The Great Taking Is Here: As the Dollar Burns, Silver Is Your Only Lifeline

Silver and Gold Are Your Only Lifeline

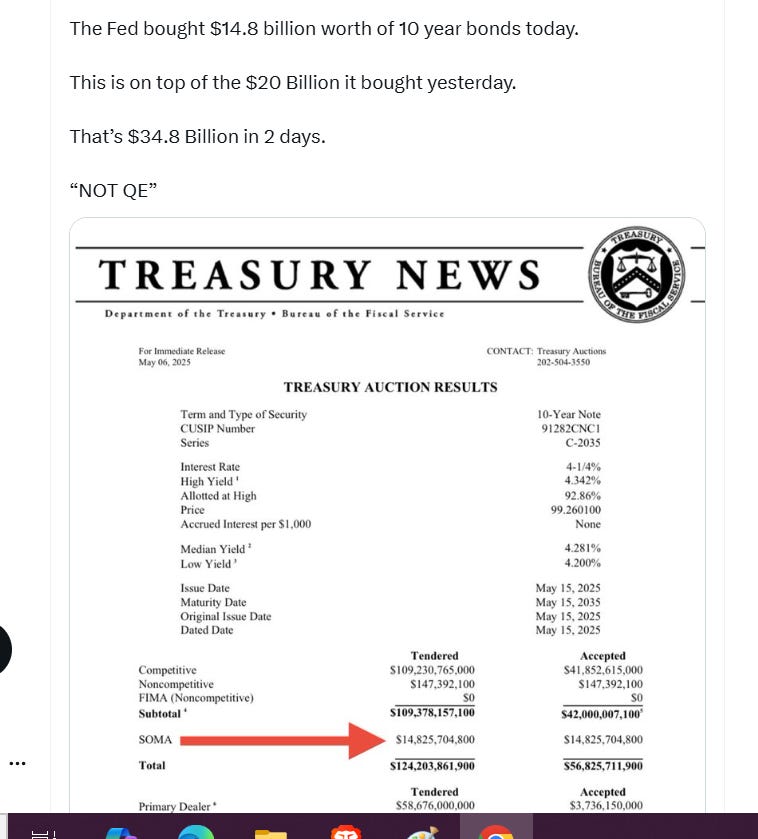

The Federal Reserve wants you to believe that quantitative easing is a thing of the past, but the numbers tell a different story. In just two days, the Fed snapped up $34.8 billion in 10-year Treasury bonds-$14.8 billion today, $20 billion yesterday. Why? Because foreign buyers have all but vanished. China and Japan, once the biggest holders of U.S. debt, have slashed their positions by over a trillion dollars since 2021.

With no one left to buy, the Fed is stepping in to keep the whole charade afloat. Call it “market operations” if you want, but let’s not kid ourselves: this is QE in everything but name.

And it’s not happening in a vacuum. Congress just passed a $1.32 trillion spending bill, a monster package that pours gasoline on an already raging fire. Every dollar of new deficit spending means more Treasury bonds hitting the market, more debt that needs a buyer.

The Fed, ever the enabler, is all too happy to oblige. This is the same doom loop we’ve been warned about for years: deficits drive up borrowing, interest payments balloon, and the government borrows even more just to stay afloat.

Who pays the price? Ordinary workers, who watch their paychecks shrink in real terms as the dollar’s value erodes.

Let’s talk about inflation. Goldman Sachs is already warning that core inflation could hit 3.5% next year, and that’s before you factor in the knock-on effects of tariffs and even more money printing.

For most Americans, that means real wages will fall even as the cost of living-housing, groceries, energy-keeps climbing. Meanwhile, all this government borrowing crowds out private investment, stifling real productivity and growth. The “sugar high” of government cash might make GDP numbers look good for a quarter or two, but underneath, it’s all rot. We’re not building a stronger economy-we’re inflating a corpse.

And here’s the kicker: this isn’t just reckless policy. It’s economic warfare, plain and simple. The Fed’s ultimate goal is to become the buyer and lender of last resort, to own it all. When the $300 trillion global credit bubble finally bursts-and it will-the central banks will be the only ones left standing, ready to seize whatever assets they can.

The “Great Taking” isn’t a conspiracy theory; it’s the logical endpoint of a system designed to concentrate power in the hands of a few unelected bankers.

So what can you do? The answer is as old as money itself: gold and silver. While the dollar burns, gold has quietly surged 20% a year since 2021. Silver, too, is in high demand, both as a store of value and for its industrial uses. Unlike stocks, bonds, or crypto, precious metals carry no counterparty risk. You hold them, you own them-no bank or government can seize them with the click of a mouse.

Don’t be fooled by the illusion of stability. The Fed’s bond-buying spree and Congress’s spending binge aren’t just policy mistakes-they’re deliberate moves in a rigged game. Inflation is the weapon, and you’re the target.

As the world’s financial system teeters on the brink, gold and silver are the only lifelines left. The question isn’t whether you should protect yourself-it’s whether you’ll act before the lifeboats are gone.

Your children and grandchildren will remember the choices you make right now. Don’t fail them.

end of segment