Saudi Arabia's Secret Gold Acquisition: Boosted their Vault to 15.5 Million Troy Ounces. Ranking Among the World's Top Holders

Visualizing How Dense and Valuable One ounce of Gold is using an ordinary purse for perspective.

The true extent of each country's gold reserves remains shrouded in mystery, much like how individuals don't broadcast their personal wealth to their neighbors.

Nations guard information about their gold holdings closely, often considering it a matter of national security. Just as a homeowner wouldn't invite strangers to inspect their safe, countries are reluctant to allow thorough audits of their gold vaults.

In the United States, citizens have repeatedly called for a comprehensive audit of Fort Knox, but these requests have been met with resistance from the Federal Reserve and the U.S. Treasury.

The lack of transparency surrounding national gold reserves has fueled speculation and many contingency theories, with some questioning whether the reported figures accurately reflect reality.

Without independent verification, the public must rely on official statements, which may not tell the whole story.

Ultimately, the secrecy surrounding gold reserves serves as a reminder that in matters of national wealth, governments often prefer to keep their cards close to their chest.

Saudi Arabian Monetary Authority (SAMA) has secretly purchased 160 tonnes of gold from Switzerland.

Saudi Arabian Monetary Authority (SAMA) has secretly purchased 160 tonnes of gold from Switzerland. This significant acquisition was discovered through Swiss customs data, which showed large gold exports to Saudi Arabia in August 2024. The purchase is noteworthy for several reasons:

Scale and Secrecy

The 160-tonne gold purchase is substantial, valued at approximately $10 billion at current market prices. SAMA conducted this transaction discreetly, without public announcement or disclosure in their official reserves.

Impact on Saudi Gold Reserves

Saudi Arabia's official gold reserves, which were previously reported at 323.1 tonnes

If confirmed, this would elevate Saudi Arabia's gold holdings to 483.1 tonnes, potentially placing them among the top 20 gold-holding nations globally.

this chart below is a bit dated old (2020) and again no one knows. Analysts like Alasdair Macleod have stated China has Gold reserves far north of 20,000 tonnes

Geopolitical Implications

The secret gold purchase is seen as part of a broader trend of de-dollarization among nations seeking to reduce their dependence on the U.S. dollar.

This move aligns with Saudi Arabia's recent efforts to diversify its economy and financial strategies, including joining the BRICS economic alliance.

.Market Reactions

The news of this substantial gold purchase has sparked discussions about its potential impact on the global gold market and geopolitical dynamics.

Analysts are closely watching for any official confirmation or statement from Saudi authorities regarding this significant gold acquisition

Understanding Why Gold, Why Now?

Because now the Nations and businesses of the World can buy more oil via Gold proxy than they could before using US dollar

1. Gold always steps up to do the accounting for human errors (greed, corruption, wars, theft, over-taxing, incompetence, poor judgment, poor stewardship, bad monetary policy, government over-reach, etc)

BRICS meeting next month in Russia

US circling the drain with rest of world dumping US treasuries and favoring Gold

No one wants a part of the US experience now which is tethered to 35.5 Trillion Debt

and a regime involved in unending wars, internal civil strife, a divided electorate and banks about to collapse larger than 2008

because 2008 wasn’t fixed and the pending Commercial Real Estate Collapse.

The UNIT (40% gold backing) has been tested, it works

With Gold at $2,550 and oil at $67, one can buy 38 barrels of oil with just one ounce of gold.

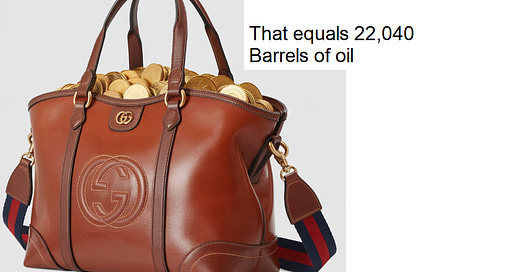

Visualizing how much oil you can buy with Gold

Let’s Look at one ladies purse with a 20 pound capacity, then run another scenario with 40 pound capacity (more like a tote/backpack)

A high-quality leather purse with reinforced straps

limited to a 20-pound capacity, could hold approximately 290 troy ounces of gold.

This purse is equal to transporting 11,020 barrels of oil

One purse, not packed to its capacity is equal to Eleven thousand and twenty barrels of oil

Purse Specification

Let's consider a high-quality leather purse with reinforced straps, designed to carry heavier items:

Material: Full-grain leather

Straps: Reinforced leather with metal hardware

Style: Ordinary 6 inches tall x 10 inches length

290 gold coins in a purse like this would fit with ease

2nd Scenario: Purse Specifications

Design: Leather Tote/Satchel

Material: Full-grain leather

Dimensions:

Length: 16 inches

Height: 12 inches

Depth: 6 inches

Straps:

Material: Reinforced leather with double stitching

Width: 1.5 inches

Length: Adjustable, 22-26 inches drop

Hardware:

Material: Solid brass or stainless steel

Features: Heavy-duty zippers, rivets, and buckles

Closure: Top zipper with leather pull

Interior:

Fully lined with durable fabric

Multiple interior pockets, including a padded laptop compartment

Key leash

Exterior:

Front and back slip pockets

Side gussets for expandability

Protective metal feet on the bottom

Weight Capacity:40 pounds (18.14 kg)

Additional Features:

Reinforced bottom panel for extra support

Double-layered leather handles for comfort and durability

Optional removable and adjustable shoulder strap

For perspective

Commercial oil storage tanks often have capacities around 1,000 gallons (about 24 barrels)

This purse above equals about 918 commercial oil storage tanks