The FDIC doesn’t want to pay its tax bill: But You Must!

Tracing the events leading to the IRS knocking on FDIC's door

Video Feature

Silicon Valley Bank, once a titan of banking, teetered on the edge of insolvency just a year ago. A behemoth that once stood tall had begun to wobble, and the signs were all there for those who cared to look. The story begins with a portfolio, a massive one, brimming with over one hundred billion dollars' worth of US government bonds. These were acquired during the years 2020 and 2021, a time when interest rates were at historic lows, and government bonds were seen as the 'safest' asset class in the world. But the tide turned in 2022.

The Federal Reserve, the central bank of the United States, started to hike interest rates, and they did it fast. As interest rates rose, bond prices fell, and even the 'safest' assets like US Treasury bonds were not spared. The fallout? By the end of 2022, Silicon Valley Bank's portfolio of US government bonds had plummeted in value by more than fifteen billion dollars. Now, consider this. Silicon Valley Bank's total capital was barely sixteen billion dollars.

With a loss of over fifteen billion, they were almost wiped out, standing at the precipice of insolvency. The danger was clear and present, and it was communicated unequivocally in their 2022 annual report. The bank's leadership must have been holding their breath, expecting their stock to crash at any moment. And yet, it didn't. After the annual report was released, after every Wall Street 'expert' had a chance to scrutinize the alarming data, the stock price of Silicon Valley Bank barely budged.

Even when the Chairman of the Federal Reserve testified to Congress that the Fed's rapid interest rate hikes presented absolutely zero risk to the financial system, the stock remained stable. Despite the clear danger signs, the bank's stock price barely moved, and the Federal Reserve Chairman testified that the rapid interest rate hikes presented no risk to the financial system. It was a calm before the storm, a tranquility that would soon give way to chaos."

"Then, within just a week, Silicon Valley Bank collapsed, and the FDIC stepped in to clean up the mess." When banks fail in the United States, it's usually a federal banking regulator, like the Federal Deposit Insurance Corporation, or FDIC, that steps in to take over. These situations are often chaotic, complex, and time-consuming. The FDIC has to liquidate assets systematically to maximize the value of the balance sheet and then prioritize claims against those assets. Depositors, naturally, need to be paid. Creditors and lenders want to receive their money as well. And let's not forget the government, which always wants its cut.

Here's where our story takes a bizarre twist. It turns out that Silicon Valley Bank had a hefty tax bill pending with the Internal Revenue Service. We're talking about one point four five billion dollars. Now, since the FDIC had assumed legal responsibility for Silicon Valley Bank, the IRS came knocking on its door, asking for the money. You'd think this would be a straightforward process, right? One government agency pays another. But no, the FDIC flatly refused. According to them, they owe absolutely zero tax and will pay nothing.

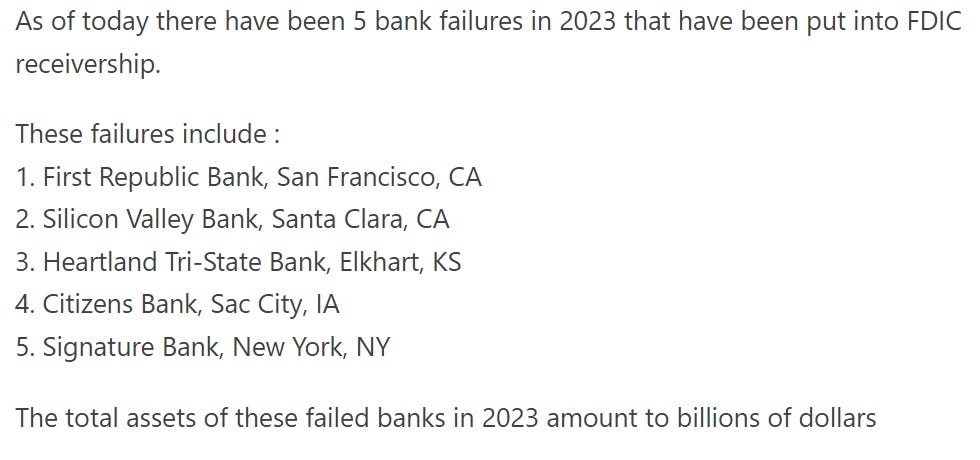

Can you believe this? It's a literal face-off between two government agencies over taxes. Instead of settling the matter like grown adults, they've decided to take the dispute to federal court. This saga of Silicon Valley Bank, from its near insolvency to its eventual collapse and now the tax dispute, is more than just a tale of financial mismanagement. It's a glaring example of the absurdities that can arise in our financial and regulatory systems. But beyond the absurdity, it also raises a critical point, a point that every taxpayer should consider. If a government agency like the FDIC can go to such lengths to minimize its tax bill, then why shouldn't everyone else? then the story gets worse. Just recently there have been 5 bank failures in 2023 that have been put into FDIC receivership.

Look at the graphic below.

It shows total deposits in typical US commercial banks at $17.34 Trillion.

Yet there is only $128 Billion in the FDIC Fund.

This means US government and banking deposits are insolvent because funds in FDIC cover .74% of our collective deposits. That’s far less than 1%

Given the simple math (ratio), this means if you have $1,000 in the bank, all of it is wiped out, but you may be able to recover $7.41 out of your $1,000

Math formula below

In our system Bankers profits are Privatized but their losses are Socialized.

Villagers Live on the sh*tting side of the horse while the Parasitic

PoliticalClass lives on the feeding side of the horse - Jon Forrest Little

When things get leveraged and financialized Bankers get commissions and bailed out, their gains are privatized. But when they lose their losses are socialized. Silver and gold are the only assets that are not simultaneously someone else's liability. Invest in Silver. For physical Silver we recommend the Money Metals Silver Starter Stack.

You receive

1 American Silver Eagle

1 Canadian Maple

1 Walking Liberty

1/2 Oz Walking Liberty

and 5 one-tenth oz Walking Liberty

Or Gain Leverage to Silver

Outcrop Silver & Gold

TSXV: OCG | OTCQX: OCGSF

Drilling the High-Grade Santa Ana Silver Project in Colombia.

To gain leverage to Silver we recommend you check out Outcrop Silver. They are one of the only pure silver mining plays in our world today and we will be having them on Goldchain soon to hear more from their new discoveries of high grade silver in Columbia.

Summarized:

the FDIC doesn’t want to pay its tax bill: But you Must

Silicon Valley Bank's Precarious Financial Position: Unveiling the 2022 Annual Report

Exploring the report's revelations of near insolvency

Analysis of the massive US government bond portfolio acquisition

The Impact of Fed's Rapid Interest Rate Hikes on Silicon Valley Bank's Bond Portfolio

Unraveling the consequences of interest rate hikes on bond prices

Examining the $15 billion decline in Silicon Valley Bank's bond portfolio

Market Response and Regulatory Oversight: A Puzzling Lack of Concern

Investigating the muted stock market reaction post-annual report release

The Federal Reserve's testimony and its dismissal of financial system risks

FDIC Intervention: Navigating Chaos in the Aftermath of Silicon Valley Bank's Collapse

Understanding the role of FDIC in taking over operations

Challenges and processes involved in bank restructurings

The Tax Conundrum: FDIC, IRS, and Silicon Valley Bank's $1.45 Billion Debt

Unveiling Silicon Valley Bank's outstanding tax bill to the IRS

FDIC's refusal to pay and the ensuing government agency dispute

From Refusal to Federal Court: The Bizarre Unfolding of FDIC and IRS Tax Dispute

Tracing the events leading to the IRS knocking on FDIC's door

The humorous yet serious escalation of the tax dispute to federal court

A Broader Perspective: FDIC's Tax Minimization Raises Questions About Government Practices

Analyzing the implications of FDIC's zero-tax stance

Prompting a broader question about tax practices in government agencies