Silver’s Shock Surge: The Gold-to-Silver Ratio Signaling America’s Financial Meltdown

The Gold-to-Silver Ratio is Moving to Historical Mean—and What Does That Mean for America’s Middle Class?

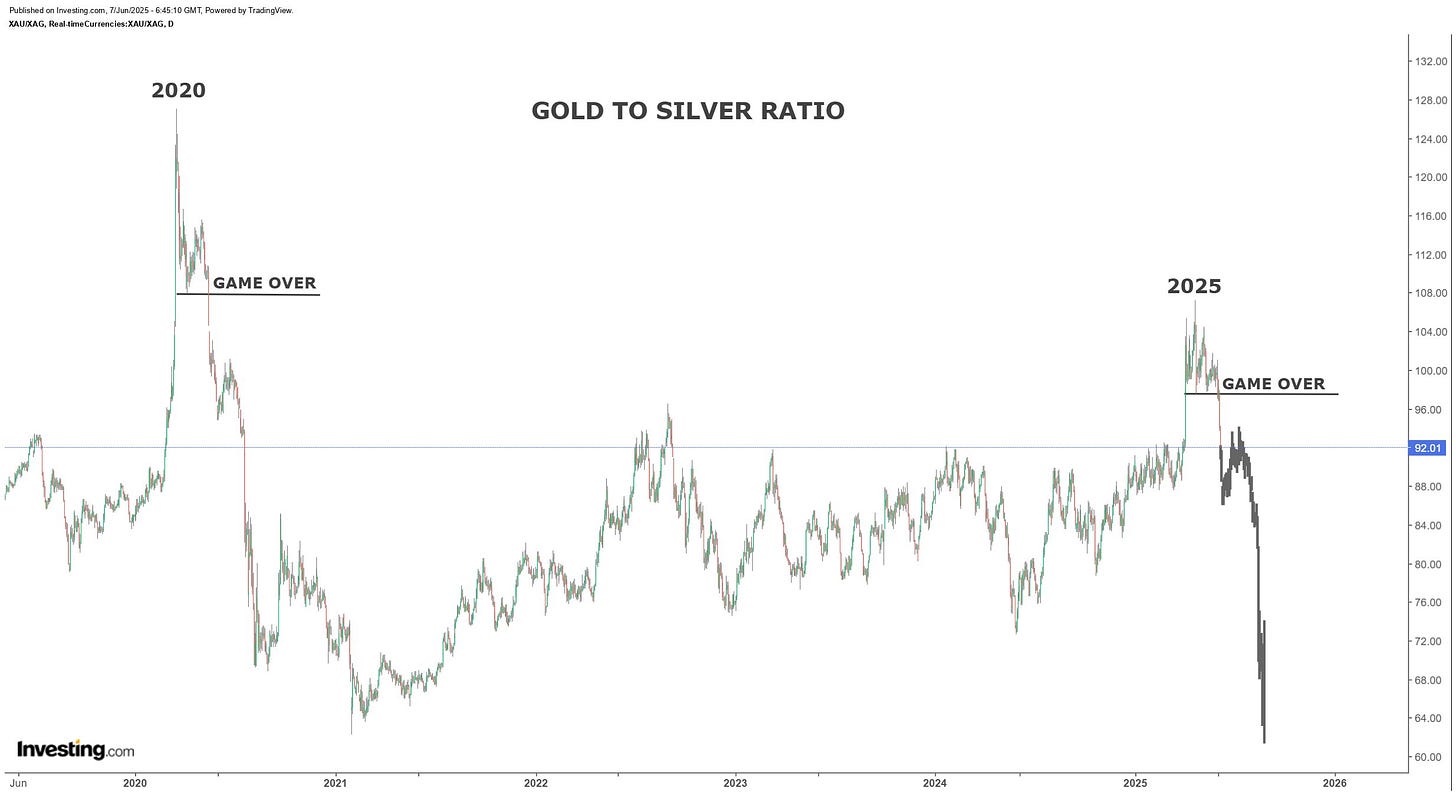

How did we get here? As of April 2025, the gold-to-silver ratio (GTS) stands at a staggering 102:1—an extreme not seen since the panic days of 2020. For context, this ratio averaged around 50:1 for most of the last century and dipped as low as 35:1 when silver nearly hit $50 in 2011. Why does this matter? Because every time the GTS has reached such extremes, it has snapped back violently, unleashing a silver rally that leaves gold in the dust.

Could 2025 be the year silver finally breaks out? The bullish case is mounting. Silver is up 43% year-to-date, outpacing gold and every other major metal. Industrial demand—especially from solar panels and electric vehicles—is surging, while supply remains in deficit for the fourth year running. Meanwhile, central banks are quietly adding silver to their reserves for the first time in decades. If gold hits $3,500 and the ratio reverts to 60, silver could rocket to $60 an ounce. At $4,000 gold, $70 silver is in play.

Have you bought enough Silver with the knowledge that the GTS is moving to its historical mean?

But why should you care about precious metals when America’s financial system is on fire? Let’s ask a simple question: Who is buying U.S. Treasuries today? The answer, increasingly, is the U.S. government itself. In June, the Treasury executed a record $10 billion bond buyback, absorbing its own debt in a maneuver eerily reminiscent of a school bake sale where only parents and students buy the goods—merely shifting the burden around, not solving the problem. With the federal debt now at $36.5 trillion and deficits projected to rise, are we witnessing the endgame for the dollar’s credibility?

What happens when the world loses faith in America’s IOUs? Treasury Secretary Scott Bessent insists the U.S. “will never default,” but when a top official has to say that out loud, isn’t that itself a red flag? The Congressional Budget Office projects deficits will remain above 6% of GDP for the next decade, with debt ballooning to 118% of GDP by 2035—levels unseen since World War II. President Trump’s “Big Beautiful Bill” could add another $2.4 trillion to the debt, even as the political class promises endless tax cuts and spending increases. Is this sustainable, or are we inching toward a fiscal reckoning?

And who pays the price for this reckless experiment? The answer: the American middle class. Since 1975, an astonishing $79 trillion has been siphoned from the bottom 90% to the top 1%. Today, the richest 1% control over 30% of the nation’s wealth—$49.2 trillion—while the bottom half holds a meager 2.4%. The so-called “Great Wealth Transfer” is in full swing, with the lion’s share of inheritance and asset growth flowing to the already wealthy. As inflation bites and jobs become less secure, middle-income families are squeezed ever tighter, forced to shoulder the costs of Wall Street’s games and Washington’s debt binge.

So, where does this leave us as we barrel toward the end of 2025? If the gold-to-silver ratio snaps back to historical norms amid a backdrop of fiscal chaos and vanishing trust in U.S. debt, silver could soar—offering a rare lifeline to those who see the writing on the wall. But for the vast majority, the consequences of this wealth transfer and monetary manipulation will be devastating.

Will you be a spectator as the system unravels—or will you take action before the next phase of America’s financial reckoning arrives? The clock is ticking, and the breakdown has already begun.