Silver Demand Soaring. Silver mining deficit persists amid soaring industrial and monetary demand.

Silver's crucial role in electrification drives industrial needs, while it serves as a hedge against geopolitical tensions, inflation, banking instability & the staggering $36 trillion national debt.

The market's hypersensitivity to every utterance from figures like Trump and Musk has reached absurd levels. We're living in volatile times where a single tweet can send shockwaves through entire industries.

Trump mentions Bitcoin, and crypto markets surge. Musk jokes about government efficiency, and suddenly Dogecoin skyrockets.

Trump hints at tariffs, and companies scramble to overhaul their strategies.

This knee-jerk reactivity is not just irrational; it's dangerous.

It creates a landscape where sound economic principles are overshadowed by the whims of celebrity personalities. Are we really at a point where Trump's immigration policies might spark a boom in Cuban boat sales to Florida?

It's time for investors and markets to regain perspective and focus on fundamentals rather than fleeting social media buzz. Our economic stability shouldn't hinge on the capricious tweets of billionaires and politicians.

In a world where billionaires are hailed as visionaries, Elon Musk stands out as the poster child for grandiose promises and spectacular failures. Yet, somehow, this modern-day snake oil salesman “master of PR” continues to captivate the public imagination and, more alarmingly, the ears of policymakers.

Let's take a stroll down memory lane, shall we? The Boring Company, Musk's solution to traffic woes, has produced little more than a claustrophobic tunnel in Las Vegas. The Hyperloop, once touted as the future of transportation, remains a pipe dream. And let's not forget the countless "coming soon" features for Tesla vehicles that are perpetually on the horizon.

But why stop at terrestrial failures when you can aim for the stars? SpaceX, while admittedly achieving some successes, has yet to deliver on its loftiest goals. Mars colonization? Still waiting. City-to-city rocket travel? Don't hold your breath.

Despite this track record of overpromising and underdelivering, Musk now fancies himself an expert on government efficiency. The irony is palpable. This is a man who has burned through billions in investor capital, leaving a trail of broken promises and delayed projects in his wake.

The last thing our bloated bureaucracy needs is advice from someone who can't even deliver a functional tunnel on time and on budget. If Musk's version of efficiency involves throwing money at problems until they go away (or until people forget about them), then perhaps it's time we reconsider our fascination with billionaire saviors and their empty promises.

Musk is now promoting cartoons as investments like his overpromoted cartoon dog coin

Elon Musk's latest venture into "government efficiency" is a classic case of misdirection from a master of smoke and mirrors. Let's not forget that this is the same man who runs a trifecta of companies that would crumble under the weight of skyrocketing silver prices.

Tesla, SolarCity (now Tesla Energy), and SpaceX all heavily rely on silver for their operations. Electric vehicles, solar panels, and spacecraft components all gobble up significant amounts of this precious metal.

It's no wonder Musk is suddenly interested in "government efficiency" – a conveniently vague concept that doesn't actually exist as a formal department.

This pivot to bureaucratic reform is a transparent attempt to divert attention from his own vested interests. Musk's empire is built on government subsidies and favorable regulations.

His companies have benefited from an estimated $4.9 billion in government support, a fact that seems to conveniently slip his mind when he dons the hat of a government reformer.

Let's not be fooled by this latest act of corporate theatrics. Musk's sudden interest in streamlining government operations is about as genuine as the promises of his Hyperloop or the functionality of his Las Vegas "loop." It's a calculated move to maintain his influence and protect his bottom line.

The irony is laughable. A man whose companies consistently overpromise and underdeliver now wants to lecture us on efficiency? Perhaps he should focus on delivering those long-awaited features for Tesla vehicles or making good on his Mars colonization plans before attempting to overhaul the government.

In the end, Musk's foray into government reform is just another distraction in his long list of grandiose claims. It's time we see through the charade and focus on the real issues at hand, rather than being led down yet another of Musk's elaborate rabbit holes.

end of section

The fundamentals for silver remain robust. A significant mining deficit persists amid soaring industrial and monetary demand. Silver's crucial role in electrification drives industrial needs, while it serves as a hedge against geopolitical tensions, inflation, banking instability, and the staggering $36 trillion national debt. These factors underscore silver's enduring value proposition, unaltered by recent market fluctuations.

Let’s get into Silver and some demand projections

Solar Demand 2024 thru 2030

To break down the calculation:

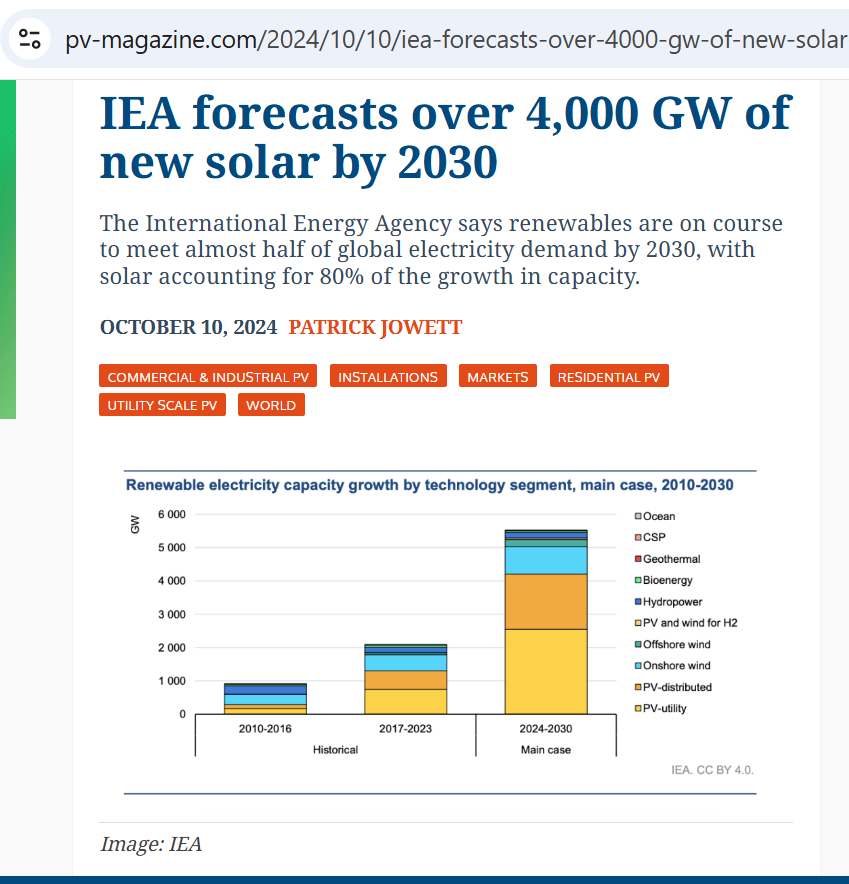

The IEA predicts over 4,000 GW of new solar capacity will be added worldwide by the end of the decade.

Each gigawatt of solar capacity requires 700,000 ounces of silver.

Multiplying 4,000 GW by 700,000 ounces per GW:

4,000 * 700,000 = 2,800,000,000 ounces of silver

This calculation shows that the predicted solar capacity expansion would require 2.8 billion ounces of silver by 2030. This is a significant amount, considering that in 2023, the total global silver demand was approximately 1.2 billion ounces.

The solar industry's growing silver consumption could indeed put substantial pressure on the silver supply leading to supply shortages and price increases in the coming years

Electric Vehicles

Electric Vehicles manufactured per year 2025 through 2030

Assuming a more conservative average annual growth rate of 25% for the next few years, and then tapering off to 20% and 15% in later years as the market matures, we can project:2024: ~17.5 million (25% growth from 2023)

2025: ~21.9 million (25% growth)

2026: ~27.4 million (25% growth)

2027: ~34.2 million (25% growth)

2028: ~41.0 million (20% growth)

2029: ~49.2 million (20% growth)

2030: ~56.6 million (15% growth)

Total EVs produced from 2025 through 2030:

21.9 + 27.4 + 34.2 + 41.0 + 49.2 + 56.6 = 230.3 million

Notes:

EVs with Silver Silver Solid State Battery is calculated as 50% of Total EVs for each year.

Each vehicle using a silver solid-state battery is assumed to use 1 kg of silver.

Total Silver (kg) is the product of EVs with Silver SSB and Silver per Vehicle.

Total Silver (troy oz) is calculated by multiplying Total Silver (kg) by 32.15074 (the conversion factor from kg to troy oz).

This table shows that if half of the projected 230.3 million electric vehicles produced from 2025 to 2030 adopt silver solid-state batteries using 1 kg of silver each, the total silver demand would be 115,150,000 kg or approximately 3,702,207,771 troy ounces.

Now let’s assume Samsung is lying or mistaken and they have no plans to introduce a silver solid state battery that has these features:

1. half the charging time

2. goes twice as far

3. lasts twice as long

4. is 40% lighter

Good, because we may not have the silver anyway because Solar, Aerospace and Military is taking most of it.

Silver Zinc Batteries

Click on the video below to see how large these silver zinc batteries really are.

Many are over the height of a human being.

Some have as many as 11,000 ounces of silver