SILVER: Chinese Media Promoting Cheaper Alternatives to Gold

Looks like by manufacturing FOMO this will be the final push

Context:

For decades, Western banking institutions have treated silver as a strategic vulnerability, employing a range of tactics to suppress its price and discourage widespread ownership. This has included persistent short selling, spoofing, and frequent rule changes at the COMEX exchange, all of which have served to demoralize and disincentivize retail investors from holding silver.

The mainstream media has largely maintained a blackout on silver’s true potential, further reinforcing the narrative that silver is an unworthy asset for the average person.

In stark contrast, China has recognized the unique value of silver and is now actively promoting it as the “poor man’s gold.” By encouraging retail investment and building strategic reserves, China is positioning itself to benefit from a surge in physical demand, while Western markets remain mired in paper-based price suppression.

This shift in narrative is fueling a wave of retail FOMO (fear of missing out) in China, as ordinary investors rush to acquire silver, sensing both its intrinsic value and its potential as a hedge against financial instability. As the old mechanisms of price control lose their grip, China’s proactive stance is poised to reshape the global silver market.

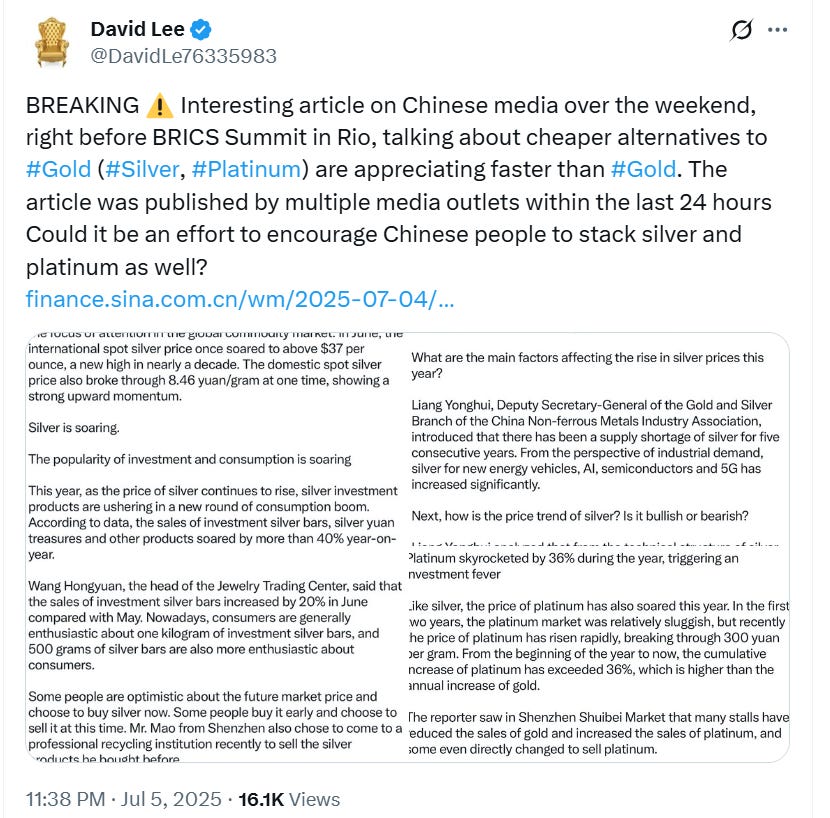

The article from Sina Finance, published on July 4, 2025, explores the dramatic rise in silver and platinum prices, positioning them as the new stars of the precious metals market, following in the footsteps of gold. Since the beginning of 2025, silver prices have soared, drawing significant attention from global investors and consumers alike. In June, the international spot price of silver broke through $37 per ounce, reaching its highest point in nearly a decade. In China’s domestic market, the price of silver also surged past 8.46 yuan per gram, signaling robust momentum.

This rapid price increase has sparked a new wave of investment and consumer enthusiasm for silver products. Sales of investment-grade silver bars and ingots have jumped by more than 40% compared to the same period last year. Wang Hongyuan, an executive at a jewelry trading center, noted that June’s sales of investment silver bars were 20% higher than in May, with 1-kilogram and 500-gram bars being particularly popular among buyers. The market is seeing a mix of investors: some are buying in anticipation of further price hikes, while others who purchased silver earlier are now selling to lock in profits. Silver recycling companies report that buybacks are brisk, though they must carefully test and melt down items to ensure purity. While counterfeit silver is relatively rare, it is not unheard of.

Several factors are driving this surge in silver prices. Liang Yonghui, Deputy Secretary-General of the Gold and Silver Branch of the China Nonferrous Metals Industry Association, explained that the global silver market has experienced a supply shortage for five consecutive years. At the same time, industrial demand for silver has increased sharply, particularly from high-growth sectors such as new energy vehicles, artificial intelligence, semiconductors, and 5G technology, all of which require significant amounts of silver for manufacturing.

Looking ahead, the outlook for silver remains bullish. Although the price is currently at a technical resistance level of $37 per ounce, Liang believes that this barrier could be easily overcome, especially with strong international capital flows. The expectation that the US Federal Reserve will continue to cut interest rates plus the injection of debt into US from Big Beautiful Bill (both factors occurring for an extended period) will further support the rise of silver and other precious metals.

Platinum has also enjoyed a remarkable rally in 2025. After years of underperformance, platinum prices have surged past 300 yuan per gram, with a cumulative increase of more than 36% since the start of the year—outpacing even gold’s gains.

In Shenzhen’s Shuibei jewelry market, many vendors have shifted their focus from gold to platinum, with some even dedicating their entire inventory to platinum products.

Despite the excitement, experts urge caution. The precious metals market is currently highly volatile, influenced by international geopolitical tensions and shifting economic policies. Consumers and investors are advised to remain rational and avoid blindly chasing rising prices, as this could expose them to significant risks.

In summary, the article highlights how silver and platinum have become the new darlings of the precious metals market in 2025, driven by both investment and industrial demand. However, it also emphasizes the importance of prudent and informed investing in such a rapidly changing environment.

end of segment

In US News

Elon Musk has officially launched the American Party, following his fierce criticism of President Trump’s “Big Beautiful Bill.” Musk, who previously led the Department of Government Efficiency, called the bill the worst legislation for workers, arguing it massively increases debt and threatens the already fragile US economy. The bill narrowly passed the Senate with a 50-50 split, requiring Vice President JD Vance to cast the tie-breaking vote, highlighting the GOP’s razor-thin majority. Musk’s new American party aims to capture a few key seats, which could stall Trump’s agenda and potentially render him a lame duck

Now Musk has taken to Twitter and is once again needling Trump about Trump sexually abusing (even raping) children.

Musk and millions of others understand that Trump frequented Epstein parties.

We all know Epstein was a spy for Israel in charge of photographing US officials with underage girls

Israel uses this leverage as blackmail to keep US politicians in their pocket

Mr. Wolff, Like the infamous Monica Lewinsky’s dress stain?

Short List of Public Figures Ruined by Sex Scandals

Kevin Spacey

Jimmy Swaggart

Dominique Strauss-Kahn

Bill Cosby

Jerry Falwell Jr.

Matt Lauer

John Profumo

Ravi Zacharias

Bill Clinton

Jim Bakker

Charlie Rose

Roger Ailes

Armie Hammer

Anthony Weiner

Tiger Woods

Robert Morris

Jian Ghomeshi

Harvey Weinstein

David Petraeus

Ted Haggard

Mark Foley

R. Kelly

John Edwards

Eddie Long

Tony Alamo

Jeffrey Epstein

Douglas Goodman

Louis C.K.

Gilbert Deya

Eliot Spitzer

Donald Trump?