SilverSqueeze 2.0 and Mexico's Nationalism: Once in a Lifetime Moon Shot

Setting the Stage for a Massive Silver Price Surge

As the CME Silver contracts for March 2025 come to a close, coinciding with the end of the first quarter of 2025, silver has reached an all-time high in the past 13 years. This convergence of events sets the stage for a potential spike in silver prices, driven by a complex interplay of supply and demand dynamics, geopolitical tensions, and economic instability.

Silver's unique properties make it an indispensable metal in industrial applications, from solar panels to electronics, accounting for over half of its annual demand. The ongoing global silver supply deficit, now in its fifth consecutive year, is exacerbated by robust industrial consumption, particularly in the solar and automotive sectors. This structural imbalance is poised to intensify as global photovoltaic installations and electric vehicle production continue to rise, further straining the already tight supply chain.

Amidst these supply constraints, trade wars and economic uncertainties are fueling investor interest in safe-haven assets like silver. Tariff policies, which increase production costs and disrupt supply chains, have historically driven up silver prices. Moreover, the escalating tensions between major economies and the U.S. debt crisis are creating an environment where investors are increasingly seeking alternatives to traditional currencies.

The BRICS nations' growing preference for gold and silver over the U.S. dollar adds another layer of complexity. As these countries explore alternatives to the dollar, their interest in precious metals could significantly boost demand. Silver, with its historical role as a monetary metal, is well-positioned to benefit from this shift. Its versatility, conductivity, and antibacterial properties make it not only a valuable industrial resource but also a store of value in uncertain times. As the global economic landscape continues to evolve, silver's unique combination of industrial and monetary appeal positions it for a potential surge in value.

Mexico, the world's largest producer of silver, is employing strategic measures to counterbalance U.S. tariffs and bolster its economy. The government is considering nationalizing silver mines, a move that aligns with its broader economic nationalism agenda, to ensure that the benefits of this valuable resource are retained domestically. Additionally, Mexico has increased taxes on mining operations to generate revenue for robust social spending programs. These programs include ambitious initiatives such as building one million homes, enhancing pensions under the Bienestar program, expanding socialized medicine and education, and providing reparations to Indigenous communities.

This left-wing approach prioritizes social welfare and environmental protection over extractivism, reflecting a shift towards economic sovereignty and resource control. By leveraging its silver resources, Mexico aims to fund these initiatives while asserting its independence in the face of global economic pressures.

Mexico's recent actions under the MORENA party have set a precedent for further resource nationalization. In 2023, Mexico nationalized lithium, aligning with its broader strategy to control critical minerals essential for clean energy technologies. In 2024, the government took significant steps towards nationalizing the electricity sector, enhancing the role of the state-owned Federal Electricity Commission (CFE). Additionally, in the same year, Mexico seized control of a rock mine, demonstrating its willingness to assert state control over strategic resources.

These moves are part of the "Cuarta Transformación" ideology, which emphasizes economic sovereignty and resource nationalism. Given this trajectory, it is plausible that silver nationalization could be on the horizon for 2025 or 2026, as Mexico continues to consolidate its control over key resources to fund social programs and assert its economic independence. This would align with the government's vision of reclaiming Mexico's natural wealth for its people, rather than allowing it to be exploited by foreign interests.

The combination of these factors—global demand, supply constraints, geopolitical tensions, and Mexico's resource nationalism—creates a potent mix that could propel silver prices to new heights.

As investors seek safe havens and industrial demand continues to grow, silver's unique position as both an industrial and monetary metal positions it for a significant price surge. With Mexico's potential nationalization of silver on the horizon, the stage is set for a dramatic shift in the global silver market, one that could redefine the metal's role in the global economy and cement its status as a valuable asset in uncertain times.

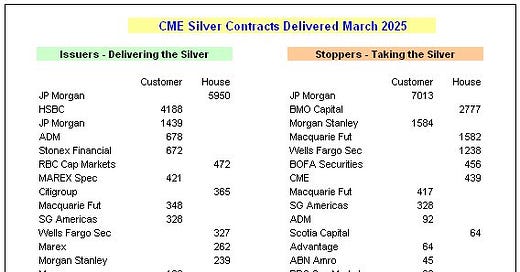

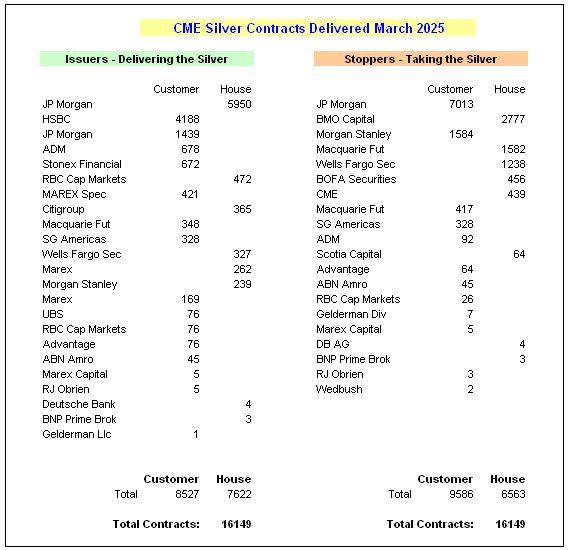

Whales swim among us

David Bateman bought 12.69 million Troy ounces of physical Silver (395 Metric Tonnes) directly from the COMEX and he stood for delivery and withdrawal via his COMEX broker

This is around $438 million USD of Silver at today’s price

David is part of our Silversqueeze 2.0 group.

David stated, “I’m no roaring kitty but I have bought 12.69M ounces in the last 4 months.

Sold my SLV and went all physical thanks to all the good advice from ya’all.” - David Bateman

end of segment