Silver’s Surge: Historic Breakout, Global Power Shift, and the Miners Set to Soar 20x & BEYOND.

Silver shatters records as global demand explodes, East-West power shifts, and unloved miners rocket higher—setting the stage for once-in-a-lifetime wealth creation.

by Jon Little intern Mr. Carmine Lombardi

Silver’s Historic Milestone: Highest Six-Month Close Ever

On June 30, 2025, silver closed at $36.17 per ounce—the highest six-month closing price in the metal’s history.

This record-setting close is not only a testament to the relentless upward momentum in the silver market, but it also marks a pivotal moment for investors and industry observers worldwide. The unprecedented six-month performance underscores the convergence of powerful forces—tightening supply, surging industrial demand, and robust investment interest—that are reshaping the global silver landscape.

This milestone signals a dramatic shift in market dynamics, confirming that silver’s rally is both historic and broad-based.

The $36.17 close serves as a new benchmark for bullish sentiment, reinforcing silver’s position as a premier asset in times of economic uncertainty and technological transformation.

As silver continues to break records and defy expectations, the significance of this six-month high will resonate throughout financial markets, setting the stage for further record breaking moves, more opportunity for investors to get in (perfect entry point is now), and yield even greater highs in the months ahead.

In the world of commodities, few stories are as electrifying—or as consequential—as the unfolding drama in the silver market. As silver flirts with historic resistance levels and technical patterns align, the stage is set for what will become the most significant breakout in capital markets since gold’s legendary surge in the early 1970s. These crucial data points now reveal why silver’s ascent is not just probable, but potentially explosive.

A 170-Year Chart Signals a Monumental Breakout

Silver’s historical chart, spanning 170 years, tells a story of long-term consolidation punctuated by rare, spectacular breakouts. The last time a precious metal staged such a move was in 1972, when gold erupted from a century-long base, igniting a bull market that redefined global finance. Silver followed suit in 1973, reaching all-time highs. Today, silver is once again coiling beneath a critical resistance: the $50/oz level. A decisive break above this threshold would not only set a new record, but could unleash volatility and momentum unseen in decades.

Silver vs. Foreign Currencies: The Stealth Rally

Silver Bull Flag

Before we get into Silver’s explosive move against Foreign currencies lets review the silver set up:

Silver is now facing its sixth consecutive year of supply deficits, with global demand consistently outstripping available supply.

The advent of silver-based solid-state batteries is poised to revolutionize the electric vehicle industry. If each EV produced between 2025 and 2028 requires one kilogram of silver, the resulting demand could rapidly exhaust global reserves, leaving "no more silver" for other uses.

Demand from critical industries—including military, aerospace, solar energy, electronics, 5G infrastructure, and artificial intelligence—continues to surge, adding immense pressure to already strained silver supplies.

Silver is increasingly being used as a monetary asset, serving as a hedge against the mounting global debt crisis and offering investors a safe haven amid economic uncertainty.

China is actively encouraging its citizens to invest in silver alongside gold, fueling a powerful new wave of retail and institutional demand that is reshaping the global silver market.

While much of silver’s recent strength can be attributed to U.S. dollar weakness, the real story emerges when silver is measured against foreign currencies. Historically, gold’s price in non-dollar terms has led its dollar price higher, and silver appears to be following the same script. The implication is profound: when silver strengthens against other major currencies, it could reach new all-time highs globally even before doing so in dollar terms. This dynamic underscores the metal’s broad-based demand and its potential to outperform as global monetary conditions evolve.

Jesse Columbo writes:

About a month ago, silver finally broke out above two key resistance zones that had capped its gains for the past year: first the $32–$33 zone, and then the $34–$35 zone. This breakout is a strong indication that silver’s bull market is gaining momentum. While silver has spent the past few weeks in a healthy consolidation, it has managed to hold onto its gains — a very constructive sign. I’m now watching for a breakout from this consolidation, which I believe will set the stage for a rapid move to $40 an ounce and beyond.

Interestingly, if you take a closer look, the recent consolidation actually resembles a classic bull flag pattern — exactly what you want to see in a strong uptrend. This pattern indicates further gains are likely on the horizon, though a decisive breakout to the upside with strong volume is needed for confirmation.

It’s also worth noting that silver often rallies in this step-like fashion, moving from one technical pattern to the next. For example, last month’s $4.50 per ounce surge was preceded by a well-defined triangle pattern that formed in April and May. The current bull flag appears to be continuing this pattern of behavior, making it an exciting setup to watch for us silver bulls.

Silver vs. the 60/40 Portfolio: Challenging Conventional Wisdom

The classic 60/40 portfolio—60% stocks, 40% bonds—has long been the bedrock of institutional investing. Yet, silver’s ratio against this benchmark is now trading at a five-year high, with moving averages gently sloping upward. The resistance formed by the 2016 and 2020 peaks represents an 11-year base. Should silver surpass this formidable barrier, it would signal a paradigm shift: the metal is not just a hedge, but a challenger to traditional asset allocation, poised to outperform as macroeconomic tides turn.

Inflation-Adjusted Silver: A 12-Year Base Ready to Erupt

Inflation-adjusted metrics are the gold standard for assessing real asset performance. For silver, the Silver/CPI ratio is on the verge of breaking out from a 12-year base. Historically, silver stocks (as tracked by the SIL ETF) have closely followed this ratio. A confirmed breakout would not only validate the current rally, but also suggest that silver equities are set to outperform dramatically if silver climbs to $40 and beyond in the medium term.

Silver’s Performance After Gold’s Breakouts: Room to Run

Silver’s behavior following gold’s three major breakouts to new all-time highs offers a compelling analog. While silver’s performance has lagged the average of these historical moves, recent price action suggests it is beginning to “perk up.” This lag is not a sign of weakness, but rather of pent-up potential. As gold leads, silver is primed to follow—often with greater velocity and magnitude once momentum takes hold.

The 1972 Blueprint: History Repeats

The parallels between today’s market and the early 1970s are striking. In 1972, gold’s breakout was the precursor to silver’s surge in 1973, when it shattered previous highs dating back to the Civil War era. Current price action reveals silver is tracking its 1972 performance with uncanny precision. If history is any guide, the next phase could see silver rapidly eclipsing its old highs, propelled by a confluence of technical and macroeconomic forces.

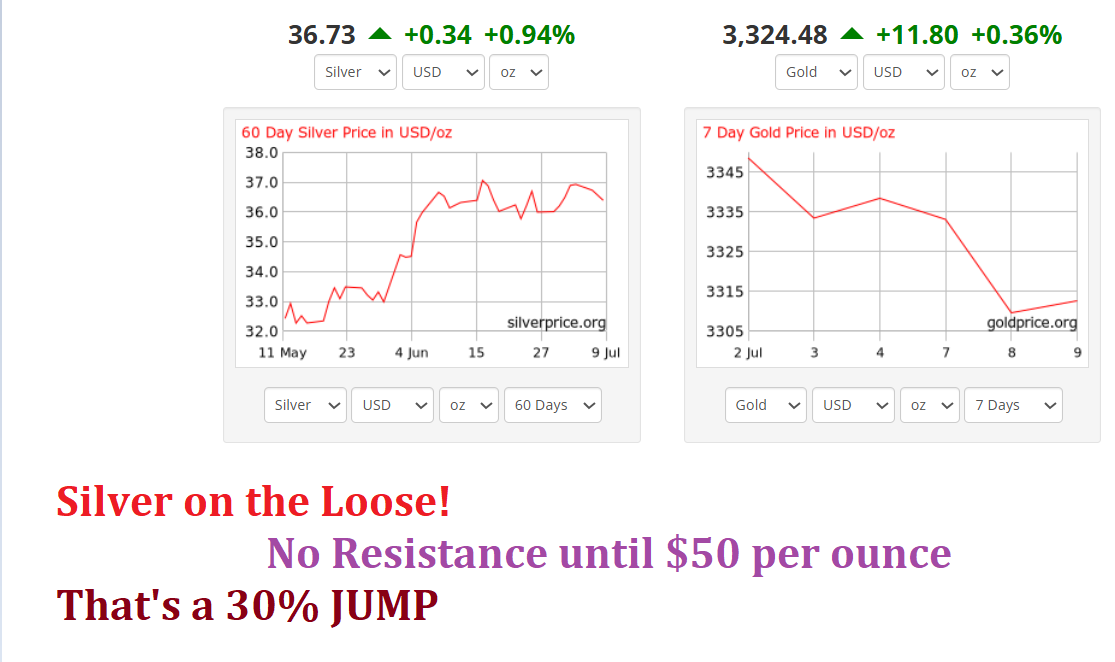

The Daily Chart: Bull Flag Points to $41, Then $50

Short-term technicals are equally bullish. Silver has formed a classic bull flag pattern, with a measured upside target of $41. This level is not just a technical milestone—it represents the last major resistance before the psychologically and historically significant $50 mark. A move above $37 would confirm a breakout in the inflation-adjusted price, setting off a cascade of bullish signals for silver stocks and related assets.

The COMEX Arbitrage: East vs. West and the End of Paper Dominance

A critical, often overlooked dynamic is the ongoing tug-of-war between the paper and physical silver markets. Historically, the COMEX system has allowed a year’s worth of global silver mining production to be traded in a single day, with as many as 450 “paper” ounces claiming the same physical ounce. This so-called “smash” by market manipulators—dubbed “Mr. Slammy”—once had a pronounced and lasting effect on prices.

However, the landscape has shifted dramatically. Since the onset of US sanctions on Russia, every attempt to drive down silver prices on the COMEX is met with robust buying from the East, particularly India and China. The persistent arbitrage between artificially suppressed COMEX prices and higher Shanghai silver prices proves that when the West sells, the East buys. Recent trends show Chinese insurance companies allocating to precious metals, further supporting demand. Notably, during COMEX trading hours, silver prices often move sideways, but when Asian markets open, silver trades freely and frequently surges higher—reflecting true market demand and a growing bid from the East.

The Road Ahead: $41, $50, and Beyond

The evidence is overwhelming: silver is on the cusp of a generational breakout.

Multiple patterns—historical, technical, and macroeconomic—converge on a short- to medium-term target of $41, with $50 as the ultimate prize. A decisive move above $37 would confirm the inflation-adjusted breakout, unleashing a new era for silver and its equities. As silver tracks the legendary rally of the 1970s and the East-West market dynamic intensifies, investors and institutions alike should prepare for volatility, opportunity, and the potential rewriting of the rules of asset allocation. The silver story is far from over—it may, in fact, be just beginning.

Buy the Miners.

The real opportunity is picking up Silver using the Sprott formula.

Why Now Is the Time to Buy the Miners

The opportunity before us is both rare and compelling. The mining companies listed below have long been overlooked and undervalued by the market—yet they are poised for extraordinary gains in the coming cycle.

Each of these miners has the potential to deliver returns of 5x to 20x as the silver market enters a historic breakout phase and global demand for precious metals accelerates.

Strategic Advantage: No Exposure to Mexico

None of these miners operate in Mexico, a country that has recently aligned itself with China, Russia, Iran, and India. This shift marks a decisive move away from traditional U.S. influence.

Mexico’s evolving partnerships, particularly with Russia supplying LNG to Mexico, signal a new era in North American energy and resource politics.

This realignment reduces the risk of U.S.-centric geopolitical disruptions for your investments.

The Changing Geopolitical Landscape

Mexico’s desire to assert its independence from the United States is not merely symbolic. While the country once had to accommodate U.S. energy needs, it is now diversifying its alliances and resources. Russia’s involvement in supporting Pemex and providing LNG underscores this transformation, ensuring Mexico is no longer bound by the constraints of its northern neighbor.

A Cautionary Reflection

If these changes concern you, it’s worth reflecting on the root causes. The deterioration in U.S.-Mexico relations can be traced back to years of inflammatory rhetoric and divisive policies. President Trump’s derogatory remarks about Mexican citizens and migrants—labeling them as criminals, rapists, and thugs—have deeply offended both politicians and the public in Mexico, fueling a desire for greater autonomy and new alliances.

The Ultimate Irony

The situation has come full circle. Notably, Elon Musk—who played a pivotal role in Trump’s 2024 victory—has publicly accused Trump himself of the very misconduct he once attributed to Mexican workers. Perhaps he shouldn’t have called them rapists, especially now that public opinion in the U.S. holds that the DOJ and FBI covered up the Epstein files because Trump himself is accused of assaulting numerous underage girls.

This irony is stark, especially considering the immense contributions of Mexican laborers to the U.S. economy: from harvesting crops and working hazardous construction jobs, to maintaining hotels, preparing food, and enduring the grueling conditions of meatpacking plants.

Now is the time to invest in these undervalued miners, free from the geopolitical uncertainties facing Mexico. The world is changing rapidly, and those who recognize and act on these shifts will be best positioned to benefit from the coming surge in precious metals.

3 Silver miners that are pure silver mines (not silver as by product mines)

All 3 of these picks are in production right now

We have selected our picks based on the strength of:

Their balance sheets

Their Ore grades

Their Metallurgy

Their Management talent

Their Jurisdiction.

Volume of ounces underground and in the pipeline

These three miners are located in Bolivia, Morocco and Peru respectively

Silver Academy’s top 3 picks

Andean Precious Metals: TSXV: APM, OTCQX: ANPMF

The company operates the largest commercial silver oxide processing plant in Bolivia's Cerro Rico region - the San Bartolomé facility. This strategic asset has produced over 65 million ounces of silver equivalents since 2009, demonstrating Andean's significant production capabilities.

Their robust balance sheet provides the company with financial flexibility and stability in a volatile industry.

The company follows a two-pronged growth strategy, focusing on organic growth in Bolivia and expansion through mergers and acquisitions in the wider Americas. This approach positions Andean for sustainable long-term growth and diversification.

Andean has successfully extended the life of the San Bartolomé mine from eight months to potentially 10 years or more, showcasing the company's operational expertise and ability to maximize asset value.

The company is committed to sustainable mining practices and community engagement, contributing approximately $75 million annually to the local economy through wages, royalties, and taxes. This dedication to social responsibility strengthens Andean's social license to operate.

By acquiring Golden Queen Mining Company (USA), Andean Precious Metals has taken a significant step towards achieving its vision of becoming a multi-jurisdictional mid-tier producer in the Americas, while positioning itself for sustainable long-term growth

Aya Gold & Silver: TSX: AYA, OTCQX: AYASF

Aya Gold & Silver Inc. is a leading silver producer, uniquely positioned as the only pure silver mining company listed on the TSX, with a strong operational base in Morocco. The company has recently reported record revenues of $13.7 million in Q2 2024, reflecting a remarkable 42% increase from the previous year, showcasing its robust growth trajectory and commitment to maximizing shareholder value. With ongoing expansions at the high-grade Zgounder Silver Mine, Aya is set to increase its processing capacity to 2,700 tonnes per day in 2024, further solidifying its market presence. Additionally, Aya's strategic exploration efforts have led to significant mineral resource estimates, including a recent discovery at the Boumadine project, which highlights the company's potential for future growth and profitability. Committed to sustainability, Aya Gold & Silver integrates responsible mining practices into its operations, ensuring long-term value creation for its stakeholders

Kuya Silver: CSE: KUYA, OTCQB: KUYAF

Kuya Silver is at the forefront of silver mining with its dual-track strategy, actively mining the high potential Bethania Silver Mine in Peru and developing the historic Silver Kings Project in Ontario. With robust mining and exploration programs underway, Kuya is poised to unlock significant value from its assets. Kuya Silver's experienced management team, led by industry veterans, is dedicated to maximizing shareholder value through strategic growth and operational excellence. As the demand for silver continues to rise, Kuya Silver stands ready to capitalize on emerging opportunities in the market.

end of segment

our opinions are not our sponsors opinions

editorial department is separate from promotions department

not financial advice

buy silver miners