Silver Skyrockets as U.S. Debt Bomb Explodes: Dollar Plunges, Jobs Vanish, and Crisis Looms

Silver’s Surge and America’s Fiscal Reckoning

The price of silver blasting above $36 is more than a technical breakout—it’s a blaring siren for the U.S. economy. For years, politicians have promised spending cuts and deficit control, but the numbers show these assurances were little more than political theater. Now, as precious metals rally, the hard reality of America’s fiscal mismanagement is coming due, with profound implications for markets, jobs, and the dollar’s global standing.

Debt and Interest: The Unstoppable Climb

The U.S. national debt is on a runaway trajectory. By the end of 2025, the debt-to-GDP ratio is projected to hit about 101%, with forecasts suggesting it could balloon to 148% by 2034 if current policies persist. The real kicker: interest on that debt. In 2025, net interest payments are projected to reach $952 billion, nearly tripling from a decade ago and now surpassing spending on Medicare and defense. Over the next decade, interest payments alone will total a staggering $13.8 trillion. This is not just an accounting problem—nearly one-third of all U.S. marketable debt will mature within the next 12 months, exposing taxpayers to the risk of refinancing at even higher rates3.

As a share of federal revenue, interest payments are expected to hit 18.4% by the end of 2025, eclipsing the previous record set in 1991. This means nearly one in five dollars the government collects will go just to service debt, crowding out critical investments in infrastructure, education, and social programs.

Commercial Real Estate: The Next Shoe to Drop

Layered atop the debt crisis is the brewing storm in commercial real estate. In 2025, a wave of commercial real estate loans is maturing—loans that were issued at rock-bottom interest rates and must now be refinanced at much higher costs. Many property owners, already struggling with post-pandemic occupancy and revenue declines, face the prospect of default or distressed sales. This echoes the financial sector’s risky behavior leading up to the 2008 crisis, when excessive leverage and falling asset values triggered widespread defaults and a credit crunch

Jobs: A Troubling Labor Market Shift

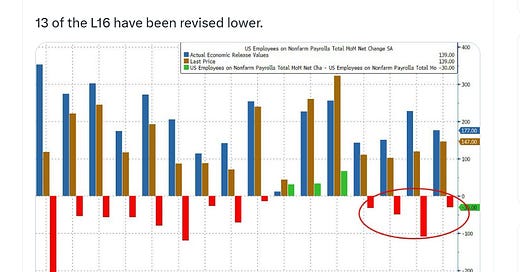

The jobs picture, often touted as a sign of resilience, is flashing warning lights. The latest reports show a staggering drop in full-time employment—down by 623,000 workers. This is not a blip. It signals a shift toward part-time and precarious work, undermining household stability and consumer spending. Such a decline in quality jobs is often a precursor to broader economic weakness, especially when paired with rising debt and financial instability.

The Dollar’s Slide: Policy or Accident?

The U.S. dollar has broken below a critical 17-year support level against the euro and is down sharply against major global currencies. Since 2025 began, it has lost 8% versus the yen, 9% against the euro, and 13% against the Swedish krona. The collapse is even more dramatic against the Taiwan dollar. While officials deny intentionally weakening the dollar, market participants see the administration’s focus on tariffs and reducing trade deficits as tacit acceptance of a weaker greenback. A weaker dollar may help exporters, but it also signals eroding confidence in U.S. fiscal stewardship and accelerates the flight to hard assets like precious metals.

Silver’s Technical Breakout: No Resistance Ahead

Technically, silver’s surge above $36 is significant—there is little resistance between $35 and $50, meaning the path is clear for further gains as investors seek refuge from fiscal and monetary uncertainty. The rush into silver and other precious metals is a direct response to the realization that Washington’s talk of fiscal discipline was, indeed, “a bunch of BS.”

Conclusion

America’s fiscal crisis is no longer theoretical. Ballooning debt, exploding interest costs, a looming commercial real estate bust, and a weakening labor market are converging. The dollar’s decline and silver’s breakout are not coincidences—they are the market’s verdict on years of empty promises. The floodgates are open, and unless policymakers act decisively, the coming storm could redefine America’s economic future.