounces of gold were offered (about 100 tonnes) in the June contract. On Monday April 15/2013 10 million ounces (300 tonnes) were offered. This 400 tonnes offering equals 15% of world production but consisted entirely of futures contracts. Peter Degraaf peterdegraaf.com