China's decision to block BlackRock's $23 billion acquisition of Panama Canal ports is a direct response to escalating economic tensions with the Trump administration. The move reflects Beijing's broader strategy to counter U.S. efforts to diminish Chinese influence in global trade and infrastructure. President Trump's aggressive policies, including heightened tariffs and rhetoric about reclaiming control over the Panama Canal, have intensified the rivalry. By halting the deal, China aims to protect its strategic assets and prevent American entities from gaining leverage in critical maritime trade routes, signaling its resistance to what it perceives as attempts at containment.

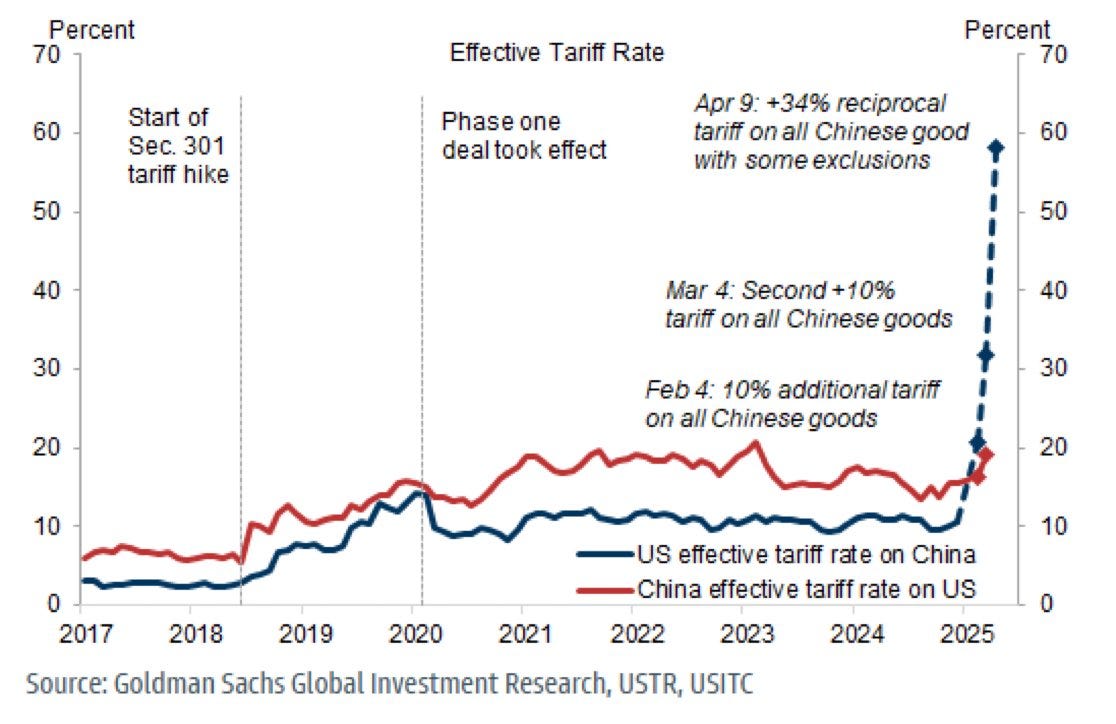

The imposition of tariffs on $450 billion worth of goods imported from China, culminating in a cumulative rate of 54%, represents a seismic shift in U.S.-China trade relations. These measures, championed by President Trump, are poised to create widespread economic disruptions.

The tariffs, which include additional levies on low-value imports under the de minimis exemption, will likely lead to significant price increases across a broad spectrum of goods, ranging from electronics and apparel to furniture and toys.

American consumers and businesses are expected to bear the brunt of these tariffs. Importers such as Walmart and Amazon will face higher costs, which they are likely to pass on to consumers through price hikes. Economists predict inflationary pressures and reduced purchasing power as a result, with everyday items becoming more expensive.

For instance, iPhones—largely manufactured in China—could see substantial price increases due to the combined effects of reciprocal tariffs

Similarly, industries reliant on Chinese imports, such as footwear and toys, will struggle to absorb the added costs without raising prices or compromising profitability.

Beyond consumer goods, these tariffs threaten global supply chains and economic growth. China's exports to the U.S., which accounted for $524 billion in 2024, are integral to both economies.

Analysts suggest that Chinese manufacturers may pivot toward other markets like Southeast Asia and Latin America. However, logistical challenges and competitive pressures could hinder this transition.

Meanwhile, Beijing is expected to counteract these tariffs through domestic stimulus and export diversification strategies.

The broader implications extend beyond China. Tariffs targeting other nations exacerbate trade tensions globally, with ripple effects across industries like automotive and metals in North America and Europe.

Ultimately, these policies risk triggering massive shortages and inflationary spirals that could destabilize economic recovery efforts worldwide.