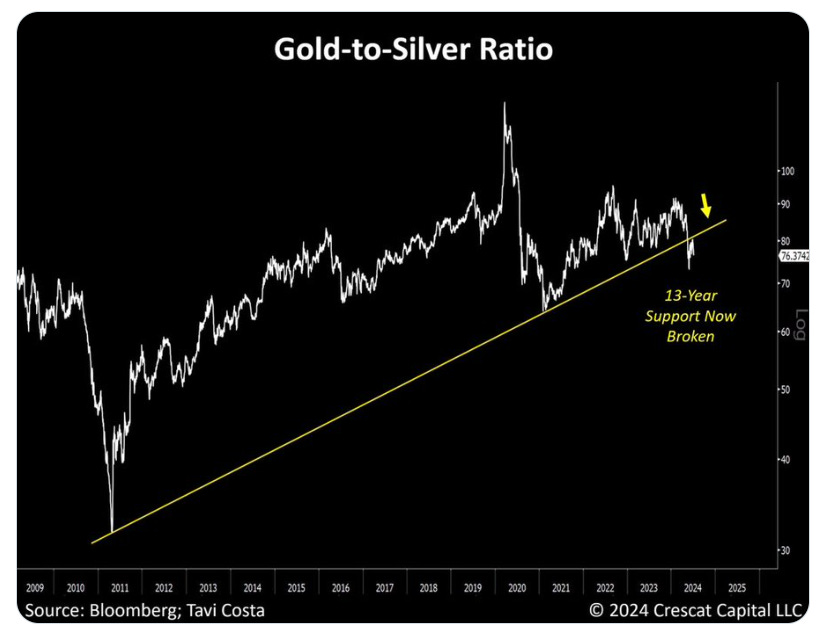

The Gold to Silver Ratio is Going Lower: 13 Year Support Now Broken and Significantly Back Tested

Gold to Silver Ratio Past 3 months

High of 87.21 to Low of 73.17

Today’s Ratio is 76.4

In the past 5 days it has fallen from 80.22 to 76.40

After breaking a 13-year support two months ago, the gold-to-silver ratio appears to be at an early-stage downward trend. Although I firmly believe that gold remains historically attractive relative to the money supply and the current lack of fiscal discipline, I believe there is nothing more undervalued and asymmetric in this macro environment than silver. - Tavi Costa

Here is inverse view (This time Silver to Gold Ratio)

SILVER is ready for the next upleg

This breakout is so powerful.

With Numerous touches.

Exploding industrial demand

No new silver inventories

and the Public has caught on to the fact that Bankers have been manipulating the market for decades

So smart investors and BRICS are stacking and hoarding (because there is no risk in doing so)

Silver is outperforming GOLD (and Gold is on a record run so that’s saying a lot)

Buy Silver (you snooze you lose)

2024 is the year of SILVER, also remember

Silver inventory in NY and London is vastly overstated.

This chart below is not to be trifled with… it’s gonna blow out and run. When it does…just like the 1970’s we will see a massive redistribution in wealth. Precious metals will be the standard to measure wealth loss or creation against for this next decade. Fiat as a measuring stick is broken. If you don’t own precious metals in a big way get ready to feel poorer. If you load up you’ll retire sooner. It’s that simple - Kevin Bambrough

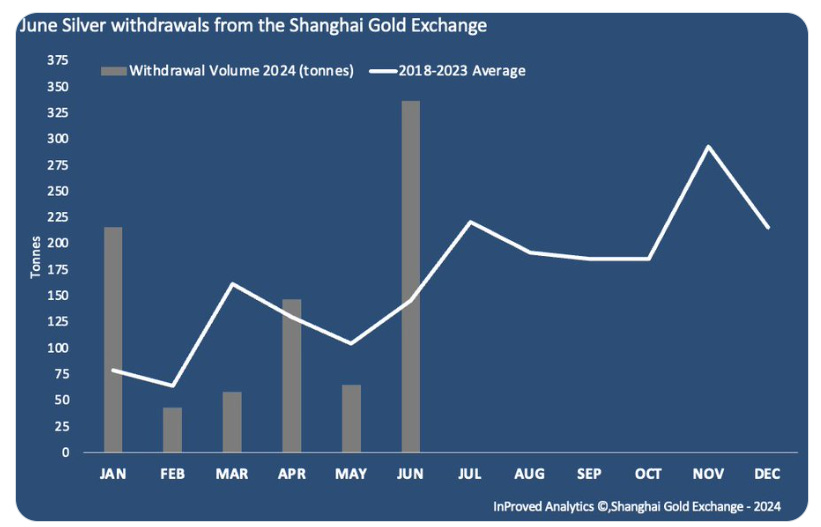

Silver withdrawals from the SGE went through the roof

Up 46.5% YoY

At 337 tons in June.

-end of section

Another Crushing Blow to US Dollar

Gold is the BRICS Currency

India's Gold Reserves Surge: Largest Increase in Two Years

India added 9.4 tons of gold to its reserves in May 2024

This marks the biggest monthly increase since June 2022

Total gold holdings now stand at 803.3 tons

Reasons for the Increase:

Diversification strategy to reduce dependence on the US dollar

Hedging against economic uncertainties

Aligning with global trend of central banks boosting gold reserves

Global Context:

Central banks worldwide added 228.4 tons of gold in Q1 2024

China led purchases with 160 tons in the first five months of 2024

Singapore and Czech Republic also increased their gold holdings

Market Impact:

Gold prices reached record highs in early 2024

Continued central bank buying supports bullish outlook for gold

Analysts predict sustained demand for gold as a safe-haven asset

India's Economic Implications:

Strengthens India's foreign exchange reserves

Enhances financial stability amid global economic challenges

Reflects India's growing economic influence on the world stage

-end of section

Zambia has indeed introduced strict measures against the use of US dollars and other foreign currencies for local transactions. Here are the key details:

The Bank of Zambia has drafted new rules aimed at curbing the use of foreign currencies, particularly the US dollar, in local transactions.

According to a draft document released by the Bank of Zambia, individuals caught using foreign currency for local transactions could face up to ten years in prison or substantial fines.

The new guidelines, soon to be formalized as a statutory instrument by the Minister of Finance and National Planning, will require all local public and private transactions to be conducted in Zambian kwacha (ZMW) and ngwee.

This policy was announced by the central bank's Deputy Governor for Operations, Francis Chipimo, at a trade fair in Ndola.

The initiative is designed to curb dollarization, which the Bank of Zambia believes hinders effective monetary and exchange rate policy management, increases credit and liquidity risks, and diminishes the central bank's influence.

Travelers are advised to exchange their foreign currency for kwacha upon arrival and use the local currency for all transactions during their visit.

It's worth noting that this is a significant change from Zambia's previous stance. In May 2012, Zambia had implemented restrictions on dollar use among local businesses, but these were abolished less than two years later. The current measures appear to be much stricter.