TARIFFS: Markets in Turmoil. Trump's Impulsivity & Lack of Clarity on Trade.

Trade Deficit Sparks Global Uncertainty. Markets and Consumers in Panic Mode.

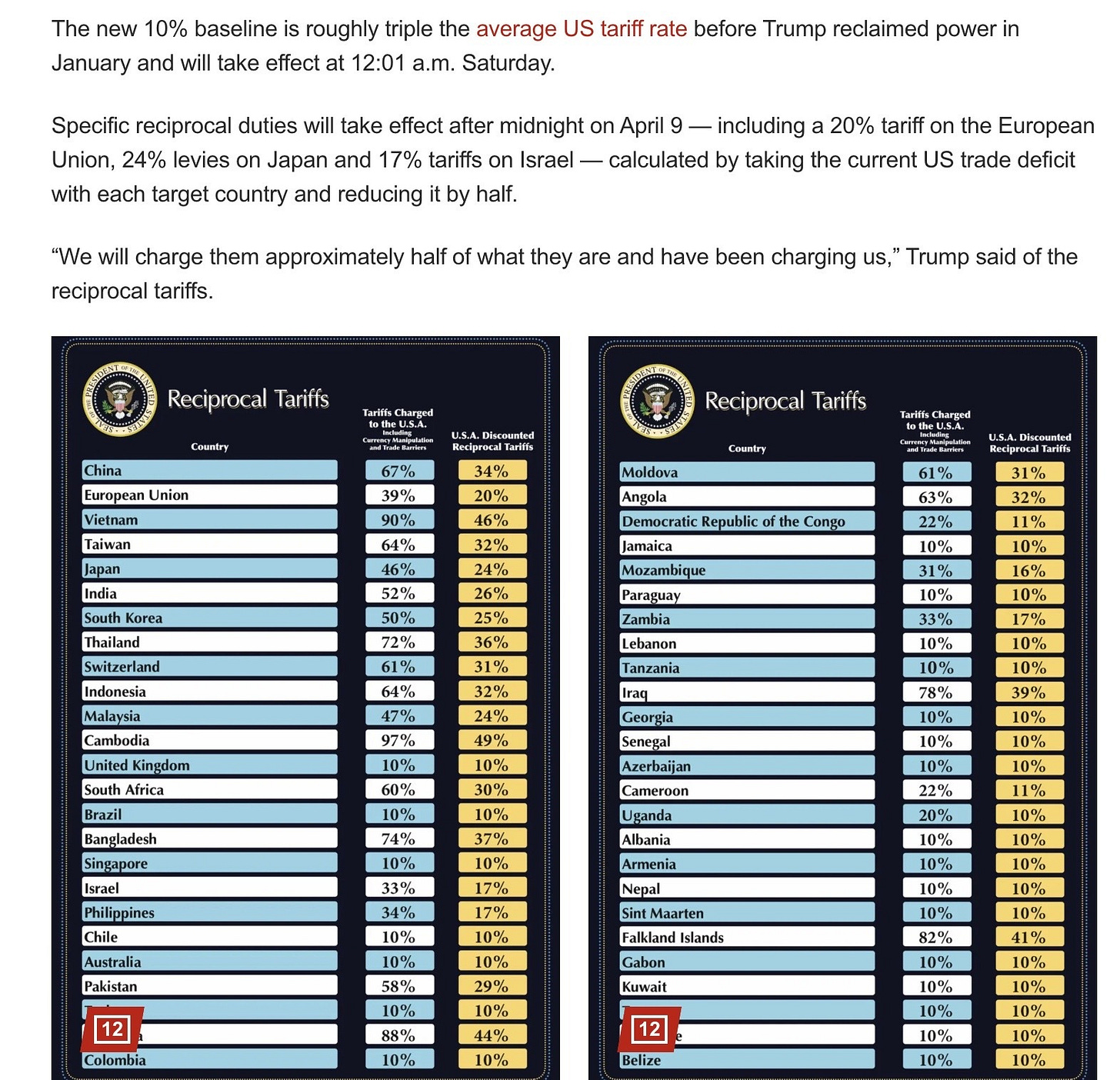

The NYPost has reported that the US tariffs on each nation is calculated by taking the current US trade deficit with each target country and dividing the deficit by half, to get the resulting tariff imposed.

President Trump recently announced a sweeping reciprocal tariff scheme that imposes baseline tariffs of at least 10% on all imports, with higher rates for numerous countries based on their trade barriers against U.S. goods. Below is a summary of the tariff rates by country:

Selected Tariff Rates by Country

China: 34%

European Union: 20%

Vietnam: 46%

Taiwan: 32%

Japan: 24%

India: 26%

South Korea: 25%

Thailand: 36%

Switzerland: 31%

Indonesia: 32%

Malaysia: 24%

Cambodia: 49%

United Kingdom: 10%

South Africa: 30%

Brazil: 10%

Bangladesh: 37%

Singapore: 10%

Israel: 17%

Philippines: 17%

Sri Lanka: 44%

Global Tariff Framework

A universal baseline tariff of 10% applies to all nations unless otherwise specified.

Canada and Mexico are exempt from the new tariffs due to prior agreements, but existing tariffs remain in place, including a 25% tariff on automobiles.

Exemptions and Special Cases

Based on the latest announcements regarding exemptions from President Trump's sweeping tariffs, the following commodities are confirmed as exempt:

Exempt Commodities

Gold and Silver (Bullion): High-purity physical gold and silver are exempt, which has led to fluctuations in global bullion markets

Copper: Copper imports are excluded from the new tariffs, benefiting industries reliant on refined copper and concentrates.

Pharmaceuticals: Pharmaceutical products are temporarily exempt, particularly benefiting India's pharma exports to the U.S..

Semiconductors: Semiconductor products are excluded, aligning with national security considerations.

Lumber: Lumber articles are also exempt from the new tariffs.

Steel and Aluminum: These metals remain excluded due to existing Section 232 tariffs already in place.

Energy Commodities: Crude oil, natural gas, and refined products are exempt to avoid disruptions in energy supply chains.

Certain Critical Minerals: Minerals not found in the U.S., likely including rare earth elements, are excluded.

Temporary Exemptions

Some exemptions, such as pharmaceuticals and semiconductors, may be subject to future sector-specific tariffs as investigations continue.

This list reflects current exemptions as of April 2025 but remains subject to change pending further policy adjustments.

Opinion: Protectionism Never Works and Always Backfires

The Danger of Unilateralism: Trump’s Tariffs and Their Impact on American Families

President Donald Trump’s sweeping tariffs, branded as "reciprocal" measures, are reshaping global trade dynamics while deepening economic and diplomatic divides.

Yet, these policies seem less like calculated strategies informed by expert consultation and more like the unilateral decisions of a "strongman" leader. Historically, sound foreign and trade policies have been crafted through collaboration with economists, historians, and other scholars.

Trump's approach, however, bypasses such consultation, favoring bold declarations that prioritize short-term political gains over long-term stability.

The Economic Fallout for American Families

While tariffs are often touted as tools to bolster domestic manufacturing, they come with significant consequences for American consumers—especially the middle and lower classes.

Studies show that Trump's latest tariff proposals could cost the average household up to $4,200 to $7,000 annually, disproportionately affecting lower-income families whose disposable incomes may drop by as much as 5.5%.

This financial strain compounds existing challenges such as record household debt, rising healthcare costs, and unaffordable housing.

The ripple effects of these tariffs extend beyond individual households. Price increases on imported goods are likely to lead to higher costs for essentials like food and clothing.

For example, food prices alone are projected to rise by 3.7%, further burdening families already struggling to make ends meet. These measures contradict the administration's claims of economic revitalization, instead exaggerating inequality and eroding consumer purchasing power.

A Global Trade War in the Making

Trump’s unilateral decision-making has also alienated key allies and trading partners. Nations like China and the European Union have responded with retaliatory measures, intensifying an already volatile trade war. The imposition of tariffs as high as 54% on Chinese imports is particularly striking, signaling a dramatic escalation that could destabilize global markets. Such actions undermine international cooperation and risk long-term damage to America’s global standing.

The Flawed Logic of Protectionism

The administration argues that these tariffs will protect American industries from unfair trade practices. However, economists warn that this protectionism could backfire by pushing the economy toward recession. Importers often pass tariff costs onto consumers through price hikes, negating any potential benefits for domestic manufacturers. Moreover, lower-income households—already at the margins—bear the brunt of these policies while wealthier Americans face comparatively minor impacts.

A Need for Balance

Trump’s tariff strategy epitomizes a unilateralist approach that disregards the nuanced complexities of global trade and domestic economics. By acting without broad consultation or consideration of long-term consequences, these policies risk deepening inequality at home while straining relationships abroad. A balanced approach—one informed by expert analysis and multilateral dialogue—is essential to avoid further harm to American families and the global economy.

Markets

Global financial markets are in turmoil following U.S. President Donald Trump's announcement of sweeping tariffs, dubbed "Liberation Day" tariffs, effective April 5, 2025. The tariffs include a baseline 10% on all imports, with significantly higher rates for specific nations, such as 34% on Chinese goods and 20% on EU imports. This aggressive move has sparked fears of a global trade war, sending U.S. stock futures and international markets into freefall.

The Dow Jones Industrial Average futures dropped over 1,200 points (approximately 3%), while S&P 500 and Nasdaq futures fell by 3.1% and 3.4%, respectively. Major corporations with global supply chains were hit hard in premarket trading. Apple shares declined by 7%, Nvidia by nearly 6%, and Nike by almost 10%. Retailers reliant on imported goods, such as Dollar Tree and Five Below, saw double-digit losses. Asian markets mirrored this downturn, with Japan's Nikkei falling over 3% and South Korea's Kospi dropping nearly 2%.

The U.S. dollar weakened sharply amid concerns over inflation and potential currency devaluation strategies tied to the tariffs. Analysts warn that these measures could disrupt global supply chains, erode corporate profit margins, and destabilize geopolitical relationships. Bond yields also fell, with the 10-year Treasury yield dropping as markets began pricing in potential Federal Reserve rate cuts to counteract economic slowdown.

Economists are alarmed by the lack of clarity in Trump's economic plan and the unprecedented scale of the tariffs. Experts fear retaliatory measures from trade partners like China and the EU, which could exaggerate economic isolation for the U.S. Some analysts predict long-term consequences, including diminished U.S. dollar reserve status and a shift toward commodities and alternative assets.

The immediate fallout underscores market aversion to uncertainty and signals widespread skepticism about the sustainability of Trump's protectionist policies.

Trump favors big corporations over small businesses

These tariffs will harm small businesses and consumers through higher costs while undermining global economic cooperation.

Silver

We are preparing a special report on Silver as soon as the dust settles. Trump likes to say things and do things impulsively, then backtrack, so until we have all the facts distinguished from fantasy, we will prepare a Silver Summary.

editorial department separate from promotions

our opinions are not our sponsors opinions

not financial advice

today is a great day to load up on physical silver and our top 5 silver miner picks which are Andean Precious Metals, Aya Gold and Silver, Kuya Silver, Summa Silver, and Dolly Varden Silver