Silver Surge: $50 Breakout on the Horizon—Beat the Stampede

CLAIM YOUR WEALTH BEFORE THE HERD ARRIVES

Look around the world—what do you see? The signs are everywhere: empires rise, they peak, and then, inevitably, they fall. Ray Dalio, the hedge fund titan, laid out the pattern in his “Big Cycle” analysis. Once a nation reaches the zenith of its dominance and the decline begins, history shows there’s no turning back. The U.S. is not immune to the laws of history. But how did we get here, and why should we believe the cycle will spare us?

Dalio’s cycle is clear: after a rise fueled by innovation, strong leadership, and shared prosperity, empires reach a top—marked by hubris, debt, and widening inequality. Then comes the decline: financial instability, inflation, social unrest, and eventually, a new world order. But here’s the question: if every fiat currency in history has collapsed to zero, what makes anyone think the U.S. dollar will be the exception? History’s track record is 100% failure for unbacked money. Why should this time be any different?

The toxic orbit of the U.S. dollar is spinning out of control. Not a single root cause of the 2008 financial crisis was truly fixed—banks got bigger, debt ballooned, and risk was socialized. Now, the Federal Reserve is out of tools. Interest rates can’t be slashed much further, and quantitative easing has lost its punch. The only card left? The revaluation of gold and silver as the world’s ultimate safe havens. But is it too late for that?

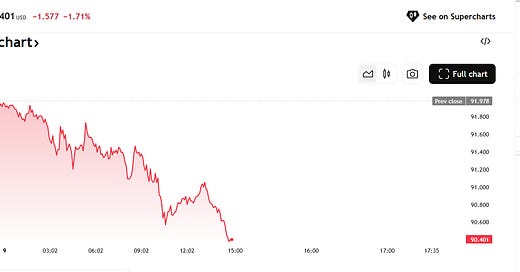

The numbers are staggering. The U.S. national debt stands at $36.5 trillion, with interest payments devouring more than $4 billion every single day. Interest rates are rising, and foreigners are no longer eager to buy U.S. Treasuries—especially after the recent credit downgrade by all three major agencies6. Who wants to go down with this ship? Meanwhile, banks are sitting on record unrealized losses, and housing inventory is at a five-year high, signaling a rush for the exits. The middle class is being hollowed out—but where is the outrage?

Layoffs are surging across every sector. In the first five months of 2025, U.S. employers announced nearly 700,000 job cuts—an 80% increase over the same period last year. Full-time jobs are disappearing, replaced by part-time gigs and contract work. Retail is hemorrhaging: 76,000 jobs lost, a 274% spike year-over-year. Government, tech, and even giants like Walmart, Procter & Gamble, and Tesla are slashing payrolls. The malls are boarded up—JoAnn Fabrics, Big Lots, Bed Bath & Beyond—ghosts of a consumer economy in retreat. Is this the new normal, or the beginning of something far worse?

Now, let’s talk tariffs. The Trump administration’s 50% steel tariff is a wrecking ball for the U.S. economy. The biggest users of steel? Oil producers and construction firms—the very sectors that drive rents and housing costs. Tariffs are driving up the price of everything from pipelines to apartment buildings, and those costs are being passed straight to consumers. Rents are already out of reach for millions; now, they’re set to climb even higher. Is this really helping American workers, or is it just another transfer of wealth to the top?

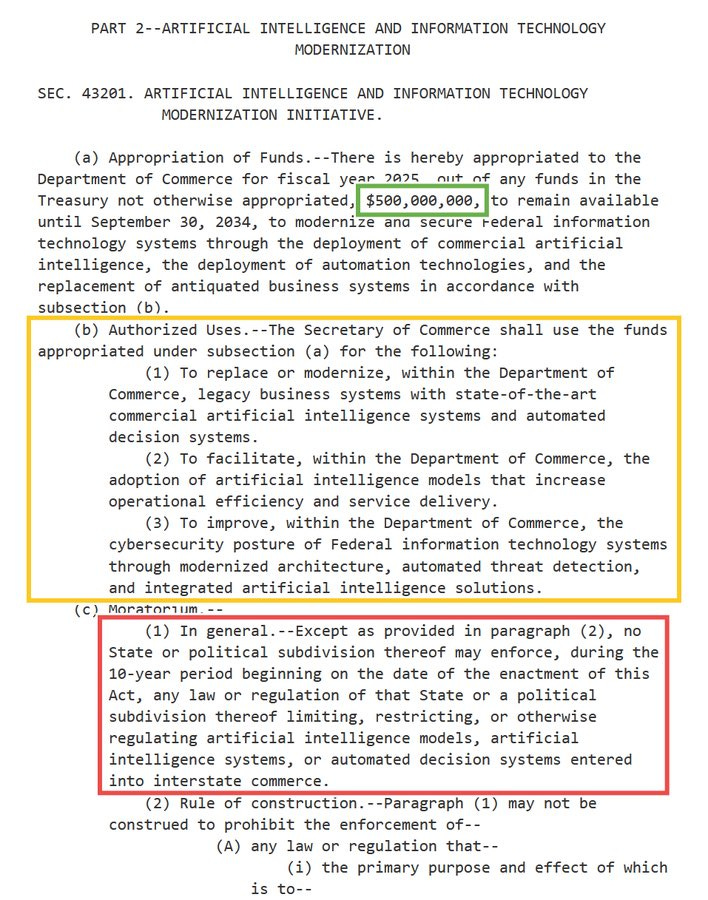

The middle class is being decimated, and it’s not an accident. The system is designed this way. The “Big Beautiful Bill” isn’t just about tax cuts—it’s about surveillance and control. Palantir, the CIA’s favorite data miner, is building a massive database that tracks every citizen: Real ID, facial recognition at airports, voting and driving records, social security, job history, credit, and bank records—all in one place. You are being profiled, judged, and potentially punished by an algorithm, with no right to defend yourself. Is this the democracy our founders envisioned, or a digital dictatorship in the making?

Meanwhile, BlackRock has admitted what many fear: depopulation is coming, and AI can do the work. Democracy is morphing into a hybrid of plutocracy, aristocracy, and kleptocracy—rule by the rich, the elite, and the thieves. The apparatus of the state is being used to extract wealth and power from the people. But is there any hope left?

There is a glimmer of good news

The gold-to-silver ratio is breaking down and could return to its historic mean of 55:1. With $3,400 dollar gold, Silver spot price would hit $61.81

Precious metals are the only real money left in a world drowning in debt and digital surveillance. When the system finally cracks, gold and silver will be the last refuge. But will enough people wake up in time?

So, look around the world—what do you see? The signs are clear. The cycle is turning. The question is: are you ready for what comes next?

Fight Back with Silver

The time for passive trust is over. The state, like the developer who strips the land and names streets after what he destroyed, is now clearing out the people—our rights, our privacy, our wealth.

You’ve seen the incompetence, the endless wars, the lies, the surveillance, the rounding up of citizens without trial. This is not democracy—it is the slow creep of something far darker. Do you truly believe that a government so reckless with lives and treasure will be careful with your money?

Silver is more than a commodity—it is a gesture of self-preservation and resistance.

While the state prints IOUs and erases your freedoms, silver stands as real, honest money. It is the people’s wealth, outside the system, beyond their control. Buy silver. Hold it. Use it. Let it be your statement: you refuse to be dependent on a broken, untrustworthy government. The trees are gone, but the seeds of resistance remain—and you, not the state, must be the planter. Will you wait until the last maple is paved over, or will you act?

Frontrunners win, Chasers Lose

“Find out where everyone is going and get there first.” Mark Twain’s advice is more urgent now than ever—especially in a world where the herd rushes toward financial ruin while the savvy look for real value. Silver, long suppressed and overlooked, is on the cusp of a historic breakout, with $50 per ounce just the beginning of its trajectory.

Why wait until the crowd finally wakes up and stampedes into silver, driving prices higher and leaving latecomers behind? Get in the game now, ahead of the curve, and position yourself as a frontrunner, not a desperate chaser.

Silver is not just an investment—it’s a gesture of self-preservation, a hedge against currency debasement and government overreach. By buying silver today, you reclaim control over your wealth and your future, outside the crumbling system. Twain’s wisdom is clear: don’t follow the herd—lead it, and let silver be your path to independence and security

Keep looking around the room. We already discussed evil Palantir

Now let’s also focus on evil Blackrock

Why is banning regulations on A.I. in BBB so dangerous? Because this isn’t accidental — it’s a coordinated plan by BlackRock and the World Economic Forum, now being executed under Donald Trump. The evidence is right here. Please wake up. They’ve openly stated their goal: to shrink the population and replace humans with AI. If left unchecked, these corporations will dominate the West — and the remaining humans will live like chickens in a coop.