Of the Three Ways to Get Gold or Silver, Which is the Easiest?

Mine Gold. Buy Gold... but there is another method that requires less work

The great German sociologist Franz Oppenheimer pointed out that there are two mutually exclusive ways of acquiring wealth; one, the above way of production and exchange, he called the “economic means.” The other way is simpler in that it does not require productivity; it is the way of seizure of another’s goods or services by the use of force and violence. This is the method of one-sided confiscation, of theft of the property of others.

Historical Gold Confiscations and Allegations: A Comparative Analysis

Spanish Conquest of Mesoamerica

During the Spanish conquest of Mesoamerica, significant amounts of gold were seized from indigenous civilizations. Hernán Cortés’s encounter with the Aztecs (1519-1521) yielded an estimated 8-10 tons of gold, though much was lost during the Spanish retreat known as La Noche Triste in June 1520. Over the next two decades, Spain shipped approximately 185 tons of gold and silver from the region.

Similarly, Francisco Pizarro’s conquest of the Inca Empire (1532-1533) resulted in the infamous ransom of Atahualpa, which filled a room with gold (estimated at 6 tons) and twice with silver. Over time, the Spanish extracted around 180 tons of gold and 16,000 tons of silver from the Inca territories.

Nazi Gold in World War II

The Nazi regime systematically looted gold during World War II, targeting both national reserves and individual victims. The Tripartite Gold Commission documented over $400 million (1945 value) stolen from central banks, equivalent to 337 tons of gold. Additionally, Holocaust victims’ personal belongings, including jewelry and dental gold, were melted down, contributing an estimated 10-12 tons to the Reichsbank’s reserves.

Despite efforts to recover the stolen gold, an estimated 5-10 tons remain missing, fueling theories such as the legend of Yamashita’s Gold.

Modern Allegations of Gold Seizures

In recent decades, allegations of gold confiscation have surfaced in various conflict zones, though evidence remains speculative.

Iraq (2003 Invasion):

Following the U.S.-led invasion, the Iraqi Central Bank claimed that 90 tons of gold (valued at $1.5 billion) had vanished. However, Pentagon audits found no evidence of systemic U.S. involvement, attributing the loss to widespread looting during the chaos of the invasion.

Snarky Comment from the editorial team:

I can't count how many NFL games, PGA tour events, Major League Baseball, NHL, and NBA Basketball I’ve watched and observed this insanity. You can’t go an entire match without some propaganda message.

The irony of "Support our Troops" dominates every sports broadcast. It's formulaic, predictable, and disingenuous.

Maybe it should be "Support our Troops Stealing Gold," for honesty’s sake.

Nothing says unity, such as using athletes to push propaganda while ignoring the real issues. But who needs critical thinking when you’ve got blind patriotism served with your nachos? Let’s not confuse distraction with devotion—genuine support goes deeper than a slogan on a jumbotron.

Libya/Gaddafi (2011):

Prior to the 2011 conflict, Libya held 144 tons of gold. Post-conflict, reports suggested that loyalists had moved the gold to Sabha, but there is no credible evidence linking the U.S. to its seizure.

What happened to 1,000 tonnes of gold reserves in Libya after the NATO invasion?

Ukraine (2014/2022):

Ukraine’s gold reserves dropped from 26 tons in 2014 to 12 tons by 2022, primarily due to economic struggles. Russian state media has alleged that the U.S. “stole” Ukrainian gold in 2022, but Kyiv has confirmed that no gold was transferred to the U.S.

Sudan and Russia (2021 to present?)

Abdel Fattah al-Burhan, the Sudanese military leader and de facto ruler, has been implicated in a complex gold smuggling network that benefits Russia. According to reports, Russia has colluded with Sudan’s military leadership, enabling billions of dollars in gold to bypass the Sudanese state. A whistleblower from the Sudanese Central Bank revealed that 32.7 tons of gold, worth approximately $1.9 billion, were unaccounted for in 2021. However, other sources suggest that the actual amount of gold smuggled out of Sudan could be as high as 90% of the country’s production, amounting to roughly $13.4 billion annually.

Al-Burhan’s ties to Russia are well-documented, with reports indicating that he and other Sudanese military leaders have facilitated the smuggling of gold to Russia, particularly through the Wagner Group, a Russian paramilitary organization. This gold has reportedly been used to support Russia’s war efforts in Ukraine and to circumvent Western sanctions.

While specific figures directly attributing the theft of gold to al-Burhan are not provided, the evidence suggests that his leadership has been complicit in the large-scale smuggling of Sudanese gold to Russia, depriving Sudan of significant revenue

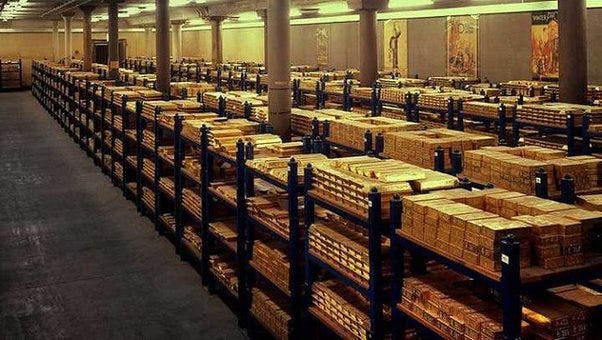

EXCLUSIVE: The Roosevelt Gold Confiscation Legacy – Inside Fort Knox’s Unaudited Reserves

March 10, 2025 | Investigative Report

Demands for transparency are growing as prominent figures such as former President Donald Trump, Elon Musk, and Senator Rand Paul call for a thorough audit of the U.S. Treasury’s substantial gold reserves. These reserves, purportedly totaling 8,133.46 metric tons, have not faced a comprehensive audit in over two decades, fueling speculation about potential mismanagement or outright theft. Critics argue that the U.S. Mint's stance of "no need to audit, we wouldn’t steal the gold" is insufficient, given the lack of external verification.

The construction of America’s gold reserves can be traced back to the Roosevelt era, a period marked by drastic monetary policy shifts. Executive Order 6102, issued in 1933, mandated that American citizens surrender their gold holdings to the government. This included gold coins, bullion, and certificates. In return, citizens received $20.67 per troy ounce—a price many considered below true market value. Through this measure, the government seized an estimated 140 metric tons of gold from private individuals, a move decried by some as legalized confiscation. Those who resisted faced severe penalties, including fines reaching what would be over $250,000 today and potential prison sentences of up to 10 years.

Adding to the controversy, in 1934, the Federal Reserve was compelled to transfer a significant portion of its gold reserves to the Treasury at the same rate of $20.67 per ounce. Shortly thereafter, President Roosevelt revalued gold to $35 per ounce, instantly generating a 69% profit for the Treasury. This maneuver not only enriched the government’s coffers but also raised questions about the fairness of the initial compensation to both citizens and the Federal Reserve.

Beyond domestic actions, the Roosevelt administration also took steps that impacted international financial obligations. The U.S. government refused to redeem World War I Liberty Bonds in gold, despite contractual obligations to do so. This decision, coupled with the later suspension of dollar-to-gold conversions under Bretton Woods in 1971, signaled a departure from honoring financial commitments and further consolidated the government's control over gold assets. As economist John Chamberlain noted, the gold that would have gone private stayed in federal vaults.

Inside Fort Knox, the composition of the gold reserves tells its own story. According to economist William C. Wood's 1994 analysis, much of the gold consists of melted-down Depression-era gold coins. This "lower-quality coin gold," as Wood describes it, is less suitable for international transactions compared to standard gold bars. Adding to the mix are WWII-era gold transfers from allies under the Lend-Lease program, which have never been fully accounted for or returned.

These historical events have present-day implications. The U.S. gold reserve, originally intended to back public currency, remains a permanent government asset, sparking debates about its purpose and management. Without a full audit, questions persist about whether the reserves match the official figures. If reserves fall short of the stated 8,133 tons, it would expose systemic failures and potentially confirm long-held suspicions of mismanagement or even theft.

Senator Paul's call for a transparent audit echoes the sentiments of many: it is not about conspiracy, but about accountability for a reserve built on broken promises. Key questions remain unanswered: How much of the gold is unusable "coin gold"? Were Bretton Woods obligations ever settled? Will the Treasury ever acknowledge Roosevelt's defaults as precedents for today's debt debates?

This report draws on U.S. Mint disclosures, economic analyses, and historical records. The Treasury declined to comment.

Or to say it more bluntly, greed is one of the original sins of mankind.

“The love of money is the root of all kinds of evil" is 1 Timothy 6:10.

Gold & silver (and any other currency, for that matter) are not inherently evil. Far from it. However, the extreme desire of it is the issue.