The Magnificent 7 Is Crashing—And Tariffs Will Only Make It Worse

Gold and Silver Thrive Once the Villagers Realize that the Emperor Has No Clothes

America’s so-called “Magnificent 7”—Google, Microsoft, Meta, Netflix, Amazon, Tesla, and Nvidia—have propped up the U.S. stock market for years, accounting for over a third of the S&P 500’s market cap by mid-2024. But the illusion of invincibility is evaporating. In just the first quarter of 2025, these tech behemoths suffered their worst month and quarter on record, with the group losing over $1 trillion in market value in a single day after Trump’s tariff announcements. The era of Big Tech as the market’s safety net is over, and tariffs are not the solution—they’re the accelerant.

The Tariff Trap: Accelerating the Collapse

Trump’s sweeping tariffs—10% across the board, with even steeper penalties for China, Vietnam, and Taiwan—have triggered a global trade war. These tariffs are not protecting American jobs or innovation; they are hammering the very companies that dominate our markets. The Magnificent 7 derive at least half their revenues from overseas, making them uniquely vulnerable to retaliation and supply chain disruptions. The Federal Reserve’s own staff now project that these trade policies will drag down real GDP growth, widen the output gap, and push unemployment above the natural rate for years to come. Tariffs will boost inflation, weaken productivity, and make a recession almost as likely as the baseline forecast.

The Real Agenda: Blockchain Surveillance and Financial Control

Is this economic self-sabotage, or something more sinister? Trump’s crypto empire is expanding at breakneck speed, with his companies now raising billions to buy bitcoin and launch speculative memecoins.

The vision: a blockchain-based financial system where every transaction is traceable, every purchase trackable, and funds can be frozen, seized, or set to expire at a politician’s whim. Imagine a world where your money is no longer private, but a digital leash—where the government, or a president with business interests in crypto, can see and control how every $20 bill is spent. Is this the “great reset” the ruling class has been engineering? Are we being herded into a dystopian surveillance state, under the guise of economic crisis and technological progress?

No Free Market in USA

US consumers suffer because ….

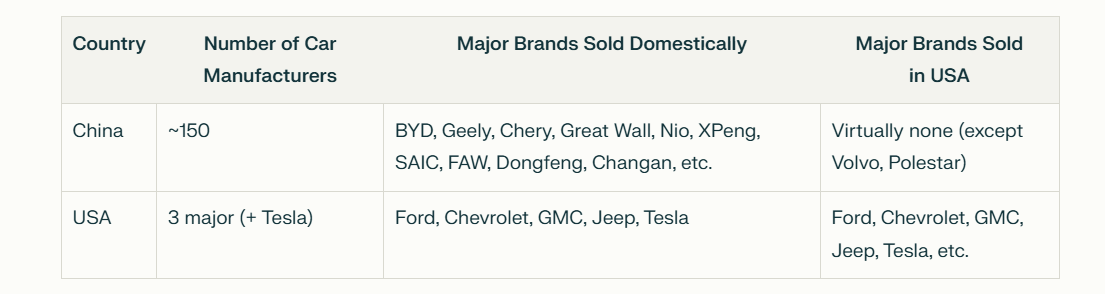

It’s strikingly odd that Chinese cars, despite their global competitiveness and technological advances, are virtually unavailable for purchase in the United States. For a country that prides itself as the “land of free trade,” this level of protectionism raises serious questions. While officials cite concerns over national security and the lack of established dealer networks, the reality is that aggressive tariffs—some as high as 100% or even 200%—and outright bans on “connected” Chinese vehicles have effectively shut the door on competition from China.

Even Chinese cars built in Mexico are targeted to close off any backdoor entry. This is not just about economics; it’s about shielding domestic automakers from superior, lower-cost alternatives and maintaining control over the technology embedded in vehicles. If America truly champions open markets and consumer choice, why are we so afraid to let Chinese automakers compete on U.S. soil? The answer seems to be less about fair competition and more about preserving a status quo that benefits a select few, at the expense of innovation and consumer freedom.

The Media’s Complicity: Silence on Gold and Silver

Why the deafening silence on gold and silver? Mainstream media, beholden to the regime, dismiss precious metals as relics, despite their proven track record as stores of value and hedges against fiat debasement. If every American bought just one ounce of gold and 20 ounces of silver, the entire fiat system would be threatened. Instead, the narrative is steered toward digital assets—transparent, controllable, and perfectly suited for a surveillance economy.

Meanwhile, Nvidia’s CEO is everywhere on Bloomberg, especially around earnings season, pushing a narrative that’s more advertorial than news. The real story: Nvidia is no longer untouchable. Huawei’s new AI chip clusters and full-stack solutions now rival or surpass Nvidia’s best, and even Jensen Huang admits the threat is real. Why does the U.S. fear Huawei so much if this is the land of free trade? The answer is control—not just of technology, but of the entire financial and social fabric.

Jensen Huang, CEO of Nvidia, has been featured extensively by Bloomberg in 2025, particularly around the company’s May earnings report.

Multiple formats and rebroadcasts of the same or related interviews.

Documented Bloomberg Appearances in 2025

May 28, 2025:

Bloomberg Technology Special: Huang was interviewed by Ed Ludlow, discussing Nvidia’s earnings, China, Trump, tariffs, and AI356.

Bloomberg Television: The same interview or excerpts were broadcast as a special segment focused on Nvidia’s results and Huang’s commentary.

Bloomberg On-Air Q&A: A detailed Q&A session aired, with Huang fielding questions on U.S. policy, tariffs, immigration, and Nvidia’s global strategy.

May 29, 2025:

Bloomberg Podcast: Ed Ludlow again hosted Huang to discuss the earnings fallout, China, and AI growth.

Pre-announced appearance:

Bloomberg Interview Announcement: News outlets and trading forums highlighted Huang’s scheduled Bloomberg interview for May 28, 2025, following the earnings call.

Huang’s comments and interviews were widely syndicated across Bloomberg’s platforms—including TV, podcasts, online videos, and news articles—suggesting a coordinated media campaign timed with Nvidia’s earnings. Bloomberg isn’t alone in this effort; CNBC, The Wall Street Journal, Forbes, and the rest of the so-called mainstream media ecosystem are all complicit in propping up these struggling tech giants.

Despite a $37 trillion national debt, ongoing market turmoil, derivatives exposure in the quadrillions, and persistent geopolitical conflicts, not a single gold or silver miner is being interviewed. Meanwhile, U.S. politicians are trading so openly that there’s even a “Nancy Pelosi trade tracker.” If this isn’t evidence of a coordinated effort to suppress discussion about gold and silver, I don’t know what is.

Why are nearly 150 Chinese car brands locked out of the U.S. market, when Americans can choose from only a handful of domestic manufacturers? The official excuse is a lack of dealer networks and compliance with local rules. But the reality is that tariffs, sanctions, and political maneuvering keep competition at bay. Are we protecting consumers, or protecting entrenched interests from superior, cheaper electric vehicles?

2. Why Is the U.S. Stock Market Propped Up by Just a Handful of Companies?

The S&P 500 is supposed to represent the breadth of American enterprise. Yet by 2024, the Magnificent 7 made up nearly 35% of its market cap. When these giants stumble, the entire market buckles. This concentration is not a sign of strength, but of fragility—a system built on sand, not bedrock. Why have policymakers allowed this dangerous imbalance, and why do they double down with policies that make these companies even more vulnerable to global shocks?

3. Why Does the U.S. Fear Huawei? Is “Free Trade” Just a Slogan?

Nvidia’s dominance is under siege. Huawei’s AI chips now match or exceed Nvidia’s, and Chinese enterprises are switching to homegrown solutions to avoid U.S. policy volatility. The U.S. bans Huawei not just for alleged security risks, but because it cannot compete on a level playing field. Is America’s “free trade” rhetoric just cover for economic protectionism and surveillance ambitions?

The Dystopian Endgame

The U.S. is at a crossroads. Will we double down on failed policies—tariffs, surveillance, and digital control—or will we reclaim economic freedom with real stores of value like gold and silver? The silence of the media is no accident. The push for a blockchain-based, trackable currency is not about innovation; it’s about control, and the destruction of privacy and autonomy.

Is this the world you want to live in?

A world where every transaction is monitored, every asset is visible, and your financial life is at the mercy of politicians and their cronies?

Or will you resist the manufactured crises, reject fiat illusions, and reclaim your freedom with real, private money?

The choice is yours—while you still have one.