Rethinking Silver Prices: Alternative Ways to Measure Value

Avoid Pricing your Silver in US dollars as Metals continue marching from the West to the East

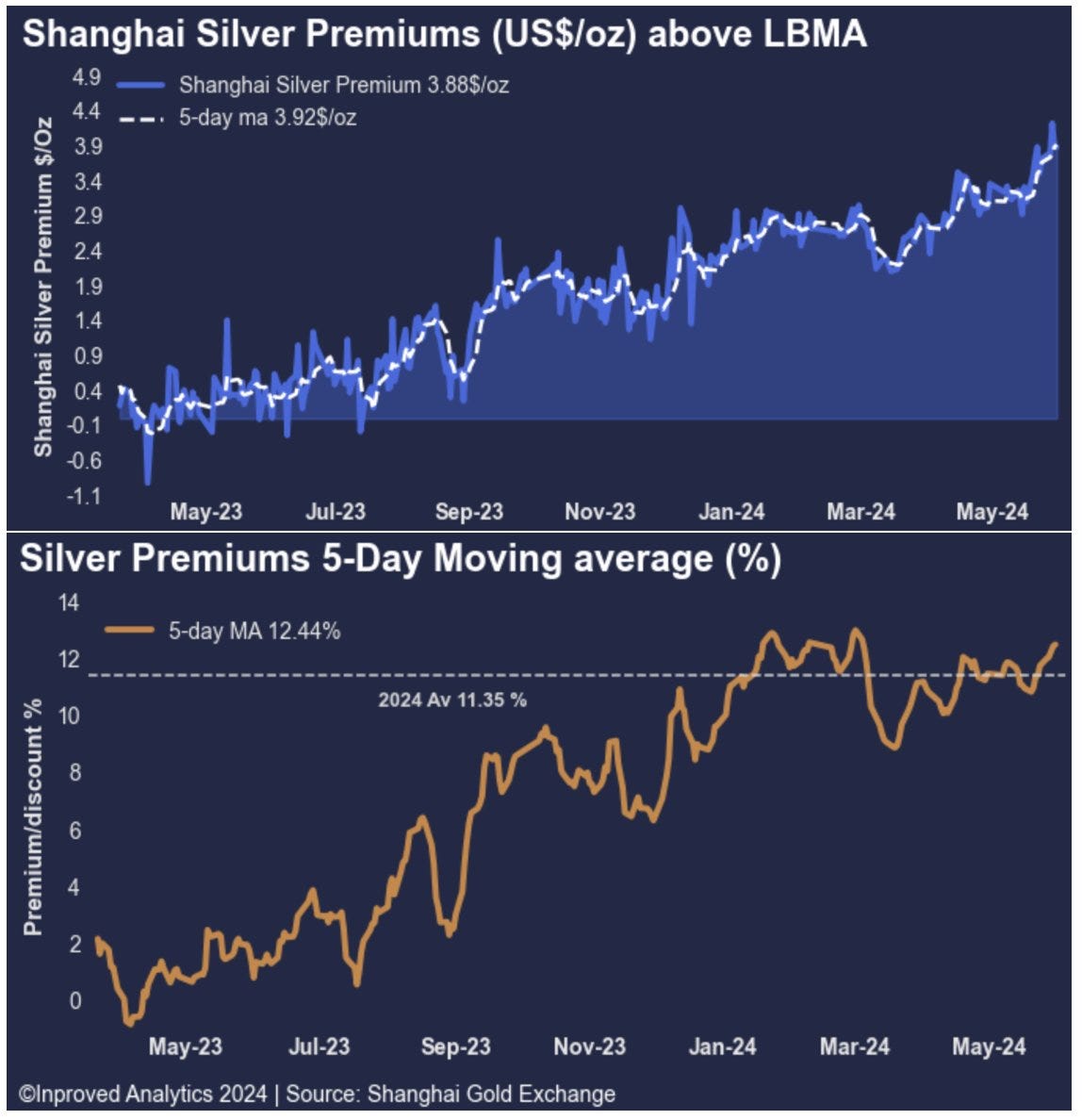

Premiums remain resilient, close to $4 per ounce above the LBMA benchmark.

12.44% Arbitrage.

As long as this spread remains, the Crimex Comex drain continues.

Given the premise that the US dollar is not backed by gold, oil or anything but the US military (please consider the trappings of thinking of Silver in dollar terms)

Silver, the unparalleled conductor and reflector on the periodic table of elements, possesses unique properties.

Silver's exceptional ductility and malleability have secured its irreplaceable role in industries such as aerospace, AI, military, communication, robotics, and computing. With its distinctive characteristics, the value of Silver is truly undeniable.

The demand for Silver is rising as the US dollar experiences a steep decline (with 2 trillion in US treasuries dumped by rival BRICS ++).

...Considering the current economic landscape, it's prudent to view Silver not just as a commodity but as a potential currency in itself.

So the correct trade is to gather whatever Federal Reserve notes you can spare and convert that paper into something portable, divisible, fungible, a store of wealth, an inflation hedge, and has intrinsic value (i.e., used for all the aforementioned emerging industries)