Our Rulers are Trying to Kill US. Empire, War & Fake Money Grind Down the People

Why Only Real Money and Real Reform Can Break the Cycle of Corruption, Collapse, and Endless War

Disclaimer

I often get asked why I’m so hard on President Trump, and my answer is straightforward: I’m equally critical of all politicians who push fake money. If we fix the money, most of our social problems would start to fix themselves. You wouldn’t build your house on a sandy foundation, and you shouldn’t build an economy on a currency that’s nothing more than printed debt.

That’s why I used to rail on the Biden crime family too—it’s about the system, not the party. If we ever truly get a people’s president, I believe it will come from a third party. Right now, Thomas Massie is looking like he could be that kind of leader—someone who stands for real reform and accountability

Why am I obsessed with silver and so critical of US policy?

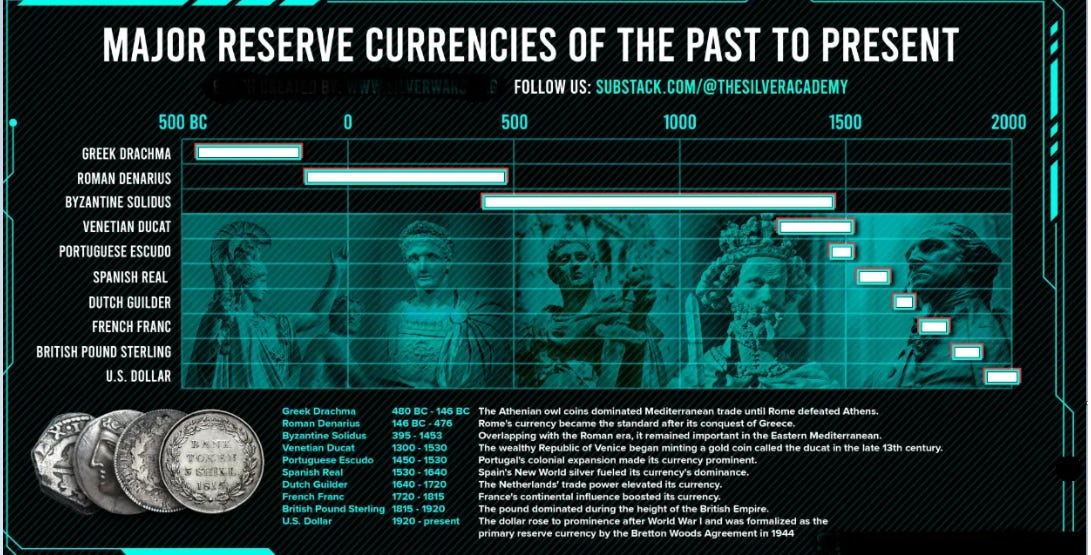

The answer is written in the history of every great empire—from Athens to Rome, from Lisbon to London, and now in Washington. It starts with the first minted coins: the Athenian owl, struck to fund Athens’ war against Sparta. The owl coin, a symbol of wisdom, became instead a tool of empire, its silver content debased over time to pay for endless conflict.

The pattern repeats, relentless and cruel. The Portuguese escudo, the Spanish real, the Dutch guilder, the British sterling—each rose to global prominence as its empire expanded, each fell as rulers grew rich from war and the people paid with inflation and taxation. The real, real de a ocho (the “piece of eight,”) fueled Spain’s conquests but collapsed under the weight of imperial ambition. The guilder, minted from gold and silver, backed the Dutch East India Company’s ruthless global reach until Britain’s sterling—backed by the Royal Navy—took its place. And the pound, once the world’s reserve currency, succumbed to devaluation as Britain’s empire waned.

Now, the US dollar reigns. Like its predecessors, it is a printed debt note, a de facto war bond, its value propped up not by gold or silver, but by the threat of military force and the suffering of workers who bear the cost of endless war.

A true patriot does not cheer for this system of printing money to enrich war profiteers. A true patriot fights it—using every tool at their disposal, including silver, the people’s money, to resist the cycle of empire, debasement, and war.

That is why I will sit back and cheer for the death of the US dollar: not out of malice, but because the dollar is the millstone that grinds down the innocent, while the rulers profit and the workers pay.

I don’t hate my country, I hate why my country’s rulers are doing to us. There is a huge difference in those last two sentences.

Nail in the Coffin Proof

Smoking Gun

We should work together to Stop or fight People like Trump if we want to promote Silver and Stop Unending Wars

Donald Trump, both as a presidential candidate and after securing the Republican nomination for the 2024 election, made multiple public statements threatening severe consequences for countries that attempt to move away from the US dollar or trade outside of it, insisting that the dollar must remain the world’s reserve currency.

One notable event occurred during a campaign rally in Mosinee, Wisconsin, on September 7, 2024, where Trump explicitly stated:

“We will keep the US dollar as the world’s reserve currency. It is currently under major siege. Many countries are leaving the dollar. They’re not going to leave the dollar with me. I’ll say, ‘You leave the dollar, you’re not doing business with the United States, because we’re going to put 100% tariff on your goods.’”

He reiterated this position in an interview on CNBC’s “Squawk Box” on March 11, 2024:

“I’m very much a traditionalist. I like staying with the dollar. I hate when countries go off the dollar. I would not allow countries to go off the dollar.”

The quote above is quite chilling really, what does he mean when he says I would not allow countries to go off the dollar?

As if the USA has some arrogant right or authority to tell other nations how to conduct their affairs.

Anyone with a brain in their skull understands this means he would use tariffs which is a tax or economic warfare (that ultimately punish the workers) and military (which leads to more death and currency debasement)

Trump also targeted the BRICS nations specifically, demanding commitments that they would not create a new currency or back any alternative to the US dollar. In a post on his Truth Social platform, he wrote:

“The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER… We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy.”

These statements are widely reported and corroborated by multiple sources

Trump’s position is that he would “not allow countries to go off the dollar,”

threatening 100% tariffs or military intervention on any country that attempts to de-dollarize or trade outside the US dollar system.

I say this almost every day on this newsletter.

Silver is the opposite of the US dollar, why?

Silver can’t be printed and has intrinsic utility (over 20,000 uses)

A constrained monetary system would not allow politicians to profit off unending wars

Putting a Trump or Biden sticker on your car is like stating “I Hate Silver”

Why? Because Silver is the opposite of the US dollar and these politicians never once try to End the Federal Reserve. Why? Because they are obedient to the Federal Reserve like Napoleon said on his death bed, “The hand that gives is above the hand that takes.”

Please abandon some bizarre loyalty to a US politician.

But don’t feel bad, the Media did this to you, it’s part of our celebrity worship culture.

The Unyielding Pattern: Military Might as the Dollar's Sole Backing

The historical record is unequivocal: nations challenging the dollar's hegemony face devastating consequences. Iraq's 2000 shift to euros for oil trade saw Saddam Hussein toppled by a U.S.-led invasion, with dollar-denominated oil trade forcibly restored within weeks. To this day Iraq’s oil is settled by the Federal Reserve. Libya's Muammar Gaddafi met a similar fate after proposing a gold-backed pan-African currency; NATO's 2011 intervention destroyed Libya's financial infrastructure and ensured the gold dinar never materialized. Syria's currency collapse to 15,000 pounds per dollar—accelerated by U.S. sanctions like the Caesar Act—forced northern regions to adopt the Turkish lira for survival. Iran's recent bombing aligns with this decades-long pattern of military enforcement.

These interventions reveal a brutal truth: the U.S. dollar's global dominance rests entirely on American military supremacy, not intrinsic economic value. As scholar Pierre Yared notes, investors seek "an asset that will preserve its value in a cataclysmic state," achievable only when backed by "a government with a very strong military". The petrodollar system—born from Nixon's 1971 abandonment of gold convertibility—collapsed in June 2024 when Saudi Arabia ended its dollar-exclusive oil agreement. With the dollar now unmoored from both gold and oil, military coercion remains its sole foundation.

The Inevitable Zero: Fiat Currencies and Dalio's Big Cycle

Ray Dalio's "Big Cycle" thesis exposes the dollar's trajectory toward collapse. All fiat currencies—including the dollar—follow a predictable path to zero due to:

Artificial demand: Fiat currencies rely on legal tender laws, not market choice, creating unsustainable artificial demand.

Debt-driven implosion: The US just crossed the $37 Trillion debt threshold. With $11 Trillion of this set to be refinanced at much higher rates. Moreover, The U.S. faces a $2 trillion annual deficit and $1 trillion interest payments, forcing money printing that devalues the currency.

Historical inevitability: The average fiat currency survives just 35 years before hyperinflation destroys it, as seen in Zimbabwe (100 trillion dollar notes), Weimar Germany, and modern Venezuela.

Dalio's model shows empires peak when combining innovation, productivity, and military strength, then decline as debt, inequality, and loss of competitiveness set in. The U.S. now exhibits all late-cycle symptoms: excessive borrowing, internal conflict, and a military stretched thin by global commitments. As Dalio warns, "It's like plaque building up in the arteries... interest payments squeeze out other consumption".

If you are wondering who Ray Dalio is:

Ray Dalio is a billionaire hedge fund manager and founder of Bridgewater Associates, the world’s largest hedge fund. Recently, Dalio slashed Bridgewater’s S&P 500 exposure while buying gold (GLD), Baidu, and Alibaba, reflecting his belief in global shifts and the need to hedge against the collapsing US dollar.

Conclusion: The Terminal Stage

The evidence is irrefutable: the dollar's dominance persists only through military enforcement, while economic fundamentals point inexorably toward collapse. Nations like China, Iran, Russia (soon Mexico) and BRICS members accelerating de-dollarization are merely the latest challengers in a cycle that has consumed every fiat currency in history. With the petrodollar dead, gold convertibility abandoned, and debt spiraling, the dollar's fate mirrors all fiat predecessors—a descent to zero.

As Dalio's data confirms, we are witnessing the terminal phase of the American-led financial order. The only uncertainty is how violently the transition unfolds.

As to the headline

Our Leaders are Trying to Kill US

Inflated Money Supply: Endless money printing devalues currency, forcing workers to labor longer for less purchasing power.

Unattainable Housing: Rampant inflation and speculation make home ownership a distant dream for many.

Skyrocketing Medical Costs: Healthcare becomes unaffordable, leaving people to suffer or go without critical treatment.

Excessive Taxation: Nearly 40% of income lost to taxes means families go without basic necessities.

Crime and Civil Strife: Economic desperation fuels crime waves and social unrest.

Death by a Thousand Cuts: The cumulative effect of these pressures slowly erodes quality of life.

Contaminated Water Supply: Aging infrastructure and industrial pollution make safe drinking water unreliable. Weird chemicals in our drinking water such as Flouride.

Corporate Farm Takeover: Family farms disappear as large corporations and foreign investors buy up land.

Tainted Food Supply: Industrial agriculture fills the food chain with artificial chemicals and harmful additives.

Lab-Made Virus Threats: Gain-of-function research and lab leaks put public health at risk from engineered pathogens.

After reading this list, you might be wondering how anyone’s supposed to keep their head above water—let alone get ahead—when the deck feels so stacked. But hey, aside from runaway inflation, unaffordable basics, poisoned food and water, corporate land grabs, and the occasional lab-cooked virus, things are going just great. Or, as the old joke goes: Other than that, Mrs. Lincoln, how did you enjoy the play?

end of segment

We are living in a critical moment: truth is under siege as mainstream media obscures the realities of war, currency collapse, and the growing power of the military-industrial complex. Workers are struggling as endless money printing funds endless wars, siphoning wealth from ordinary people. Only courageous, independent media dares to report the facts. Our team has broken major stories—the U.S. silver stockpile, Mexico’s red flag jurisdiction, and now Congressman Thomas Massie’s lonely stand against entrenched interests. We urgently need your support to keep uncovering truth and exposing hidden agendas. Please donate now—your contribution keeps independent journalism alive.

Thank you!

not financial advice

our opinions are not our sponsors opinions

editorial department is separate from promotions department