The prospect of $27,000 gold may seem outlandish at first glance, but not really when you do the math.

I know I know, Let's get to $3000 first!

Indeed, while the prospect of $27,000 gold may seem outlandish at first glance, it pales in comparison to the truly staggering economic challenges we face. The sticky high inflation, looming debt crisis, ongoing recession, and surging job layoffs are just the tip of the iceberg.

The impending commercial real estate collapse threatens to unleash a tsunami of financial distress. Even more alarming are the banks' unrealized losses and their quadrillion-dollar derivative exposure – figures that dwarf the seemingly bold gold predictions. In this context, a call for $27,000 gold is not just plausible but perhaps conservative.

As we navigate these treacherous economic waters, it's crucial to remember that unprecedented times may well demand unprecedented measures. The once unthinkable may become our new reality, and preparing for such possibilities is not alarmism, but prudence.

Since the election, Judy Shelton has made notable appearances on Fox with Larry Kudlow, CNBC's Squawk Box, and Yahoo Finance

These high-profile media engagements suggest that Shelton is being strategically positioned in the public eye, potentially as a candidate for Federal Reserve Chair or a key role in shaping monetary policy in a potential future Trump administration

In an era of economic uncertainty and inflationary pressures, it's time to seriously consider returning to a gold standard or implementing gold-backed Treasury bonds to restore confidence in the U.S. dollar. This approach, championed by economists like Judy Shelton, offers a compelling solution to the challenges posed by our current monetary system.

The Federal Reserve's discretionary policies have led to unpredictable fluctuations in interest rates and inflation, eroding the dollar's value over time. A dollar today is worth a fraction of what it was decades ago, undermining savings and distorting economic calculations.

This instability not only affects domestic markets but also creates unnecessary complications in international trade and investment.

A gold standard would provide a stable anchor for our currency, eliminating the need for complex hedging strategies and reducing the financialization of our economy. It would also constrain the ability of policymakers to manipulate the currency for short-term political gains, ensuring long-term economic stability and growth.

Modern Monetary Theory advocates respond that a gold standard is outdated, but its implementation could be surprisingly straightforward. By introducing gold-redeemability clauses in Treasury bonds, we could effectively tie the dollar back to gold without overhauling the entire monetary system.

This approach would leverage the U.S.'s substantial gold reserves, currently undervalued on government ledgers, and potentially allow for longer-dated, lower-interest debt.

Adopting a gold standard or gold-backed Treasuries would signal a commitment to fiscal responsibility and monetary stability. It would restore the dollar's role as a reliable measure of value, rather than a tool for economic manipulation. While resistance from those benefiting from the current system is expected, the potential benefits for long-term economic prosperity and stability make this a worthy pursuit.As we navigate an increasingly complex global economy, returning to the principles of sound money could be the key to securing America's financial future and maintaining its economic leadership on the world stage.

end of section

The Golden Path to $27,000: A Bold Forecast or Economic Reality?

In an era of economic uncertainty, Jim Rickards' forecast of gold reaching $27,000 per ounce by 2026 has raised eyebrows and sparked debate.

While skeptics may dismiss this prediction as sensationalism, Rickards' analysis deserves serious consideration.

The crux of Rickards' argument lies in the potential return to a gold standard, not by choice, but by necessity. As global confidence in fiat currencies wanes, central banks may be forced to anchor their monetary systems to gold once again.

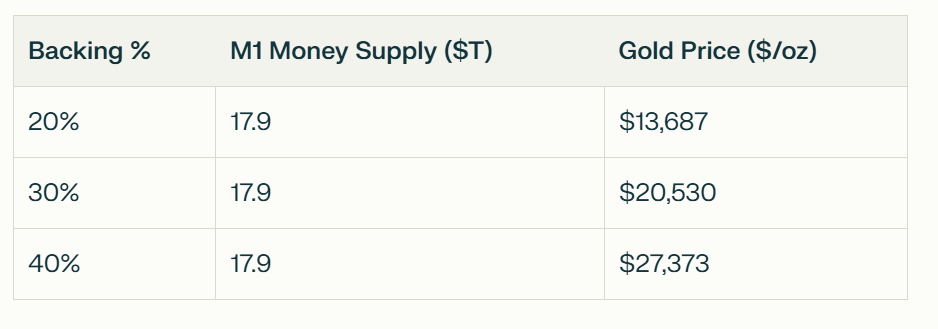

Using the U.S. as a model, Rickards calculates that a 40% gold backing of the M1 money supply would require a gold price of $27,533 per ounce.

This isn't mere speculation. Historical precedents, such as the U.K.'s 1925 return to the gold standard and FDR's 1933 dollar devaluation, underscore the delicate balance required in setting gold prices. Too low, and deflation ensues; too high, and inflation runs rampant.

Rickards' forecast is further supported by supply and demand dynamics. Gold mine production has been declining, while central bank demand has surged tenfold since 2010. This imbalance creates a perfect storm for price appreciation.

Critics might argue that a return to the gold standard is unlikely. However, Rickards posits that it may become inevitable in the face of excessive money creation, cryptocurrency competition, or global crises.The implications of such a dramatic rise in gold prices are far-reaching. It could reshape global financial systems, alter investment strategies, and potentially redistribute wealth on an unprecedented scale.

While $27,000 gold may seem far-fetched today, history has shown that economic paradigms can shift rapidly. Prudent investors would do well to consider gold's potential role in their portfolios, not as a guarantee, but as a hedge against the increasing uncertainty in our financial future.

Jim Rickards discusses various gold standards and their implications for gold pricing. Let's break down the calculations he suggests for determining a potential gold price under different scenarios:

Gold Standard Scenarios

Rickards mentions several historical and potential gold standard regimes:

Great Britain in the 19th century: 20% backing

Various regimes: Range from 20% to 40% backing

BRICS countries (rumored): 40% backing

Calculation Components

To perform the calculations, we need the following data:

US M1 Money Supply

US Gold Reserves: 8,133 metric tonnes

Let's convert the gold reserves to troy ounces:

8,133 metric tonnes = 261,480,215 troy ounces

Here's a table showing the implied gold price under different backing percentages:

To calculate the gold price based on the M2 money supply instead of M1, we'll use a similar approach but with the M2 figure. Let's break down the calculation:

Components

US Gold Reserves: 8,133 metric tonnes = 261,480,215 troy ounces

M2 Money Supply: $21.8 trillion (as of the most recent data available)

Calculation

We'll use the same backing percentages as before (20%, 30%, and 40%) to create a comparison table.

The formula is:

Gold Price = (Backing % × M2 Money Supply) ÷ US Gold Reserves in troy ounces

Using the M2 money supply instead of M1 results in higher implied gold prices across all backing percentages. This is because M2 is a broader measure of the money supply, including savings deposits, small time deposits, and retail money market mutual funds in addition to the components of M1

The calculation using M2 aligns more closely with Jim Rickards' prediction of $27,000/oz gold, falling between the 30% and 40% backing scenarios

This suggests that Rickards may have based his calculations on a broader money supply measure like M2, rather than the narrower M1.It's important to note that these calculations are theoretical and based on the assumption of returning to a gold standard, which is not currently the case for any major economy. The actual price of gold is determined by various factors including supply and demand, economic conditions, and investor sentiment, rather than a direct backing of the money supply