The Final Stand: Breaking Silver’s Chains in a Rigged System

China's markets were recently closed for five days due to the Labor Day holiday, which began on April 30, 2025. The market reopened last night. And guess what? Silver started soaring. Here's Why?

Op-Ed by Jon Forrest Little

Silver’s Paper Trap: How the West’s "Fake Metal" Market Suppresses Prices

As China’s markets reopen after a holiday, a glaring pattern reemerges: silver’s price surges during Asian trading hours, only to be crushed when Western banks take the reins. The manipulation isn’t subtle-it’s systemic, and the data proves it.

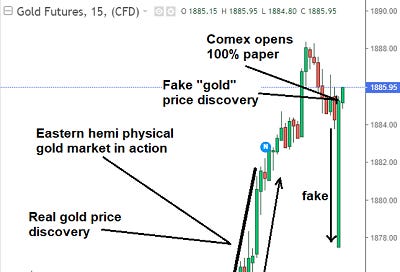

Here’s the smoking gun: Over 90% of silver’s price gains occur during Eastern Hemisphere trading hours, when the Shanghai Gold Exchange (SGE) dominates with physical bullion transactions. Conversely, 90% of its declines happen during COMEX and LBMA hours in New York and London, where paper contracts dwarf real metal by a staggering 250:1 ratio. This isn’t free-market economics-it’s financial engineering at its most brazen.

The Paper vs. Physical Divide

While the SGE settles trades in tangible silver, COMEX and LBMA operate as a derivatives casino. Banks like JPMorgan Chase-fined $920 million in 2020 for spoofing silver markets-flood exchanges with unbacked “paper silver” futures. These contracts, equivalent to 378 times annual mining output, create an artificial surplus that suppresses prices.

But here’s the kicker: When Asian buyers snap up physical metal, Western banks counter with coordinated “price slams.” During New York’s COMEX hours (8:30–11 AM EST), bullion banks dump billions in paper contracts, triggering algorithmic sell-offs and stop-loss cascades. The result? Silver’s breakout attempts-like its recent push toward $35/oz-are systematically torpedoed.

China’s Reopening Exposes the Farce

This week’s post-holiday trading in Shanghai saw aggressive physical buying, yet COMEX’s paper dominance again prevailed. The reason? Less than 1% of COMEX contracts result in physical delivery. Banks profit from this asymmetry: they short-sell paper contracts to depress prices, then hoard discounted physical metal.

Why Regulators Turn a Blind Eye

The CFTC has acknowledged banks’ spoofing tactics, yet fines remain a cost of doing business. Meanwhile, the LBMA-controlled by the same banks-sets benchmark prices through opaque “fixes”. This revolving door between regulators and Wall Street ensures the status quo: silver trades at 1/103th of gold’s price despite a 15:1 historical ratio.

The Endgame

Physical shortages are mounting (COMEX inventories have dropped 45% since 2020), and Eastern demand is relentless. When the paper edifice cracks, the reckoning will be swift. But for now, the West’s “fake metal” market remains silver’s prison-a manipulation so blatant, it’s hiding in plain sight.

David Kranzler made some marks on this showing the metals soaring during trading hours in Eastern Hemisphere (real) vs the manipulation with COMEX / LBMA (fake).

Mike Maloney has featured this trend on his YouTube Station.

Same true with Craig Hemke, Editor of TF Metals Report

The Final Stand: Breaking Silver’s Chains in a Rigged System

This isn’t just about silver-it’s about exposing the rot at the core of a debt-based empire. The West’s paper markets, propped up by 800 U.S. military bases and a dollar backed not by gold or oil but by F-35s and aircraft carriers, have turned finance into a weapon. As Napoleon warned: “When central banks lend to governments, the hand that gives rules the hand that takes.” Today, that hand strangles free markets to sustain a fiat Ponzi scheme-one where the Federal Reserve and Treasury dictate Pentagon priorities, not the other way around.

Why does CNBC never mention silver? Because physical bullion is the antidote to their paper poison. Gold and silver can’t be printed, quantified, or spun into subprime derivatives. They’re truth serum for a system built on lies-90% of silver’s price declines during COMEX hours aren’t accidents. They’re financial warfare waged by banks like JPMorgan (fined $920 million for spoofing), whose boardrooms are littered with defense contractors demanding cheap industrial inputs.

The raid on strategic silver reserves, like the draining of oil stockpiles, isn’t incompetence-it’s collusion. Aerospace giants and war profiteers need $20/oz cheap silver to fuel missiles, solar panels, and AI data centers. Your retirement? Your savings? Collateral damage in their profit hunt.

Here’s the revolution: Buy physical silver. Hoard it. Drain COMEX vaults. When millions defy paper contracts and demand real metal, the manipulation collapses. Silver isn’t a commodity-it’s a vote against central bank tyranny, a rejection of “confidence games” backed by carrier strike groups.

The swarm is rising. Join it. Every ounce you hold is a bullet in the clip of economic rebellion. The banks can’t spoof scarcity. They can’t print real money. And they can’t stop a global awakening to their greatest fear: silver at $500/oz, screaming the dollar’s obituary from every trading floor.

Break their system. Own the metal they can’t fake.