SILVER: How Banks & Governments Suppress History’s Most Strategic Metal

There's a Silver Stampede Marching West to East. Western Vaults will be out of Silver before US banking panic sets in. Like the adage goes, Gradually Then Suddenly.

The Silver Squeeze: How Banks and Governments Suppress History’s Most Strategic Metal

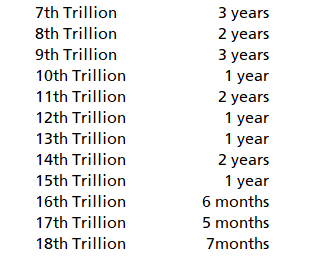

The price of silver today sits at $33 per ounce-33% below its 1980 inflation-adjusted peak of $50. Meanwhile, the U.S. money supply has exploded from $1.5 trillion to $21.5 trillion. What other critical asset remains shackled to 44-year-old prices while currency debasement runs rampant?

For five consecutive years, the silver market has operated in a structural deficit, with demand outstripping supply by 117–215 million ounces annually. Industrial consumption now claims 60% of global silver use, driven by solar panels, AI hardware, and defense tech. Yet prices lag far behind fundamentals. Who benefits from this disconnect, and why?

The Paper Silver Mirage

Since 2008, JPMorgan, HSBC, and other bullion banks have been accused of flooding futures markets with “paper” silver contracts-unbacked by physical metal-to suppress prices. In 2023, former JPM traders were convicted for spoofing tactics: placing fake sell orders to trigger algorithmic panic. These banks hold net short positions equivalent to 25% of annual global production, creating artificial resistance at key price levels.

Why would financial institutions break the law ( risking legal consequences) to cap silver’s value? It’s kind of like those laws in Southern California that its OK to shoplift as long as you don’t steal over $1000 from Macy’s.

The Military’s Silent Silver Heist

During WWII, the Manhattan Project requisitioned 14,700 tons of silver (worth $12B today) from the U.S. Treasury to build uranium-enriching calutron magnets. The loan was returned decades later with just 0.0036% lost-a testament to silver’s irreplaceability in critical systems.

Today, the military-industrial complex remains the largest unreported silver consumer:

Missile guidance systems rely on silver-zinc batteries containing 11,000 oz of silver each.

The F-35 Raptor uses silver-coated components for EMP shielding.

Satellite solar panels and naval systems depend on silver’s unmatched conductivity.

Torpedo systems are the #1 user of Silver (followed by cruise missiles)

Even night vision goggles use silver

Even nuclear energy uses a lot of silver (we were first to report over 6 months ago, article below)

What happens when defense contractors need cheap silver… indefinitely?

The Fed’s Two-Pronged Betrayal

Monetary Policy: Since 1980, the Fed’s money printing has diluted the dollar’s purchasing power by 97%. Silver’s inflation-adjusted high would be $180/oz today-yet it trades at just 18% of that.

Regulatory Complicity: By tolerating paper market manipulation, the Treasury ensures industrial users-especially defense contractors-access silver at Depression-era prices.

Result: A factory worker’s lifetime savings, taxed via income, capital gains, and inheritance levies, evaporates as central banks monetize debt. Meanwhile, the military-industrial complex secures subsidized silver for hypersonic missiles and AI-driven warfare.

The $64,000 Question

With global debt at $307 trillion and trade wars escalating, silver’s historic role as monetary insurance should be skyrocketing. Yet prices remain suppressed. Is this a coincidence-or a calculated strategy to prioritize NATO’s arsenal over citizens’ financial sovereignty?

Consider:

1980 vs. 2025: Adjusted for M2, silver needs a 14x increase to match its prior high.

Supply Crisis: Mine output lags demand

Geopolitical Wildcard: U.S.-China tensions have already triggered silver rallies to $35.10 amid tariff threats.

The Trigger Waiting in the Shadows

When the Hunt Brothers cornered silver in 1980, prices spiked 10x in two years. Today’s deficits are larger, and the COMEX has 3x less registered silver.

What happens when ETF investors or BRICS nations demand physical delivery?

We already see this happening as we reported yesterday. The arbitrage gap between SGE and Comex is a vacuum moving metals West to East. China knows US monetary policy much better than any member of US Congress and they are going to win the Economic war by cutting off the head of the Serpent (The Fed Reserve, US Treasury, MIC, Banking Syndicate)

The system’s fragility is undeniable. As Jon Forrest Little stated on a recent podcast: “They’re not just manipulating silver-they’re managing a controlled demolition.”

Will the 2025 supply crunch finally expose this rigged game? Or will central banks and bullion banks continue sacrificing Main Street’s wealth to arm the Pentagon’s silver-hungry war machines? Recall that the Military Industrial Complex is the only thing backing the US Dollar so the MIC feeds the war machine with two prong attack

1. Eliminate competition for the blood money thats printed into existence

2. Devour Silver for unending wars.

The ticking clock of the debt crisis suggests the reckoning is near.

Final thought:

If 14,700 tons of silver helped end WWII, how many megatons of financial destruction await when today’s paper market collapses under the weight of its own lies?