Nothing is Safe: Seems Like Everyone's Getting Fired

Projections for 2025 paint a grim picture, with an estimated 15,000 store closures expected in the United States alone.

President Trump's second term has begun with a whirlwind of executive actions and controversial decisions. In his first 30 days, Trump has signed over 150 executive orders, 20 memoranda, and 7 proclamations, reshaping federal policies on immigration, climate change, and economic reform.

The newly created Department of Government Efficiency (DOGE), led by billionaire Elon Musk, has become a wrecking ball for federal agencies, echoing Trump's famous "You're fired!" catchphrase from his reality TV days.

Estimates suggest that approximately 30,000 federal employees have been laid off in the first wave of audits, with more cuts expected

On to the private sector

Joann Closing all 800 stores

In the ever-evolving ecosystem of retail, we've witnessed a Darwinian struggle for survival that has reshaped the landscape of American commerce. The story begins with the rise of big-box retailers like Walmart and Target, which dealt a crushing blow to small, family-owned businesses across the country. These retail giants, with their vast economies of scale and relentless focus on low prices, effectively outcompeted countless "ma and pa" stores, forcing many to close their doors forever.

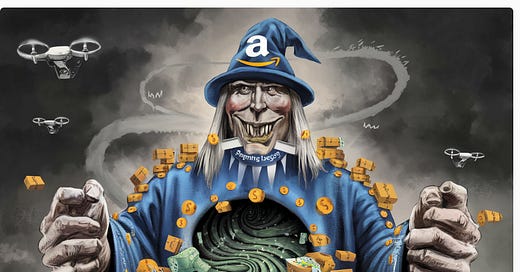

But the food chain of retail didn't stop there. Just as Walmart and Target had preyed upon smaller retailers, a new apex predator emerged in the form of Amazon. The e-commerce behemoth has taken a metaphorical club to traditional retail, disrupting the entire industry with its unparalleled convenience, vast product selection, and aggressive pricing strategies. Amazon's impact has been so profound that it has given rise to the term "Amazon Effect," referring to the company's disruptive influence on traditional retail models and its role in driving changes in consumer behavior.

The retail ecosystem is now in a state of constant flux, with mergers and acquisitions reshaping the competitive landscape at an unprecedented pace. This Darwinian "survival of the fittest" mentality has left no segment of retail safe from disruption. Even well-established brands and retail chains find themselves vulnerable to takeover or extinction if they fail to adapt to changing consumer preferences and technological advancements.

The COVID-19 pandemic served as a stark illustration of this brutal selection process. As lockdowns and social distancing measures took hold, the retail world quickly divided into winners and losers. E-commerce platforms and essential retailers thrived, while many traditional brick-and-mortar stores struggled to survive. This period accelerated existing trends, with online shopping experiencing "ten years of growth in 90 days," according to some estimates. The pandemic's impact was so severe that many retailers, unable to weather the storm, were forced to close their doors permanently.

Looking ahead, the future of retail appears increasingly precarious for those unable to adapt. Projections for 2025 paint a grim picture, with an estimated 15,000 store closures expected in the United States alone. This represents a significant increase from the 7,325 closures seen in 2024, highlighting the accelerating pace of retail transformation.

The recent announcement of Joann's bankruptcy and the closure of all 800 of its stores serves as a poignant example of this trend. Despite experiencing a boom during the pandemic, the 82-year-old fabric and crafts retailer ultimately succumbed to inventory shortages, online competition, and overwhelming debt. Joann's fate is not unique; other specialty retailers like Party City and Big Lots are facing similar challenges, underscoring the broader difficulties facing the retail sector.

As we look to the future, it's clear that the retail landscape will continue to evolve at a rapid pace. The rise of AI-driven personalization, increased focus on sustainability, and the expansion of social commerce are just a few of the trends shaping the industry. Retailers that can successfully navigate these changes and meet evolving consumer expectations may find opportunities for growth. However, those that fail to adapt risk becoming the next victims in retail's ongoing Darwinian struggle.

In this new retail ecosystem, size and legacy are no longer guarantees of survival. Even retail giants must remain agile and innovative to maintain their position in the food chain. As Amazon and other e-commerce platforms continue to reshape consumer expectations, traditional retailers must find ways to differentiate themselves and provide value beyond mere product availability.

The retail apocalypse, long predicted but slow to materialize fully, appears to be accelerating. As we move through 2025 and beyond, we can expect to see further consolidation in the industry, with stronger players acquiring or outlasting their weaker competitors. The future of retail belongs to those who can adapt quickly, leverage technology effectively, and create compelling experiences that resonate with consumers across all channels.

In this brave new world of retail, the only constant is change. Retailers, brands, and consumers alike must be prepared for a future where the lines between physical and digital commerce continue to blur, and where survival depends on the ability to evolve rapidly in response to shifting market dynamics.

And how does this all impact Gold and Silver?

During times of economic uncertainty, gold and silver emerge as top-tier assets due to their inherent stability and historical value. These precious metals act as hedges against inflation, currency debasement, and systemic risks. As fiat currencies lose purchasing power, gold and silver tend to retain or increase in value, providing a safe haven for investors.

Their limited supply and universal acceptance make them resistant to government manipulation and economic downturns. Additionally, gold and silver's tangible nature offers protection against digital vulnerabilities and financial system failures. In periods of geopolitical tensions, such as trade wars and tariffs, these metals often see increased demand, further solidifying their status as reliable stores of value.