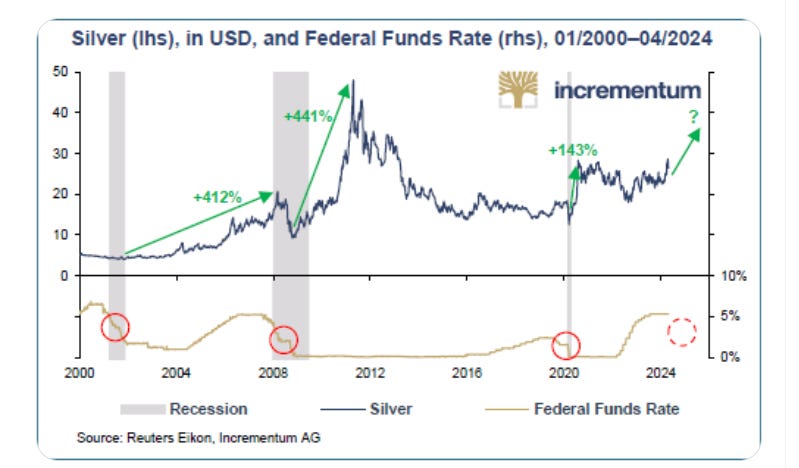

Silver has delivered an average return of +332% during the last three Federal Reserve rate-cutting cycles.

by Pixy St. Claire

1. Silver Spiking.

2. Percentage Growth Following the Last 3 Rate Cut Cycles

3. Per this data, $100 per ounce Silver by 2025 is in play.

Let’s discuss some context leading up to these 3 things:

The stage is set for another move higher for precious metals:

Weakening economic data is sparking increased expectations of rate cuts

Domestic political risk increases after attempted assassination of former President Trump and the Deep State cover up failures (slope roof, shooter acted alone unravels, shooter has encrypted foreign bank accounts, FBI (woman in black hat) implications, etc

The majority of the public believes the assassination attempt was an inside job which signals the transition from US being a world superpower to a “banana republic” (no disrespect towards bananas intended)

Heightened tensions with China & Russia

JD Vance wanting to war with Iran (he states in his first media appearance as VP Pick)

But on the other side of the coin (that has no silver in it) JD Vance is committed to a Rust Belt First monetary policy that will devalue the US dollar.

Devaluing US dollar will make US made goods cheaper and a weaker dollar will send Silver Soaring.

We expect the US dollar to continue lower

Other Facts in playBRICS adopting a hybrid gold standard (More on The Unit and mBridge)

US banks unrealized losses spiking

Commercial Real estate collapsing

Layoffs across all sectors (most notably tech, retail, manufacturing, construction)

Housing market cooling as home values are now a victim of their own success and GenZ and Millennials are shut out of the American dream

GenZ fastest growing group adding gold to their portfolios (can’t afford houses and are watching how its done in China, Vietnam, Thailand, Korea via TikTok and YouTube)

China’s silver imports are picking up…

Moderating US inflation and a weakening labor market are bolstering the case of two cuts this year.

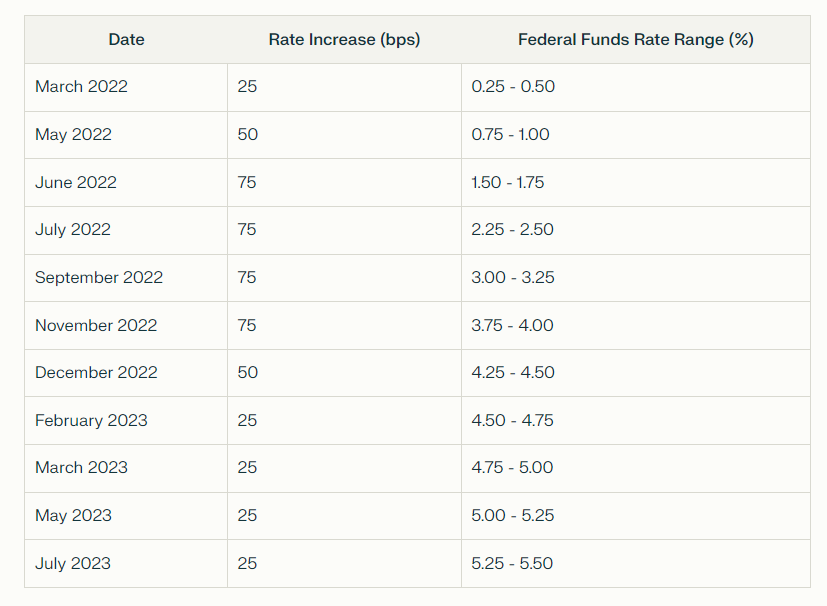

The Federal Reserve has increased rates multiple times over the past 2.5 years, marking one of the most rapid series of rate hikes in recent history. Below is a table summarizing these rate increases:

Federal Reserve Chair Jerome Powell has indicated potential rate cuts in the near future, driven by various economic factors, including the substantial national debt and the high cost of servicing it. Here are the key details:

Economic Context and Signals for Rate Cuts

Debt Servicing Concerns:

The U.S. national debt is approaching $35 trillion. With the federal funds rate currently at 5.25%, the cost of servicing this debt is either impossible or unsustainable. US history has never had servicing the debt as the largest US budget line item and every politician knows this would be their death sentence. Who would re-elect such a condition?

Inflation and Economic Growth:

Powell has highlighted a cooling job market and persistent to sticky inflation as significant concerns. Despite some progress in fooling the villagers into accepting this raging inflation, it remains above the Federal Reserve's 2% target.

When considering what matters (Food, Gas, Rent, Hardware Goods, Medical, Restaurant, Everything) things like Food and Gas are 2 to 3 times more than they were a few years ago.

Powell has indicated that the Federal Reserve might not wait until inflation is fully down to 2% before cutting rates, acknowledging the long and variable lags in the effect of monetary policy.

Market Reactions and Financial Conditions:

The Federal Reserve's shift towards a more accommodative stance has made the prospect of lowering rates more complicated. The Bloomberg U.S. Financial Conditions Index shows that credit conditions have become more favorable, complicating the Fed's ability to cut rates without inadvertently easing financial conditions too much.

The stock market has reacted positively to the Fed's signals, with significant gains in indices like the S&P 500, further complicating the Fed's position on rate cuts.

Policy Discussions and Projections:

Recent minutes from the Fed's policy meetings reveal ongoing discussions about the efficacy of continued tightening measures and the potential diminishing impact of high rates on economic growth.

Powell has emphasized that delaying rate cuts could negatively impact economic activity and employment, signaling a potential shift towards reducing rates if economic conditions warrant it.

Summary of Statements

Bloomberg: Powell kept hopes alive for an interest-rate cut in 2023 but did not provide a definitive schedule, citing the need for inflation to decelerate.

Fortune: An economist warned of a paradox where the Fed's stance on rate cuts could inadvertently ease financial conditions, complicating the actual implementation of rate cuts.

Wall Street Journal: Powell suggested a shift in focus towards considering rate cuts as inflation declines and the labor market slows.

AP News: Powell's testimony highlighted a cooling job market and persistent high prices, indicating a potential move towards reducing interest rates.

CNBC: Powell stated that the Fed would not wait until inflation hits 2% to cut rates, emphasizing the importance of timely policy adjustments.

These developments indicate that while the Federal Reserve is considering rate cuts, the timing and implementation are complex and influenced by multiple economic factors.

end of section

Silver is once again at a 4-year previous resistance, which will act as a support.

Last Thursday and Friday's drop in Silver can be explained by the Gold/Silver Ratio Back testing the previous Support line.

Despite Silver’s Drop last week Silver is still the #1 winner for 2024

Silver has shown a larger percentage increase in value compared to gold in 2024. Here's a breakdown of the information:

Silver has experienced a significant price increase in 2024, with reports indicating a rise of nearly 35% since the start of the year.

On May 21, silver prices closed at approximately $32.00/ounce, representing this substantial rally.

In contrast, gold's price increase has been more modest. According to one source, gold has risen about 13% year-to-date (YTD). This is significantly less than silver's 35% increase.

Another source mentions that silver has gained more than 22% so far in 2024, outperforming gold. While this figure is lower than the 35% mentioned in the first source, it still shows silver outpacing gold's growth.

The strong performance of silver is attributed to various factors, including favorable supply-demand dynamics, expectations of Federal Reserve interest rate cuts, and increased industrial demand.

Silver Academy reporter Jon Little believes the Trump Vance administration will devalue the US dollar sending Silver much higher.

Jon Little also stated that the Gold to Silver ratio will continue in Silver’s favor.

Several analysts and institutions have positive forecasts for silver in 2024, with predictions ranging from $30 to $48 per ounce by the end of the year. These projections further support the strong performance of silver relative to gold.

Silver has shown a larger percentage increase in value compared to gold in 2024, with silver's growth ranging from 22% to 35%, while gold's increase is reported at around 13%.

Silver Academy Modest Fundraiser (Only 2 per year)

We want to raise a quick $5,000 dollars to Grow this channel as a Voice for The Villagers Against the Ruling Class

Please Smash the Donate Button and Please give any amount you can!

Our commitment to research is unwavering, and we are continually expanding our team and resources to ensure we deliver the most comprehensive and reliable information.

If you find value in our research, your support is crucial to our continued work. We appreciate your contribution to our mission.

As the only channel in the USA that curates Silver Promotions, we understand the importance of our unique content. While some may find our frequency excessive, it's necessary due to the lack of silver coverage in the mainstream. For context, the Silver Institute, a well-established authority in the industry, publishes six newsletters per year. We, on the other hand, manage to produce the same amount of content in just two days, showcasing our efficiency and dedication to keeping our audience informed.

Numerous Silver Stations in the US use our content, including Andy Schectman, Money Metals, Guidhall Wealth, Ron's Basement, Silver Slayer, and many more. We have never received compensation for these efforts but consider their echoes to be endorsements.

We were the first to tell why the US Department of Defense stopped reporting its silver numbers.

We were first to sound the alarm concerning Maria Luisa Albores Gonzalez, Mexico's Rising Political Star and Secretary of Environment. She is an earnest, authentic, astute, popular, and competent leader. The US does not have anyone even close to her effectiveness in attracting an impressive coalition of support. (and the potential risk fallout and negative investment impact on Silver.)

First to report Silver as a catalyst in Hydrogen Fuel Cell Vehicles (Silver being more effective than the expensive Platinum Group Metals)

First to report Silver's explosive use in AI data centers

First to connect all the dots (closure of the US Bureau of Mines, depletion of Silver strategic stockpiles, and locating the files on Baker's testimony that US silver supply wasn't adequate for US military silver use)

First to report that Rajesh Exports used cover as a jewelry company when the majority of their Silver was for Silver Zinc batteries (torpedo manufacturing in India)

First to break the story on how gold gets stronger when attacked by lasers.

First to draw the lines between DiRienzo, Bateman, Dept of Treasury, Federal Reserve, and Military elites

First to tie Silver Institue's DiRienzo and Bateman to Klein & Saks / DaVinci Group lobbying conflicts of interest while posing as double agents ( silver advocacy interests)

We have also launched the SilverWars website, (an inexpensive endeavor) which is a comprehensive resource that meticulously documents the military use of Silver. This platform, often referred to as the 'Wikileaks of Silver ', is a testament to our commitment to transparency and in-depth research.

click on the image below to donate