Market Manipulation in the Silver Industry: Large Scale Industrial Users Enjoy Low Silver Prices

We’ve written over 25 articles on this subject:

Silver is the critical mineral that makes torpedoes, satellites, space craft, space stations and over 10,000 other products possible due to its unique physical properties listed below.

For this reason industrialists enjoy low factory inputs to maximize profits. Industrialists run their manufacturing facilities but also serve on bank boards and have the power over trading desks to engage in paper selling of Silver on Futures market.

The paper to physical ratio is around 400 meaning for every one ounce of physical silver 400 paper versions of that same ounce (derivatives) exist.

Industrialists can create trading environments making it look like “silver is selling off” to ensure cheap silver for their factory inputs. This game has been played for centuries in different versions.

Market Manipulation in the Silver Industry

Silver market experiences significant manipulation due to its dual role as industrial metal and investment commodity

Trading desks at major banks treat silver as "just a number on a screen," ignoring its fundamental value

Traders are missing opportunities when overlooking silver's importance as a strategic metal

Silver has these unique characteristics (Best conductor, Most Ductile, Malleability, Corrosion Resistance, Highest Reflectivity, Thermal Properties, Antimicrobial )

Supply-Demand Dynamics

Global silver deficit expected to rise by over 20% to 265 million ounces in mid-2024

4% growth in industrial demand coupled with 2% decline in supply

Demand spans electronics, aerospace, military, solar panels, robotics, AI, batteries (silver zinc, silver oxide, silver aluminum, silver magnesium) and electric vehicles

Silver crucial for advancing technology and renewable energy solutions

Silver's Structural Deficit

Silver market in structural deficit for four consecutive years

Current deficit at 240 million ounces

Global mining sector produces around 850 million ounces annually

Deficits expected to continue due to increasing industrial consumption

Institutional Investors and Silver

Notable absence of institutional investors in the silver market

Canadian and US Pension Plans lacks significant positions in silver or mining equities

Retail investors and smaller entities primarily fill the market support gap

Silver Price Predictions

Keith Neumeyer's prediction of triple-digit silver prices gaining traction

Current spot silver price at $31.52, up 31% year-to-date

Potential for higher prices grounded in silver's role in green energy revolution and industrial applications

Expert Opinions.

Mining Best Practices Explained.

Silver's importance as a strategic commodity has been largely ignored by institutional investors

Institutional investors flock towards “financialized products” so they can churn these products for commission. The issue with these products as they are deeply enmeshed within a financial system that rides on a sea of debt and derivatives.

Growing silver supply deficits will yield significant price increases.

Mexico has experienced a 27% decline in past 2 years and are now challenged by the Secretary of Environment’s soft nationalization policies

Peru has experienced a 40% decline but Kuya Silver is an exception to this trend and the market has not priced in that Kuya is in production (extremely rare for a Jr to be in production)

Outcrop Silver CEO Ian Harris states, “Silver is the best conductor of Energy. Period.”

Shawn Khunkhun CEO of Dolly Varden stated “Gold is not rare, in North America alone there are 170 Gold deposits with minimum of 750,000 ounces of Gold. There are only 33 Silver projects that have a minimum of 25 Million ounces of Silver. To have both the Silver and the Gold in one Project…there are only 14” (Dolly Varden is one of those 14 with grade 500% richer than the other 13)

Andean Precious Metals purchases ore from thousands of Artisanal miners. Moreover APM owns and operates the San Bartolomé processing facility in Potosí, Bolivia (largest of its kind in Bolivia)

This cooperative arrangement of working with small scale miners yields a classic win win. The rural miners are lifted out of poverty, have a larger mining voice, and are mindful of environmental best practices. Meanwhile APM is able to produce millions of ounces over the next 4.6 years while they are still exploring the vast mineral deposits in this prolific region.

The best way to think of Andean Precious Metals mining approach is to imagine there are thousands of farmers in Kansas but they rally together in this way:

Farming cooperatives typically share a variety of equipment to reduce individual costs and improve efficiency. This shared equipment often includes:Combine harvesters

Threshing machines

Grain elevators

Warehouses for storage

Tractors and implements

Seeders and planters

Sprayers for pesticides and fertilizers

Balers for hay and straw

Grain dryers

Transportation vehicles like trucks

These shared resources allow smaller farmers to access expensive machinery and facilities that would be cost-prohibitive for individual ownership, enhancing their productivity and competitiveness in the agricultural market.

Likewise with Andean Precious Metals it makes perfect sense that they have the processing equipment and the individual artisans make a great living turning their ore over to Andean for processing. (Equipment that can be shared so everyone wins)Silver academy only endorses 4 silver miners (we have to turn down the majority who approach us)

These 4 miners listed above are up over 60% (average) past 6 months and this bull run is just getting started.

end of this section

Other Facts

a global physical silver shortage driving an estimated 265M oz. market deficit in 2024

Supply/demand fundamentals will drive prices higher until a market balance is achieved.

Bullion banks hold a 5B to 8B oz. silver short position in the London physical silver market

Our readers are Silver Stackers, #Silversqueeze #MOASS means the Mother of All Short Squeezes. Stack Silver Now

Keep in mind that in Shanghai it is a physical market (you have to make a physical deposit first) where Western markets are paper markets.

Price rise and increasing metal shortage would is bad news for these bullion banks.

In fact, silver losses could be of an existential level for the bullion banks and signal loss of the paper price-setting system used in London to set global silver prices since 1987. - David Jensen

Jensen continues, “Recognizing that the vast majority of this bullion bank short position in London consists of un-backed promissory notes for immediate bar delivery in the cash market that constitutes ~ 90% of daily London trading, the potential for cascading market defaults by bullion banks is very real in a market beset by physical shortage when demand for physical delivery on these cash contracts arises.

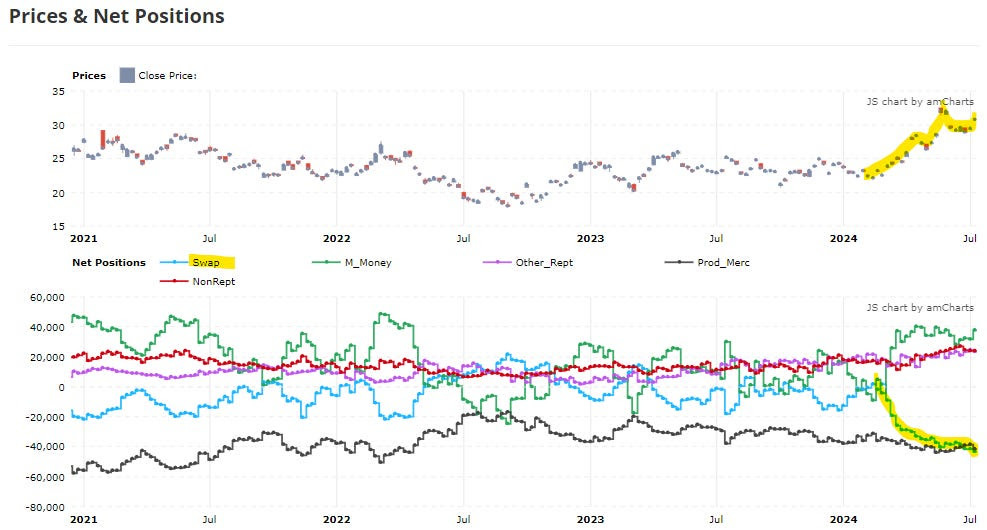

The London silver market is largely opaque with no data provided by the London Bullion Market Association (LBMA) on market participant positions however we can see an interesting market signal in the much smaller NY / COMEX silver futures market.

COMEX data indicate that since February 2024, as silver has risen in price from $22 /oz. to $31 /oz., bullion banks (also called Swap Dealers) have increased their COMEX net short positions in silver from initially flat to now short 217M oz. of silver, as can be seen below.

Instead of mitigating losses or even profiting, over 4 months bullion banks have increased their losses by scaling their COMEX silver net short position to 43,400 contracts or 217M oz. (as each contract constitutes 5,000 oz.) in the latest Commitment of Traders (COT) report.

NY / CME COMEX Trader (COT) NET Silver Positions - Swap Dealers (Bullion Banks) in Blue

In essence, bullion banks appear to be accepting much smaller losses in the COMEX market to prevent a potentially existential loss in the London physical silver cash market.

Not all market participants are sleeping however and this strategy could instead signal to the market that the bullion banks are hopelessly trapped short in the global silver market that is beset by shortage.

follow David Jensen on substack here -