Monetizing the asset side of U.S. balance sheet WILL SEND GOLD & SILVER SOARING

The $42.22 valuation is a relic of past monetary systems, so how many election cycles have past where no one has questioned why $42.22?

A man walks into a bar, feeling hungry and thirsty after a long day. He approaches the bartender and asks, "How much for a pint of beer and a slice of pizza?" The bartender, with a straight face, replies, "That'll be $1.50, sir." Surprised by the incredibly low price, the man excitedly orders, only to have the bartender chuckle and say, "Oh, I'm sorry. Those are our 1970 prices. We just keep them on the menu to show you what things cost 55 years ago. Your actual total will be $14.50 sir."

A man walks into a barbershop, running his fingers through his overgrown hair. He asks the barber, "How much for a haircut?" The barber glances at a dusty price list on the wall and replies, "That'll be $3.50, sir." Excited by the bargain, the man sits in the chair, only to have the barber laugh and say, "Oh, I apologize. That's our 1970 price list. We keep it up for nostalgia. Your actual haircut will cost $32.00." Confused, the man asks, "But why display such outdated prices?" The barber shrugs and responds, "Well, why does the U.S. government value its gold reserves at $42.22 per ounce on its balance sheet?"

Scott Bessent: Over the next 12 months we will be monetizing the asset side of the U.S. balance sheet.

Recent comments by Trump's Treasury Secretary Scott Bessent have sparked intense speculation on Wall Street about potential plans to monetize U.S. government assets, particularly through a dramatic revaluation of gold. On February 3, Bessent announced intentions to "monetize the asset side of the U.S. balance sheet" over the next 12 months, leading to widespread discussion about the implications of such a move.

The government's balance sheet is unique: it does not always resemble that of a business or household. As shown in the first chart, there is a significant gap between the total size of assets reported by the U.S. federal government (nearly $5.7 trillion) and the total size of liabilities (approximately $45.5 trillion).

The possibility of gold revaluation has garnered significant attention. Currently, U.S. gold stocks are valued at $42 per ounce in national accounts. However, at current market prices of around $2,800 per ounce, a revaluation could potentially inject $800 billion into the U.S. Treasury General Account (TGA). This has led to concerns about the impact on financial markets and monetary policy.

Mark Cabana, Bank of America's top Federal Reserve expert, has weighed in on the potential consequences of such a move. He outlined three main areas where U.S. assets could be monetized: fixed assets (property, plant, and equipment), institutional investments in government-sponsored enterprises like Fannie Mae and Freddie Mac, and gold and silver reserves.

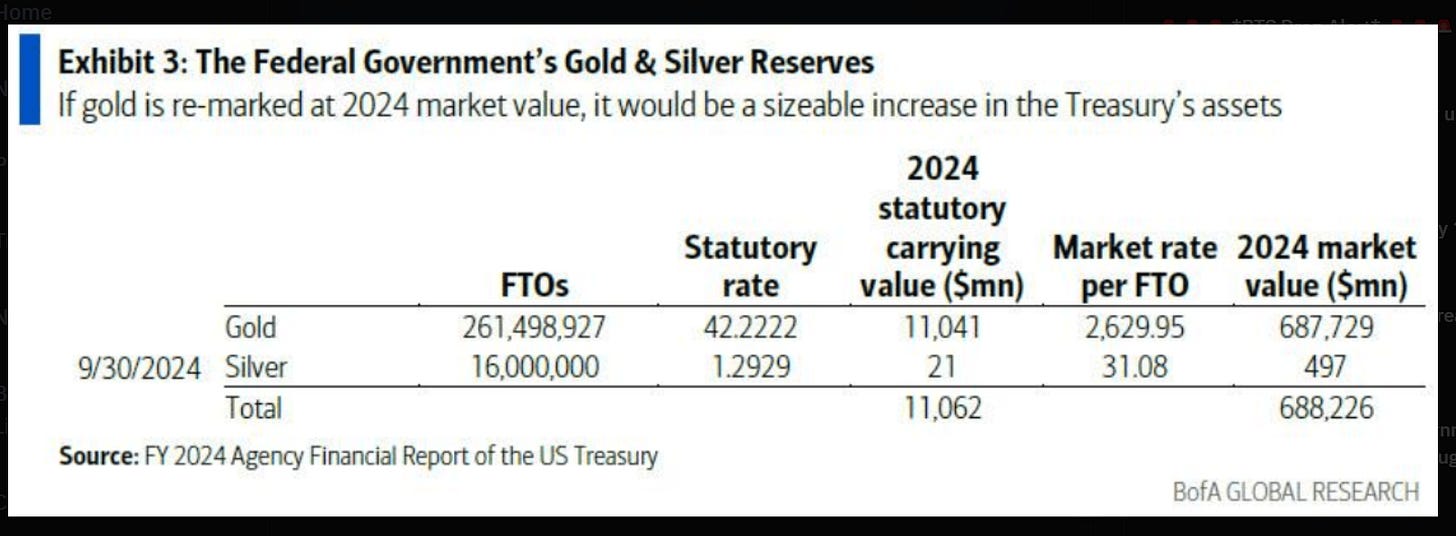

Of these options, the revaluation of gold presents the most significant potential impact. The U.S. government currently holds $11.044 billion in gold and silver, based on the statutory rate of $42.22 per ounce set in 1973.

If revalued at current market prices, this could increase to around $784.5 Billion dollars.

Cabana notes that such a revaluation would have far-reaching effects on both the Treasury and Federal Reserve balance sheets. It would essentially function as a form of quantitative easing, injecting a substantial amount of cash into the Treasury without requiring open market purchases. This could lead to increased macro activity, inflation risks, and additional cash in the banking system.

However, Cabana also highlights potential drawbacks, including legal issues and market concerns about loosening fiscal and monetary policy and weakening the independence of these authorities. Additionally, a gold revaluation will cause gold prices to soar further, potentially impacting other assets like Bitcoin.

While Bank of America currently believes the chances of U.S. asset monetization are low, they acknowledge that the unpredictable nature of the Trump administration could increase the likelihood of such a move. This uncertainty is reflected in the current high trading prices of gold, which are approaching $3,000 per ounce.

As the financial world awaits more details from Bessent on how the U.S. plans to monetize its balance sheet assets, the potential for a gold revaluation continues to be a topic of intense interest and speculation in financial markets.

Gold Revaluation Scenarios

All Roads indicate how wasteful, reckless and irresponsible US policy makers have been

Now what will Scott Bessent do?

see below

The DOGE Factor

MUSK

Rand Paul

Ron Paul has even been “floated” out there as the perfect person for the job

The call for an audit of U.S. gold reserves, led by figures like Elon Musk and Senator Rand Paul, has reignited debates about the transparency and integrity of the nation's gold holdings. Three scenarios could emerge from such an audit, each with significant implications.

The U.S. has less gold than reported: If the audit reveals a shortfall in the 261 million ounces (or 8,133 metric tons) of gold reserves claimed, it would validate long-standing skepticism among precious metals enthusiasts. This could severely undermine trust in the U.S. financial system and the dollar, as gold has historically been a symbol of monetary stability. Discrepancies could also expose potential mismanagement or leasing practices that inflate paper claims on gold beyond physical reserves. Such revelations might trigger market panic and a surge in gold and silver prices.

The U.S. has exactly the reported amount: Confirming the presence of all 261 million ounces would bolster confidence in government transparency and the dollar's stability. It would dispel all our skepticism theories and reassure both domestic and international stakeholders that U.S. reserves are intact and properly managed. However, questions about purity or encumbrances (e.g., leasing) could still arise, prompting calls for stricter oversight.

The U.S. has more gold than reported: Discovering excess reserves would be unexpected (next to impossible) but could strengthen the dollar's position globally by demonstrating greater fiscal strength than assumed. AGAIN THIS IS NEXT TO IMPOSSIBLE IN LIKELIHOOD

Given decades of limited audits and secrecy surrounding Fort Knox, skepticism persists. Transparency advocates argue that refusal to audit often signals concealment, making this initiative crucial for restoring public trust and addressing lingering doubts about America's gold reserves.