Mining’s Secret Weapon: Massive Gains as Dilution Risk Plummets for Cash-Flowing Producers

Kuya Silver Corporation | OTC Ticker: KUYAF | CSE Ticker: KUYA.CN

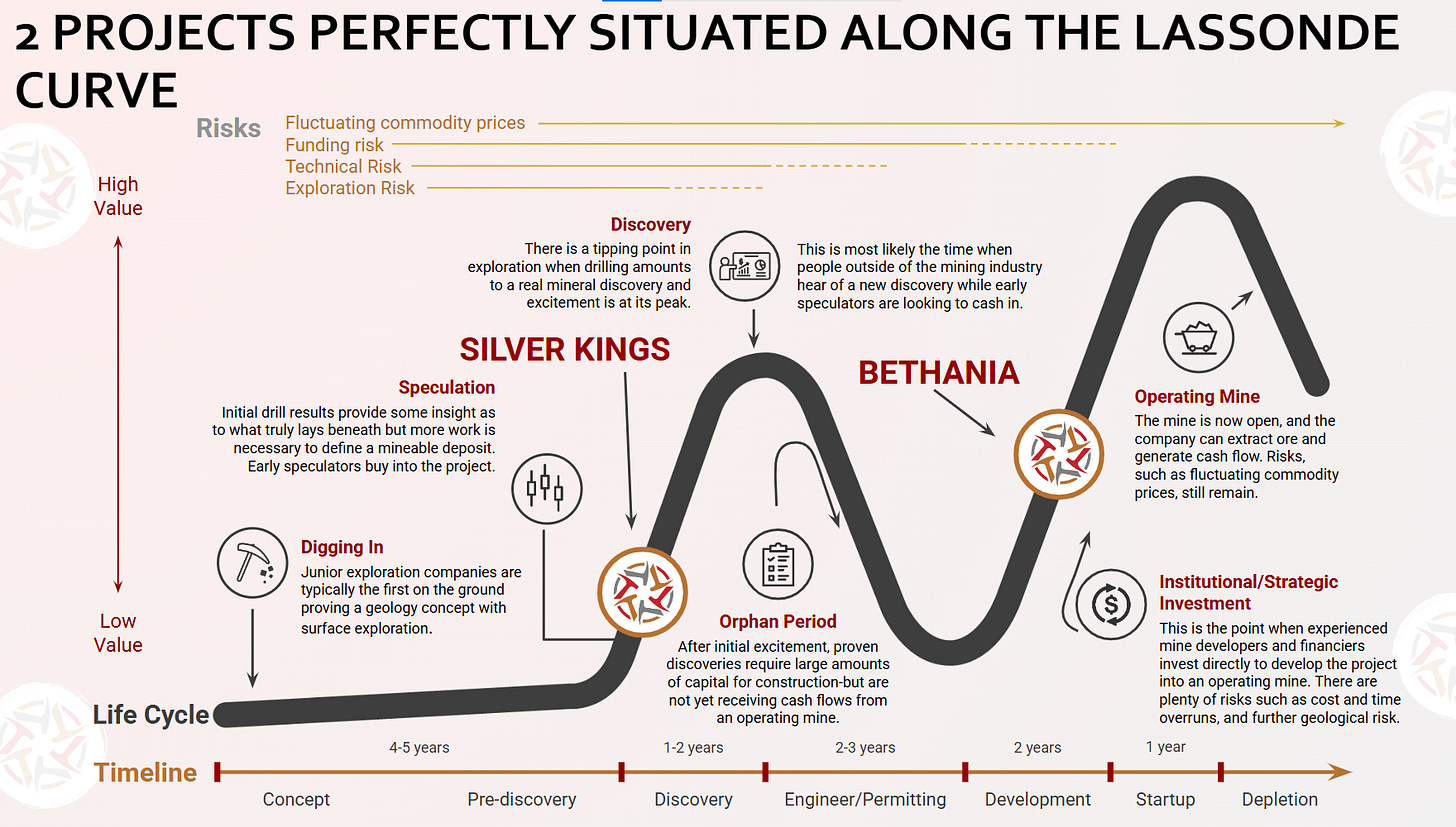

Lassonde Curve Applied to Kuya Silver’s two projects

Peru’s Bethania Mine is in Production

Canada’s Silver Kings Project in development phase

Pierre Lassonde, a leading mining executive, developed the Lassonde Curve to illustrate the typical life cycle and valuation trajectory of a mining stock. The curve demonstrates how investor sentiment and perceived value fluctuate as a mining project progresses from early exploration to production. It highlights both the high-risk, high-reward nature of early-stage mining investments and the cyclical patterns of excitement and stagnation that characterize the sector.

The Lassonde Curve maps the value of a mining project through stages: concept, discovery, feasibility, development, and production.

Valuation often spikes during discovery, then dips during feasibility and development as excitement wanes and risks become clearer.

Value typically rises again as the project nears production and cash flow becomes imminent.

The curve helps investors identify optimal entry and exit points by visualizing risk and reward at each stage.

It underscores the importance of project milestones (e.g., discoveries, feasibility studies) as catalysts for changes in perceived value

Introducing David Stein (CEO of Kuya Silver)

David Stein, CEO and founder of Kuya Silver, previously spent nearly a decade as a mining analyst and seven years in private equity, evaluating mining companies for institutional and retail investors. Leveraging his financial success and deep sector knowledge, Stein invested his own capital to acquire and revive the Bethania silver mine in Peru, now in production-a rare achievement in junior mining, given the long odds of success. Stein’s investor-focused approach also drives Kuya’s Silver Kings project in Canada

What is the “Stein Curve”

In a recent Silver Academy masterclass, Kuya Silver CEO David Stein introduced the “Stein Curve,” a conceptual framework that addresses the critical issue of shareholder dilution in mining and venture companies. Stein, drawing on his background as an analyst and investor, explained that early-stage mining ventures are particularly vulnerable to dilution as they repeatedly raise capital for exploration and development long before generating revenue. This often means shareholders see their ownership stakes diluted with each new financing round.

The Stein Curve illustrates how dilution risk is highest during the exploration and pre-production phases, when companies have no cash flow and must continually issue new shares to fund operations. As a mining company matures and begins generating cash flow-typically after bringing a mine into production-the need for new equity financing diminishes. At this stage, dilution slows dramatically, and the company can even consider share buybacks if profits are substantial and growth projects are limited.

Stein emphasized that Kuya Silver has recently begun production and expects to be cash flow positive within months, marking its transition into the “mature” phase of the Stein Curve. He noted that while minor dilution may still occur through exercised options or small financings, the overall impact on shareholder value will be minimal compared to earlier stages.

The discussion also highlighted that public markets often undervalue companies that are further along in development, presenting what Stein sees as an attractive entry point for investors. As firms like Kuya Silver achieve consistent cash flow, they tend to be re-rated by the market, leading to higher valuations and inclusion in sector ETFs-further boosting returns for early shareholders. Stein concluded that with silver prices near production costs and Kuya’s low all-in sustaining costs, the company is well-positioned for profitability and growth in the current market environment.

Video with David Stein explaining share dilution and marching towards being cash flow positive.

This video below, which is under 20 minutes in length, discusses the Lassonde Curve and introduces the “Stein Curve” as a further development in understanding mining project financing. The Stein Curve elucidates how, in the initial stages of a mining project, companies are subject to significant share dilution because they must repeatedly seek additional funding through multiple rounds of equity financing. This process is necessary to support ongoing exploration and development activities prior to the generation of revenue. However, for those mining projects that successfully advance to the production stage, the company eventually reaches a point at which positive cash flow from operations reduces or eliminates the need for further equity financing. As a result, the risk of additional dilution for shareholders is substantially mitigated once the company becomes cash flow positive.

end of segment

not financial advice

buy the dip