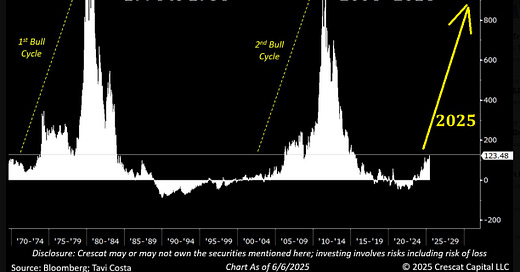

Tavi Costa wrote on June 6th, “Another remarkable week for silver. We are likely in the early stages of a new secular bull market for the metal, in my view.”

Silver Academy Price Target Updated to $24.75 (Currently trading at $10.66) Representing 132% Jump

Aya Gold & Silver Inc. (TSX: AYA.TO / OTCQX: AYASF)

The Silver Market: A Perfect Storm

The silver market is on the brink of a historic transformation, propelled by a perfect storm of surging demand and tightening supply. The world is witnessing a dramatic silver shortage, driven by a confluence of global trends that are reshaping the investment and industrial landscape.

Green Energy and Industrial Demand

A wave of green energy initiatives is sweeping across developed nations, with silver playing a starring role. As a critical component in solar panels—used for its superior conductivity—silver demand is skyrocketing. The UK’s bold new law mandating solar installations on nearly all new rooftops is set to fuel this trend even further, potentially impacting up to 90% of new homes. Beyond solar, silver is making its mark in next-generation electric vehicles. Samsung’s breakthrough silver solid-state batteries promise to double the range and lifespan of EVs while slashing charging times. If adopted widely, this technology alone could consume a staggering percentage of global silver output.

The industrial appetite for silver doesn’t stop there. The metal is increasingly vital in military and aerospace applications, from drones to satellites and advanced weaponry. Meanwhile, the rapid growth of AI data centers and robotics is opening up new, large-scale uses for silver, further tightening the market.

Silver as a Safe Haven

Amid these developments, silver is also reclaiming its role as a monetary metal. With US debt soaring and global uncertainty on the rise—fueled by geopolitical tensions, tariff policies, and economic instability—investors are flocking to silver as a hedge against currency devaluation and market volatility.

Supply Constraints and Geopolitics

Yet, as demand soars, supply is under unprecedented pressure. Mexico, the world’s largest silver producer, is considering nationalizing its silver resources, which could severely restrict global supply. This leaves only a handful of mining-friendly jurisdictions—Morocco, Bolivia, Peru, the US, and Canada—to pick up the slack.

Morocco: The Silver Investment Hotspot

Among these, Morocco stands out as a prime destination for silver investment. The country offers political stability, a welcoming environment for mining, and some of the world’s most promising high-grade silver deposits. Leading the charge is Aya Gold & Silver, whose Boumadine project is yielding exceptional exploration results.

Recent drilling has confirmed high-grade silver continuity and expanded the company’s exploration footprint, positioning it as a key player in the global silver supply chain.

The Gold-to-Silver Ratio and Market Outlook

Looking ahead, the gold-to-silver ratio is expected to return to its historical average of around 55:1. With gold projected at $3,400 per ounce, this would put silver at roughly $62 per ounce—a dramatic leap from current levels. Add to this a weakening US dollar and ongoing monetary stimulus, and silver appears poised for a historic rally.

Conclusion: A Pivotal Moment for Silver

In summary, the silver market is at a pivotal moment. Surging demand from green energy, EVs, military, AI, and safe-haven investors is colliding with tightening supply and geopolitical uncertainty. With Mexico’s potential nationalization threatening to further restrict global supply, Morocco—and companies like Aya Gold & Silver—are emerging as critical sources for the world’s silver needs. As the gold-to-silver ratio normalizes and the dollar weakens, silver is set for a historic revaluation, presenting a compelling opportunity for forward-looking investors.

end of segment