Silver Ripping up over 3%. SGE Lowering its “execution threshold (KG)” of PHYSICAL Silver contracts ACROSS THE BOARD by almost 40%

Silver Vaults Could Drain Quicker

from our Hong Kong colleague Eric Yeung:

read the announcement from Shanghai Gold Exchange

https://en.sge.com.cn/eng_news_Announcement/10002091

The Shanghai Gold Exchange (SGE) and COMEX represent two contrasting approaches to precious metals trading, particularly in gold and silver markets.

COMEX, operated by CME Group, is primarily a paper-based futures market. Over 99% of its transactions are paper transactions rather than physical metal delivery. This allows for high trading volumes and liquidity, but it has been criticized for distorting true supply and demand dynamics of physical metals.

In contrast, the SGE is a physical exchange where trades are backed by actual metal. This model aims to more closely reflect real-world supply and demand conditions. The recent reduction in execution thresholds for silver contracts at SGE by nearly 40% could indicate tightening physical silver supplies, potentially signaling increased demand or decreased availability of physical silver in the market.

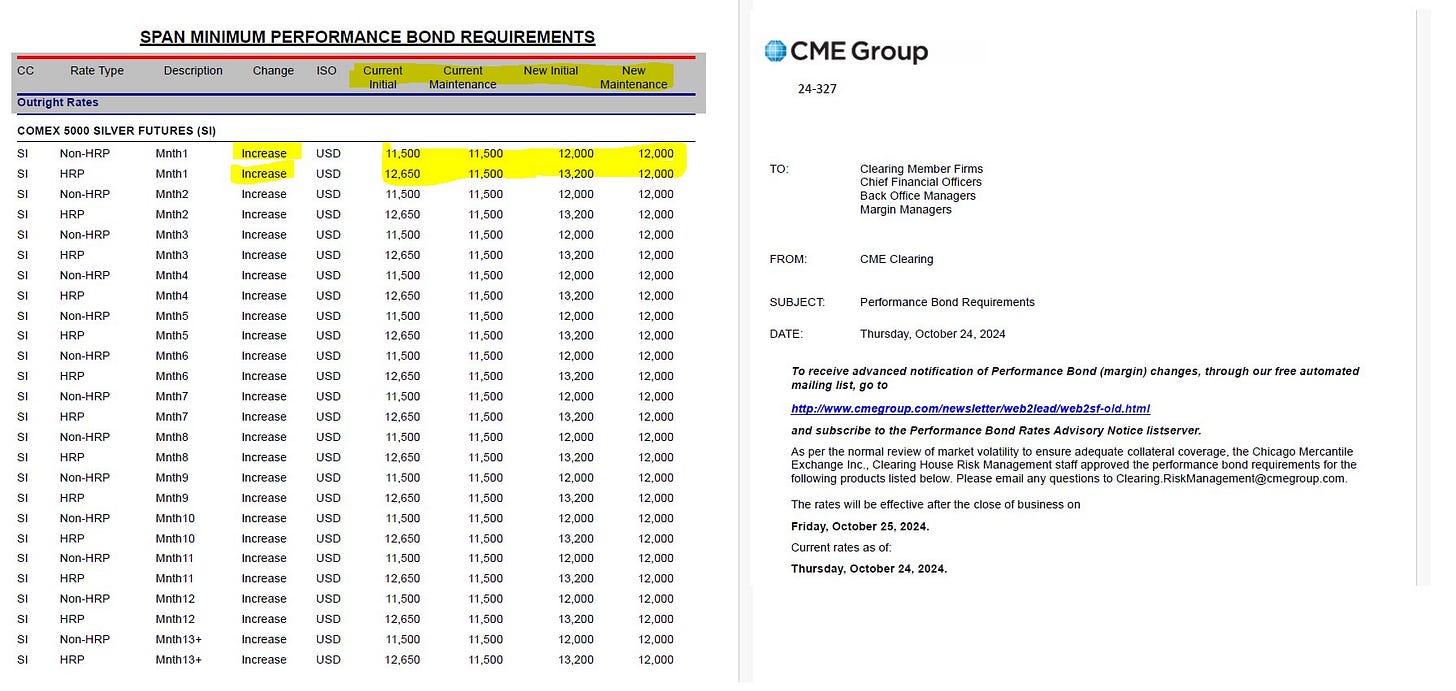

Meanwhile at Comex

CME raised their margin requirements by 4.3% on Silver Futures effective after October 25, 2024

From Craig Hemke’s twitter account

COMEX's recent 4% increase in margin requirements for silver futures contracts serves to reduce trading volume by making it more expensive to hold positions. This can help stabilize prices and protect short sellers in times of volatility. However, it may also reduce market liquidity.

These differing approaches highlight the fundamental distinction between paper and physical precious metals markets. While COMEX provides high liquidity and ease of trading, SGE's physical-delivery focus may offer a more direct reflection of actual metal supply and demand dynamics

How COMEX works explained to a Third Grader

Imagine you have one shiny silver coin, but 400 kids want to play with it. Instead of sharing the real coin, you give each kid a piece of paper saying they "own" the coin.

Now, all these kids think they have a silver coin, but there's only one real coin! This is kind of how COMEX works with silver. They sell lots of paper promises for silver, way more than the actual silver they have. It's like a big game of pretend, but with money

Imagine if all the kids with paper "coins" suddenly think silver isn't cool anymore. They might start selling their paper for less and less. Even though there's still only one real coin, the price goes down because everyone thinks silver isn't worth much. This makes real silver seem cheaper too. Remember, it’s psychology along with supply, demand and regulations that set the price.

end of section