Solar and Samsung’s Silver Solid-State Battery Revolution Silver Use Equals Nearly 5 Billion Ounces of Silver

Equivalent to Almost Six Years of Global Mine Production. These are the FACTS.

Silver Shortage feature by Jon Forrest Little

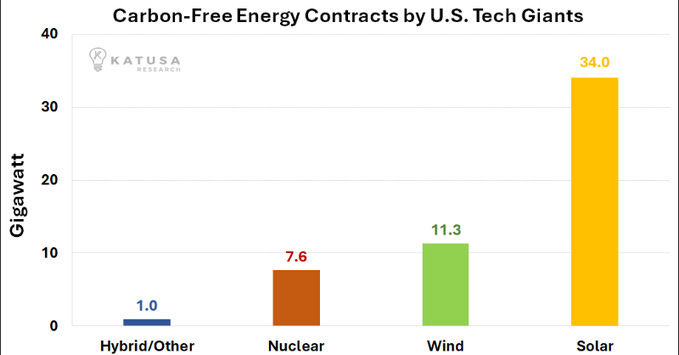

The surge in artificial intelligence and cloud computing is driving an unprecedented wave of investment in solar energy by the world’s largest tech companies-Amazon, Google, Meta, and Microsoft-collectively known as hyperscalers. These companies are rapidly expanding their renewable energy portfolios, signing deals across 34 states to secure vast amounts of solar power for their energy-hungry data centers and operations.

Amazon, for example, is now the world’s largest corporate purchaser of renewable energy, with more than 500 solar and wind projects globally-enough to power 7.2 million U.S. homes annually. Google recently inked a 724MW solar power purchase agreement in Oklahoma to directly supply its data centers, part of its broader goal to run entirely on carbon-free energy by 2030. Microsoft’s latest deal with Nexamp will add 100 new community solar projects across the U.S., targeting regions with little existing solar infrastructure and delivering both clean energy and local economic benefits.

This marks a major shift for the solar industry. Hyperscalers are not just buying renewable energy-they are catalyzing the construction of new solar plants, accelerating grid modernization, and supporting domestic job creation. Their investments are helping to tip the balance away from fossil fuels, making solar a cornerstone of America’s future energy mix and a critical solution for meeting soaring AI-driven electricity demand

Solar is Becoming Relatively Cheap. Even if you Double the Silver price, Solar is still very inexpensive!

Why is Solar so Cheap?

Facts to Consider:

Between 2025 and 2030, global solar photovoltaic (PV) installations are projected to expand at an unprecedented pace

with most authoritative forecasts converging on a total exceeding 4,000 gigawatts (GW) of new solar capacity added worldwide in this six-year span.

International Energy Agency (IEA): The IEA forecasts that more than 4,000 GW of new solar PV will be installed globally by 2030

accounting for approximately 80% of all new renewable capacity additions in this period

Now let’s add Solar + Samsung’s Silver Solid State Battery

Remember that Samsung can leverage “made in Vietnam” to be lower than EV batteries made in China

Let’s just add up the projected Solar use along with Samsung’s Silver Solid State Battery

Solar + Samsung’s Silver Solid State Battery

Total Silver Use: Four Billion, Eight hundred Fifty Seven Million, Six Hundred Forty Five Thousand, Troy Ounces of Silver!

Almost 6 years of Global Silver Mining Output

Doesn’t count military and aerospace (largest users of Silver, unreported due to “national security”

Doesn’t count AI

Doesn’t count Robotics

Doesn’t count 5G

Doesn’t count electronics

Doesn’t count Jewelry

Doesn’t count Bullion (bars and coins)

Where Will We Find the Silver Needed for Surging Demand Amid Declining Discoveries and Grades?

Moreover, Mexico (World’s #1 producer) is signaling nationalizing.

Silver Academy endorses these 3 miners based on:

1. Ore grade

2. Management team

3. Metallurgy

4. Jurisdiction

5. Volume of Ounces Below Ground

6. All 3 below are in production thus they do not have to dilute their shares to raise money to get into production

Andean Precious Metals, Significant Boost to their Cash on Hand and Bolstered Balance Sheet.

- Andean Precious Metals Corp. (TSX: APM) (OTCQX: ANPMF)

On Monday May 6, Andean Precious Metals released its first quarter financial results with the highlights included below. Attached is a copy of the release, along with the MD&A and Financial Statements.

First Quarter 2025 Highlights:

Consolidated revenue of $62.0 million from sales at an average realized gold price of $2,694/oz and an average realized silver price of $31.91/oz for Q1 2025 versus consolidated revenue of $43.1 million from sales at an average realized gold price of $2,074/oz and an average realized silver price of $23.64/oz for Q1 2024.

Consolidated Q1 2025 production of 21,361 gold equivalent ounces versus consolidated Q1 2024 production of 21,031 gold equivalent ounces.

Gross operating income of $23.1 million for Q1 2025 versus $0.3 million for Q1 2024, mainly due to higher average realized gold and silver prices, higher sales volume, and lower operating costs at San Bartolome and Golden Queen.

Income from operations of $18.9 million for Q1 2025 versus a net loss from operations of $1.6 million for Q1 2024, mainly due to higher gross operating income partially off-set by higher exploration and evaluation expenditures.

Adjusted EBITDA of $21.9 million for Q1 2025 adjusted EBITDA of $1.0 million for Q1 2024.

Net income and net income per share of $14.6 million and $0.10 (diluted basis), respectively for Q1 2025, net loss and net loss per share of $0.1 million and $0.00 (diluted basis) for Q1 2024.

The Company ended Q1 2025 with $75.7 million in liquid assets as compared to $61.4 million in liquid assets at the end of Q1 2024.

The Company strengthened its balance sheet with $320.0 million in total assets as compared to $315.1 million in total assets at the end of Q4 2024, and $155.1 million in total liabilities at the end of Q1 2025 as compared to $164.1 million at the end of Q4 2024.

Golden Queen Results:

Golden Queen produced 11,189 gold equivalent ounces in Q1 2025 versus 11,490 gold equivalent ounces in Q1 2024.

Golden Queen OCC of $1,459/oz and AISC of $2,213/oz for Q1 2025 versus OCC of $1,762/oz and AISC of $1,936/oz for Q1 2024.

San Bartolome Results:

San Bartolome produced 10,172 gold equivalent ounces in Q1 2025 versus 9,541 gold equivalent ounces in Q1 2024.

CGOM of $11.86 per silver equivalent ounce sold and a GMR of 42.11% for Q1 2025, versus a CGOM of $(0.73) per silver equivalent ounce sold and a GMR of (1.12) % for Q1 2024.

Corporate Updates:

On May 1, 2025 the Company reported the results of the 2024 exploration program and outlined plans for its 2025 exploration program objectives and targets at Golden Queen.

Effective January 9, 2025, the Company’s shares began trading on the TSX under the ticker symbol APM.

On January 12, 2025, the Company announced it entered an automatic share purchase plan in conjunction with its normal course issuer bid and renewed the program on January 2, 2025.

On January 16, 2025, the Company released the initial drill results from the 2024 exploration program at Golden Queen.

On February 24, 2025, the Company announced the appointment of Yohann Bouchard as President of the Company. Mr. Bouchard will continue to serve on the Board of Directors of the Company as a non-independent director.

Aya Gold & Silver: The target share price is $18, with an upside scenario of $25 if exploration results surpass expectations and silver prices outperform current forecasts.

Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF)

Assuming silver prices remain above $30, we see increased emphasis on open pit mining at Aya, which supports my view that AYA shares are undervalued. As their ramp-up continues, I expect the company’s valuation to improve. Site infrastructure is performing well: the plant is already running above nameplate capacity, mining is progressing both at surface and underground, process water reservoirs are full, and the tailings facility has sufficient capacity for the next two years.

There is potential for further throughput increases in the near term through incremental gains, and preliminary design work has been completed for a larger expansion in the future.

I have adjusted my model to reflect a revised mine plan and challenges with underground dilution, now forecasting average grades of approximately 195g/t.

Their production profile has been recalibrated to 2,200tpd from the open pit and 1,000tpd from underground, with a total processing rate of 3,200tpd-slightly above nameplate-resulting in annual production of 6.4 million ounces.

We believe these targets are achievable and expect AYA shares to respond positively as operations ramp up and a new mine plan is released in the second half.

The target share price is $18, with an upside scenario of $25 if exploration results surpass expectations and silver prices outperform current forecasts.

Despite ongoing volatility in financial markets, the global demand for silver remains robust-driven by surging needs in solar energy, the superior performance of silver-zinc batteries compared to lithium batteries, and increased applications in military, aerospace, AI, robotics, and 5G technologies.

Silver is Recession Proof

Regardless of the potential for a looming recession, the world requires reliable sources of silver, ideally from jurisdictions that are significantly less risky than Morocco or even some regions of the USA and Canada.

Kuya Silver Corporation (CSE: KUYA) (OTCQB: KUYAF) (Frankfurt: 6MR1)

Here is the latest update on operational activities at the Bethania silver mine which re-started operations in 2024 and is currently ramping-up production.

Kuya Silver is an emerging silver producer, which restarted the Bethania silver mine in 2024. The first tonnes of mineralized material were recovered in May, 2024.

Table 1 shows the production and development achieved to date since restarting of activities in early 2024. Reconditioning, and mine development activities continued over the rest of 2024 (June-December), however development (and production) was slowed by lack of available explosives at the mine (see Kuya Silver Press Release, December 5, 2024).

This issue was resolved by late November and daily production and mine development has significantly increased since then. Q1 2025 represented the first quarter of consistent daily drill and blast operations, although production of mineralized material was inconsistent due to requirements to prioritize development and overall limits on capacity, normal in the earlier stage of a mine ramp-up.

Christian Aramayo, Kuya Silver Chief Operating Officer, stated, “Despite earlier financial constraints, our operations team at Bethania has delivered a number of critical projects that set us up for future growth in production in the near term. With the additional funding raised recently we are accelerating our investments in underground development and we are on track to achieve 100 tonnes per day by Q3 2025 as per our current approved budget and mine plan. Notably, daily production doubled over the last 10 days of April, highlighting the momentum now building at the mine site.

Our team will continue ramping up to the nameplate 350 tonnes per day target over the rest of the year with the goal of becoming a leading primary silver producer in the region.”

Juan Espinosa, Finance Manager, Kuya (Peru) and Acting General Manager, Minera Toro de Plata, remarked, “I am proud of the accomplishments of our now 80-person team at Bethania. Our team is 100% Peruvian, harnessing generations of local mining knowledge and expertise to help the operation grow in scale while keeping safety and community values at our core.”

Table 1: Production highlights from the Bethania silver mine

(1) production from May 21, 2024 to December 31, 2024

(2) prices for silver equivalent calculations use period ending spot prices and are as follows: Dec. 31, 2024 period; silver $28.90/oz, gold $2606.72/oz, lead $1921.50/tonne, zinc $2974/tonne, and Mar. 31, 2025 period; silver $34.46/oz, gold $3122.80/oz, lead $2002/tonne, zinc $2829/tonne.

(3) includes only payable recovery i.e. lead in the silver- lead concentrate and zinc in the zinc concentrate and silver in both concentrates.(4) may include provisional settlements at the end of the period

Operational Progress In Q1 2025

Building on the experience in 2024,KuyaSilverexecuted a comprehensive optimization of the underground infrastructure, to better prepare for larger quantities of mineralized material to produced later this year and beyond. Some of the key achievements included upgrades to utilities, compressed air, power and water distribution extending below the 640 level (currently the deepest production level). Ventilation improvements, grade control optimization, and improvements to safety training, were other projects executed in the first quarter of 2025. The Company’s experience in the first few months of 2025 was that it had a limited ability to perform the scale of underground development needed to ramp-up as quickly as planned, due to financial constraints at the time, however this has been improved signficantly by the recent equity financing.

KuyaSilveralso has seen a steady improvement its metallurgical recoveries from toll milling operations since the commencement of processing in October 2024, with an effort to optimizesilverrecoveries from both concentrates.Silverrecoveries on its first toll milling batch in April have been further improved, with the first 342 tonnes processed in April having an estimatedsilverrecovery of 94.2%.

Production Expected to Grow Steadily Over The Rest of 2025

With the additional investments being made to accelerate underground development,KuyaSilveris strategically progressing toward its near-term targets. The Company expects to achieve its first major production milestone of 100 tonnes per day (tpd) of mineralized material by Q3 2025, supported by its current approved budget and short term mine plan. Following this milestone, sufficient infrastructure will be in place to systematically ramp up toward its Phase One Objectives of 350 tpd. Key operational and financial milestones anticipated over the remainder of 2025 include:

Q3 2025: Reach 100 tpd production

Q4 2025: Achieve operational break-even and declare commercial production.

H2 2025: Progressively scale underground infrastructure and production toward 350 tpd.

Kuya Silver will provide frequent operational updates to the market as these milestones are met.

The entire news release is here

end of segment

Editorial Department Separate from Promotions

Not financial advice

Buy as much Silver as you can afford.

You are not buying Silver really. You are exchanging Fiat notes getting hammered by inflation and debasement for the World’s most under-valued asset