This graphic is a widget that involves a complex series of math formulas to determine the spot price of Silver on Shanghai Exchange (a physical only market) in US Dollars.

Methodology: To convert the Shanghai silver price from Chinese yuan per kilogram to US dollars per ounce, divide the yuan price by a thousand (kilo is 100 ounces), multiply by the ounce weight, then multiply by the yuan-to-dollar exchange rate. This gives the price in dollars per ounce.

Price of Silver for majority of World is closing in on $39 per ounce

We’ve been telling people (some complain too often) that Silver is on the march as a monetary metal (a less expensive alternative to gold) and why?

The US dollar is collapsing

US Treasuries are collapsing

US Banks have no liquidity

US Debt is closing in on 37 Trillion dollars

Silver is a hedge against inflation and currency debasement

US is experiencing a Sovereign Debt Crisis

The majority of the World buys Silver recognizing the Shanghai exchange with the three largest buyers being China, India and Russia (dwarfing US retail silver bullion buying)

Keep in mind once silver blew by $35 to north of $36 in only 1 or 2 trading days that there is no technical lines of resistance until $50

Step Aside Western Silver ETFs:

Kevin Bambrough (co-founder of Sprott Resources) states, “India will buy up coins on mass and spark a blow out rally to crazy heights. Precious metals in their DNA. It’s wired in epigenetically in their history of getting screwed by governments and suffering financial trauma.”

Chart by Stephen St. Angelo who tweeted, “Step Aside Western Silver ETFs: Powerful Indian Silver ETF Demand Surpasses iShares SLV & Sprott PLSV ETF Something BIG is happening in India, as Silver ETF demand surpassed the SLV and PSLV ETFs in 2025.”

Really the only chart we pay attention over next few months is the Gold to Silver ratio which is on the move towards 55 to 1. Eric Sprott thinks it is headed much lower to between 15-1 and 12-1. And given there is less Silver above ground than Gold, I’ve heard logical predictions that it may head to the ratio to which it is mined relative to Gold which is around 8 to 1.

Silver is detecting there is big trouble with Western Banks and the Government that allows Western banks to go rogue with money creation via fractional reserve banking (zero reserve requirement)

The economy is breaking—and the only question is, how long before it shatters completely? For the first time, all 12 Federal Reserve districts are reporting lower labor demand, with hiring freezes, slashed hours, and waves of layoffs echoing from coast to coast. But is anyone paying attention, or are we sleepwalking into the abyss?

Severance? If you’re lucky, you’ll get 8–12 weeks—before taxes. What happens when that runs out and the next job is nowhere in sight? Credit delinquencies have surged to 12.31%, the highest in over a decade, as millions struggle to pay their bills. Can you imagine the cascade when even more families can’t keep up?

Nearly 42% of homeowners seeking to refinance are being denied, with mortgage application rejections hitting a decade high. How many living rooms are now doubling as war rooms, where every bill is a battle? Over 600,000 Americans have already lost their jobs in 2025 alone—and that’s just the official count. Who’s next?

Forecasters warn that unemployment could hit 4.8% by year’s end, with some economists painting an even grimmer picture. Are you ready for a six-month job search with just two months of cash? Add to that soaring debt, shrinking access to credit, and wage garnishments from student loans about to hit, and the crisis becomes personal—fast. How many more downward revisions to job data will it take before the headlines finally catch up?

This isn’t just a slowdown. It’s a warning siren for a system under siege. The question is, will we wake up in time—or will we keep pretending everything’s fine until the headlines force us to look?

Trump’s response to the FROZEN US Economy

is …..

A Military Parade and Normalizing our Militarized Future.

Use the Military against Your Own People.

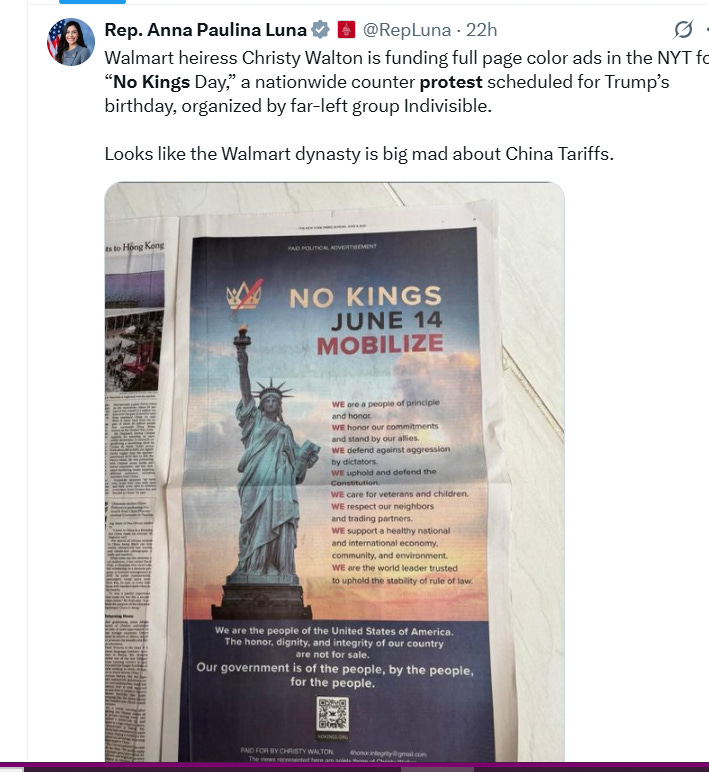

Trump tweeted that anyone protesting The Military Parade will be met with “Very Heavy” Force.

President Trump’s tariffs—especially sweeping import taxes—have created major uncertainty for markets and employers, threatening millions of jobs and slowing hiring as companies brace for higher costs and potential layoffs. His erratic tariff approach, with rates on Chinese goods jumping from 10% to as high as 25% ,30%, 100% in past tweets, has made it difficult for businesses to plan ahead. Economists warn that Trump’s policies will drastically cut U.S. GDP growth and raise unemployment, with long-run damage potentially worse than corporate tax hikes.

Meanwhile, Trump has undertaken a self-dealing Middle East tour, securing deals with Gulf states and Syria—while his net worth soared nearly 40% thanks to crypto schemes and the launch of the $TRUMP coin, enriching himself through play-to-pay ventures. Let’s not forget the $500,000 per year membership (access to Trump) to join the “Executive Branch” a private club in Georgetown.

Then Musk tweeted (followed by by him being scared and removing the post)

Trump’s response has been to double down, deploying the U.S. military against American citizens. He is leveraging immigration—the only issue where he consistently polls well, and the most divisive one left—to shift the news cycle away from his decades-long entanglement with Epstein.

Trump is dispatching Marines and federalized National Guard troops, stretching the legal boundaries of Title 10 without invoking the Insurrection Act. This is not merely an exercise in crowd control—it is a litmus test for how far the federal government can push military presence into the civilian domain.

Why? The stated reason is a familiar refrain: “illegals.” But let’s be clear—the so-called “fight against illegal immigration” is a smokescreen, a narrative carefully crafted to secure public support or at least passive acquiescence. The real objective runs deeper.

This is a trial run for federal overreach against state authority. It is a probe into public tolerance for uniformed troops in American cities, a test of military discipline under civilian command, and a measure of how effectively the media can spin the story to avoid backlash.

They know what’s coming. Economic strain. Skyrocketing food prices. Debt implosion. Currency collapse. The powers that be are preparing their playbook: “How do we impose order when the system buckles?” That’s why this California deployment matters—it’s a dry run for what’s next.

When the dollar finally plummets and desperate Americans take to the streets, this framework will be rolled out for economic martial control.

Why Marines? Because they are swift, disciplined, and accustomed to projecting force. They are less connected to local communities than National Guard units, making them ideal for this psychological and legal conditioning. The goal is to normalize the sight of uniformed military on American streets.

The federal government is watching closely—gauging public reaction, tracking legal challenges, and assessing how troops respond to political direction. This is preparation for the next phase, when the foundations of our society begin to crumble. This is no ordinary crisis management. It is the rehearsal for collapse.

Response from main street

The US Villagers are sick of Authoritarianism

end of segment